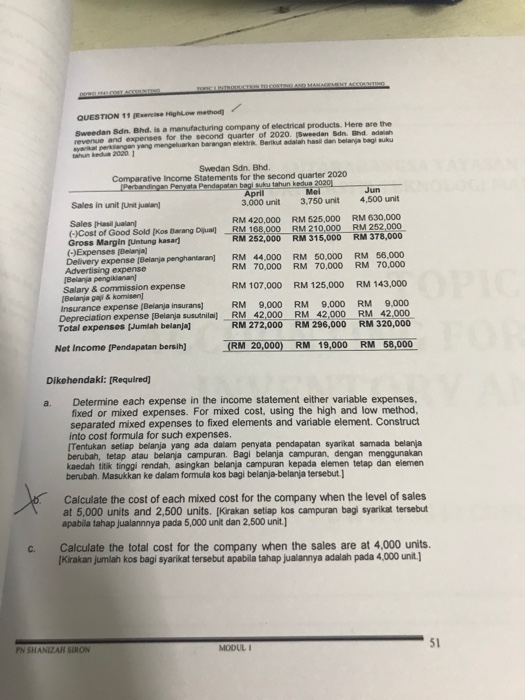

ToICLENTRpoUCTION TOCOSTO AND MANAGEMENT ACCOHTIND DerwO s4roST ACCOUNTING QUESTION 11 (Exercise Hight.ow method Sweedan Sdn. Bhd. is a manufacturing company of electrical products. Here are the revenue and expenses for the second quarter of 2020. (Sweedan Sdn. Bhd adaiah ayaa perkangan yang mengeluarkan barangan elektrik Berikut adalah hasil dan belanja bagi suku tahun kedua 2020. Swedan Sdn, Bhd. Comparative Income Statements for the second quarter 2020 Perbandingan Penyata Pendapatan bagi suku tahun kedua 2020 Mei Jun April 3,000 unit 4,500 unit 3.750 unit Sales in unit [Unit jualan) RM 630,000 RM 252,000 RM 378,000 RM 525,000 RM 210,000 RM 315,000 RM 420,000 RM 168,000 RM 252,000 Sales Hasil jualan ()Cost of Good Sold [Kos Barang Dijual Gross Margin (Untung kasar ()Expenses (Belanja) Delivery expense (Belanja penghantaran Advertising expense (Belanja pengikianan Salary & commission expense Belanja gaji&komisen Insurance expense (Belanja insurans) Depreciation expense (Belanja susutnilal) Total expenses [Jumlah belanja] RM 56,000 RM 70,000 RM 50,000 RM 70,000 RM 44,000 RM 70,000 OPIC RM 143,000 RM 107,000 RM 125,000 RM 9.000 RM 9,000 RM 42,000 RM 272,000 RM 9.000 RM 42,000 RM 320,000 RM 42,000 RM 296,000 RM 19,000 RM 58,000 (RM 20,000) Net Income [Pendapatan bersih) Dikehendaki: [Required] Determine each expense in the income statement either variable expenses. fixed or mixed expenses. For mixed cost, using the high and low method, separated mixed expenses to fixed elements and variable element. Construct into cost formula for such expenses. [Tentukan setiap belanja yang ada dalam penyata pendapatan syarikat samada belanja berubah, tetap atau belanja campuran. Bagi belanja campuran, dengan menggunakan kaedah titik tinggi rendah, asingkan belanja campuran kepada elemen tetap dan elemen berubah. Masukkan ke dalam formula kos bagi belanja-belanja tersebut a. Calculate the cost of each mixed cost for the company when the level of sales at 5,000 units and 2,500 units. [Kirakan setiap kos campuran bagi syarikat tersebut apabila tahap jualannnya pada 5,000 unit dan 2,500 unit] Calculate the total cost for the company when the sales are at 4,000 units. C. Kirakan jumlah kos bagi syarikat tersebut apabila tahap jualannya adalah pada 4,000 unit.] 51 MODUL I PN SHANIZAH SIRON