Answered step by step

Verified Expert Solution

Question

1 Approved Answer

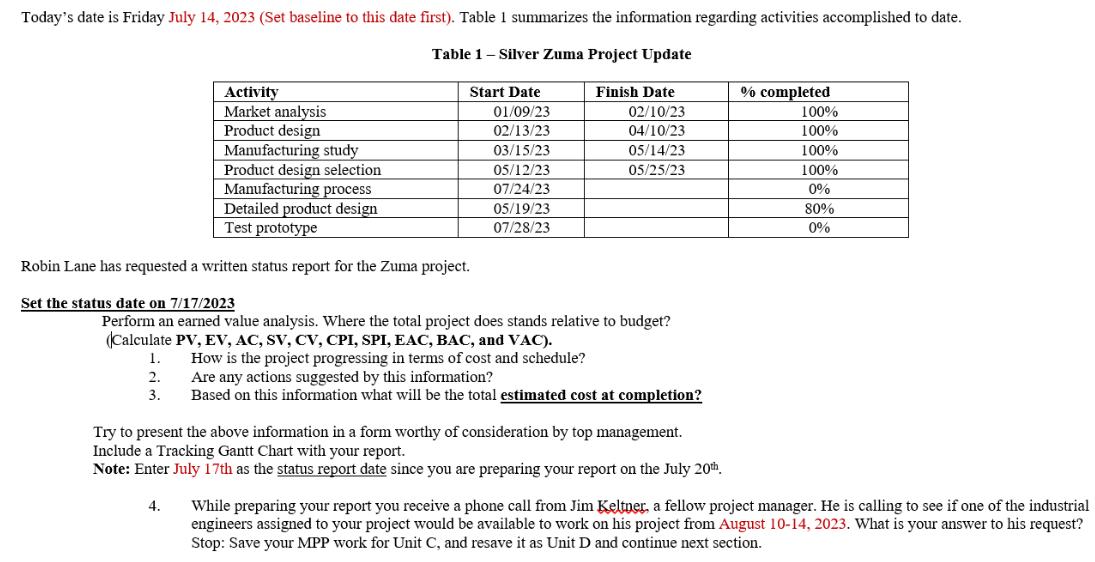

Today's date is Friday July 14, 2023 (Set baseline to this date first). Table 1 summarizes the information regarding activities accomplished to date. Table

Today's date is Friday July 14, 2023 (Set baseline to this date first). Table 1 summarizes the information regarding activities accomplished to date. Table 1 - Silver Zuma Project Update Activity Market analysis Product design Manufacturing study Product design selection. Manufacturing process Detailed product design Test prototype Robin Lane has requested a written status report for the Zuma project. Set the status date on 7/17/2023 1. 2. 3. Start Date 4. 01/09/23 02/13/23 03/15/23 05/12/23 07/24/23 05/19/23 07/28/23 Finish Date Perform an earned value analysis. Where the total project does stands relative to budget? (Calculate PV, EV, AC, SV, CV, CPI, SPI, EAC, BAC, and VAC). How is the project progressing in terms of cost and schedule? Are any actions suggested by this information? Based on this information what will be the total estimated cost at completion? 02/10/23 04/10/23 05/14/23 05/25/23 Try to present the above information in a form worthy of consideration by top management. Include a Tracking Gantt Chart with your report. Note: Enter July 17th as the status report date since you are preparing your report on the July 20th % completed 100% 100% 100% 100% 0% 80% 0% While preparing your report you receive a phone call from Jim Keltner, a fellow project manager. He is calling to see if one of the industrial engineers assigned to your project would be available to work on his project from August 10-14, 2023. What is your answer to his request? Stop: Save your MPP work for Unit C, and resave it as Unit D and continue next section.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Earned Value Analysis 1 Planned Value PV It represents the budgeted cost of work scheduled to be completed by the status date PV Budget at Completion ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started