Answered step by step

Verified Expert Solution

Question

1 Approved Answer

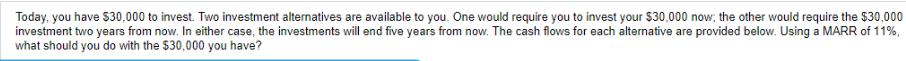

Today, you have $30,000 to invest. Two investment alternatives are available to you. One would require you to invest your $30,000 now; the other

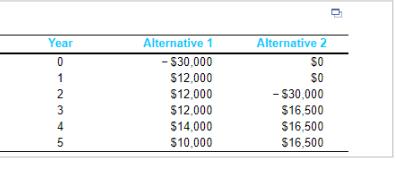

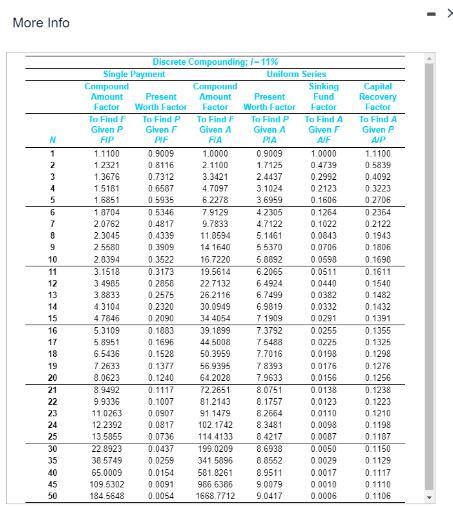

Today, you have $30,000 to invest. Two investment alternatives are available to you. One would require you to invest your $30,000 now; the other would require the $30,000 investment two years from now. In either case, the investments will end five years from now. The cash flows for each alternative are provided below. Using a MARR of 11%, what should you do with the $30,000 you have? Year 0 1 2 3 45 Alternative 1 - $30.000 $12,000 $12,000 $12,000 $14,000 $10,000 Alternative 2 SO SO -$30,000 $16,500 $16,500 $16,500 More Infor N 1 2 3 4 5 6719 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 30 35 40 45 50 Single Payment Compound Amount Factor To Find F Given P AP 1.1100 1.2321 1.3676 1.5181 1.6851 1.8704 2.0762 2.3045 25580 2.8394 3.1518 3.4985 3.8833 4.3104 4.7845 5.3109 5.8951 6.5436 7.2633 8.0623 Discrete Compounding; -11% 8.9492 9.9336 11:0263 12.2392 13.5855 22.8923 Present Worth Factor To Find P Given F PIF 0.9009 0.8116 0.7312 0.6587 0.5935 0.5346 0.4817 0.4339 0 3909 Compound Amount Factor To Find F Given A RA 1.0000 2.1100 3.3421 4.7097 6.2278 0.3522 0.3173 0.2858 0.2575 0.2320 0 2090 0.1883 0.1696 0.1528 0.1377 0.1240 0.1117 0.1007 0.0907 0.0817 102.1742 0.0736 114.4133 0.0437 199.0209 38.5749 0.0259 341.5896 65.0009 0.0154 581.8261 109.5302 0.0091 986 6386 184.5648 0.0054 1668.7712 7.9129 9.7833 11.0594 14 1640 16.7220 19.5614 22.7132 26.2116 30.0949 34 4054 39.1899 44.5008 50.3959 56.9395 64.2028 72.2651 81.2143 91 1479 Uniform Series Present Worth Factor To Find P Given A PIA 0.9009 1.7125 2.4437 3.1024 3.6959 4.2305 4.7122 5.1461 5.5370 5.8892 6.2065 6.4924 6.7499 6.9819 7. 1909 7.3792 7.5488 7.7016 7.8393 7.9633 8.0751 8.1757 8.2664 8.3481 8.4217 8.6938 8.8552 8.9511 9.0079 9.0417 Sinking Fund Factor To Find A Given F A/F 1.0000 0.4739 0.2992 0.2123 0.1606 0.1264 0.1022 0.0043 0.0706 0.0598 0.0511 0.0440 0.0382 0.0332 0.0291 0.0255 0.0225 0.0198 0.0176 0.0156 0.0138 0.0123 0.0110 0.0098 0.0087 0.0050 0.0029 0.0017 0.0010 0.0006 Capital Recovery Factor To Find A Given P AIP 1.1100 0.5839 0.4092 0.3223 0:2706 0 2364 0.2122 0.1943 0.1806 0.1698 0.1611 0.1540 0.1482 0.1432 0.1391 0.1355 0.1325 0.1298 0.1276 0.1256 0.1238 0.1223 0.1210 0.1198 0.1187 0.1150 0.1129 0.1117 0.1110 0.1106

Step by Step Solution

★★★★★

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Answer FW of Alternative 13000011...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started