Question

Todd Service Company, on January 1, 20xx, purchased a machine that makes a particular part for dining room tables. The following information applies to the

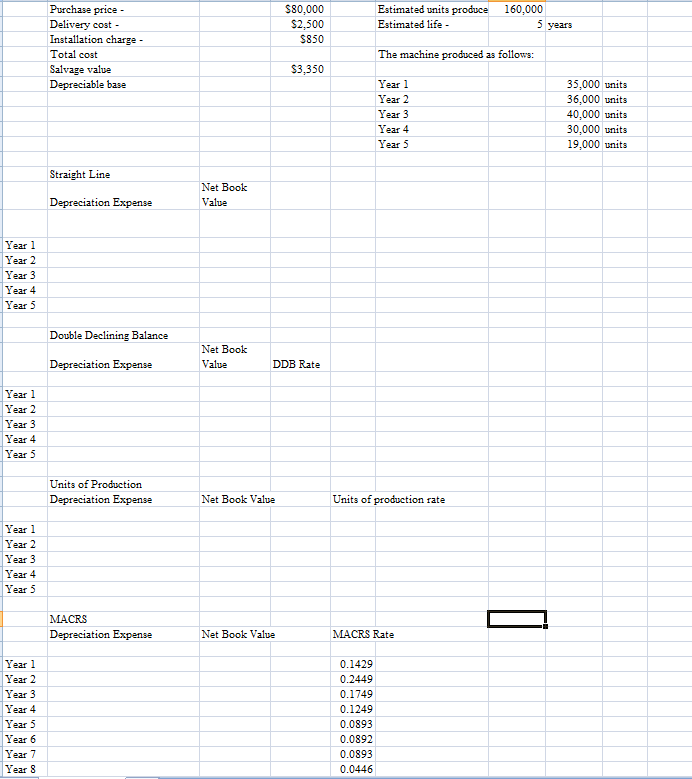

Todd Service Company, on January 1, 20xx, purchased a machine that makes a particular part for dining room tables. The following information applies to the machine purchased:

Purchase price - $80,000

Delivery cost - $ 2,500

Installation Cost $ 850

Estimated life - 5 years

Estimated parts produced 160,000

Salvage value $ 3,350

The copies produced as follows:

Year 1 35,000 parts

Year 2 36,000 parts

Year 3 40,000 parts

Year 4 30,000 parts Year 5 19,000 parts

Using Excel, determine the amount of depreciation expense and the net book value for each of the five years (8 years for MACRS) using each of the following methods:

Straight-line

Double-declining balance

Units of production

MACRS, assuming the machine is classified as five-year property

After you completed the worksheet then copy it and assume the machine cost was $90,000 instead of $80,000 (all other information remains the same) and calculate depreciation expense and the net book value for each of the five years (8 years for MACRS) using each of the following methods: Straight-line Double-declining balance (Be sure to double check the calculation for this type of depreciation.) Units of production MACRS, assuming the machine is classified as five-year property If you link the cells then this change of the cost of the machine will be easy to calculate.

After you completed the worksheet then copy it and assume the machine cost was $90,000 instead of $80,000 (all other information remains the same) and calculate depreciation expense and the net book value for each of the five years (8 years for MACRS) using each of the following methods: Straight-line Double-declining balance (Be sure to double check the calculation for this type of depreciation.) Units of production MACRS, assuming the machine is classified as five-year property If you link the cells then this change of the cost of the machine will be easy to calculate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started