Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tollowing information for Questions 1-2: ACL Co. manufactures and sells sporting equipment to athletes. At the beginning of 20X1, ACL Corp. decides to build a

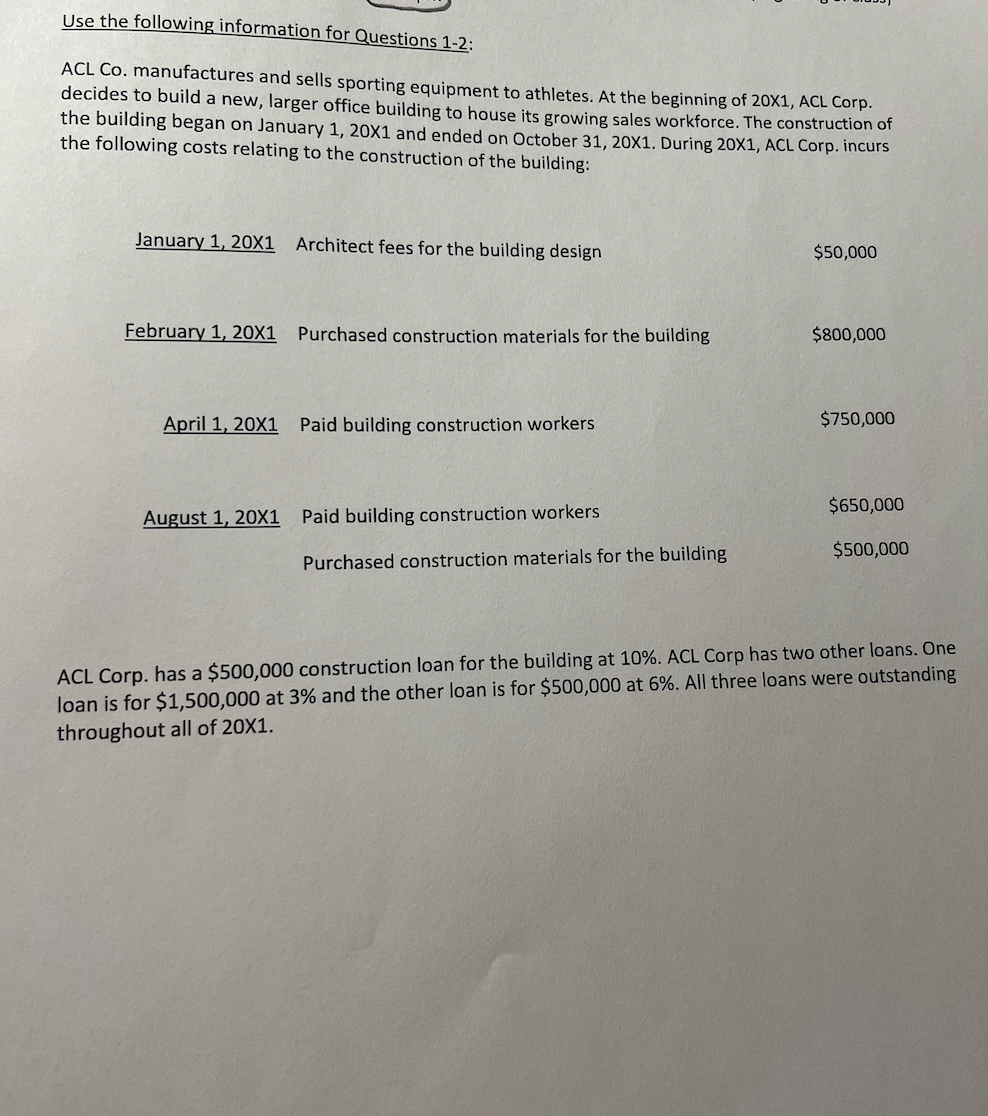

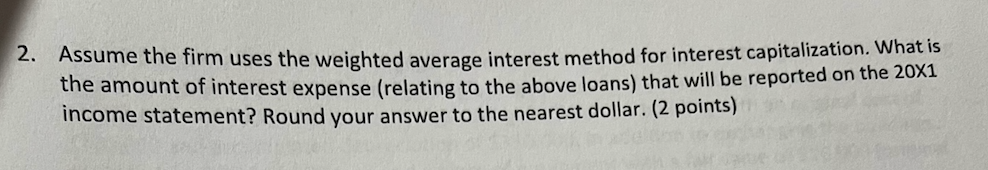

Tollowing information for Questions 1-2: ACL Co. manufactures and sells sporting equipment to athletes. At the beginning of 20X1, ACL Corp. decides to build a new, larger office building to house its growing sales workforce. The construction of the building began on January 1, 20X1 and ended on October 31, 20X1. During 20X1, ACL Corp. incurs the following costs relating to the construction of the building: January 1, 20X1 Architect fees for the building design $50,000 February 1, 20X1 Purchased construction materials for the building $800,000 April 1,20X1 Paid building construction workers $750,000 August 1, 20X1 Paid building construction workers $650,000 Purchased construction materials for the building $500,000 ACL Corp. has a $500,000 construction loan for the building at 10%. ACL Corp has two other loans. One loan is for $1,500,000 at 3% and the other loan is for $500,000 at 6%. All three loans were outstanding throughout all of 201. Assume the firm uses the weighted average interest method for interest capitalization. What is the amount of interest expense (relating to the above loans) that will be reported on the 20X1 income statement? Round your answer to the nearest dollar. ( 2 points)

Tollowing information for Questions 1-2: ACL Co. manufactures and sells sporting equipment to athletes. At the beginning of 20X1, ACL Corp. decides to build a new, larger office building to house its growing sales workforce. The construction of the building began on January 1, 20X1 and ended on October 31, 20X1. During 20X1, ACL Corp. incurs the following costs relating to the construction of the building: January 1, 20X1 Architect fees for the building design $50,000 February 1, 20X1 Purchased construction materials for the building $800,000 April 1,20X1 Paid building construction workers $750,000 August 1, 20X1 Paid building construction workers $650,000 Purchased construction materials for the building $500,000 ACL Corp. has a $500,000 construction loan for the building at 10%. ACL Corp has two other loans. One loan is for $1,500,000 at 3% and the other loan is for $500,000 at 6%. All three loans were outstanding throughout all of 201. Assume the firm uses the weighted average interest method for interest capitalization. What is the amount of interest expense (relating to the above loans) that will be reported on the 20X1 income statement? Round your answer to the nearest dollar. ( 2 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started