Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tom, aged 42, and Lauren, aged 41, are new clients. Tom works in sales for a large pharmaceutical company earning a base salary of

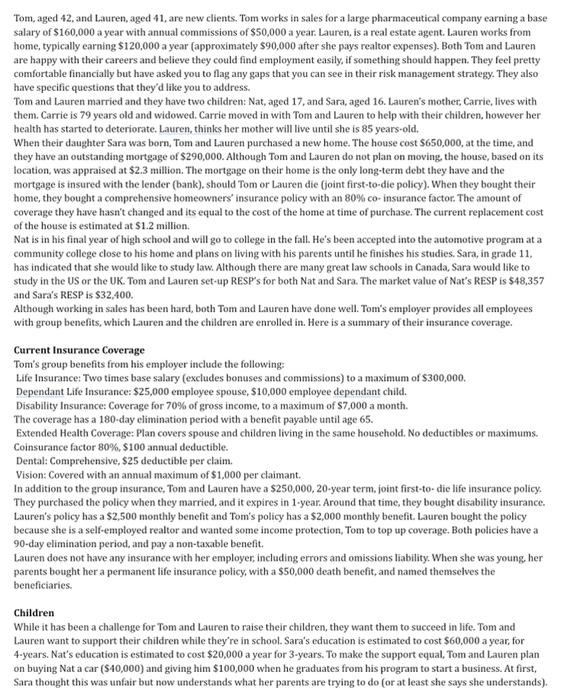

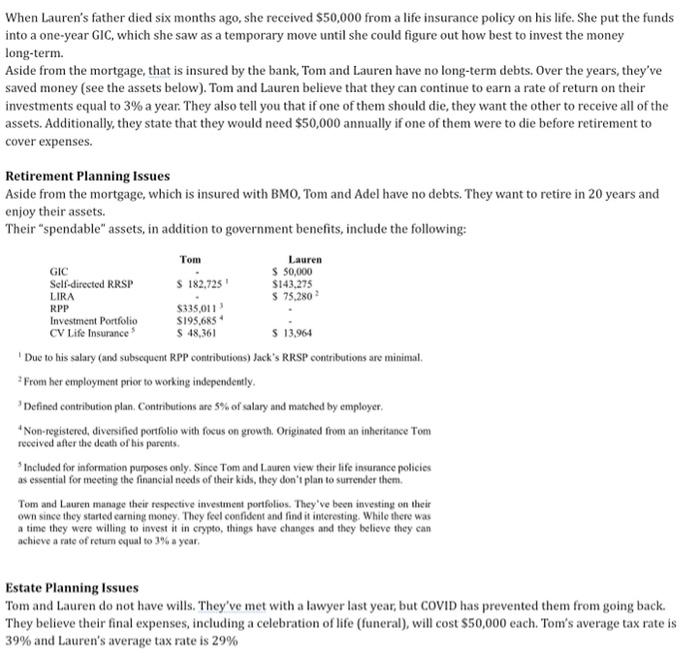

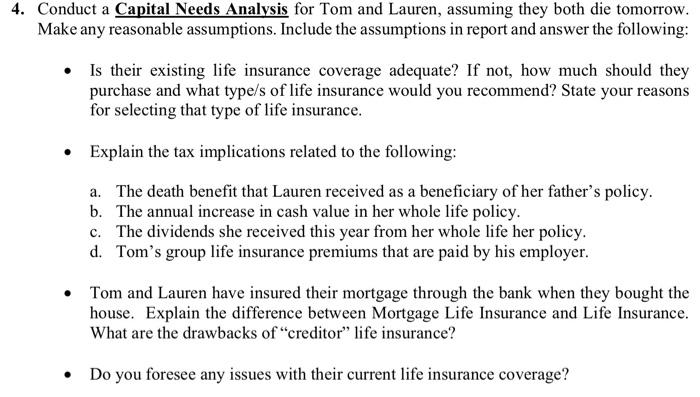

Tom, aged 42, and Lauren, aged 41, are new clients. Tom works in sales for a large pharmaceutical company earning a base salary of $160,000 a year with annual commissions of $50,000 a year. Lauren, is a real estate agent. Lauren works from home, typically earning $120,000 a year (approximately $90,000 after she pays realtor expenses). Both Tom and Lauren are happy with their careers and believe they could find employment easily, if something should happen. They feel pretty comfortable financially but have asked you to flag any gaps that you can see in their risk management strategy. They also have specific questions that they'd like you to address. Tom and Lauren married and they have two children: Nat, aged 17, and Sara, aged 16. Lauren's mother, Carrie, lives with them. Carrie is 79 years old and widowed. Carrie moved in with Tom and Lauren to help with their children, however her health has started to deteriorate. Lauren, thinks her mother will live until she is 85 years-old. When their daughter Sara was born, Tom and Lauren purchased a new home. The house cost $650,000, at the time, and they have an outstanding mortgage of $290,000. Although Tom and Lauren do not plan on moving, the house, based on its location, was appraised at $2.3 million. The mortgage on their home is the only long-term debt they have and the mortgage is insured with the lender (bank), should Tom or Lauren die (joint first-to-die policy). When they bought their home, they bought a comprehensive homeowners' insurance policy with an 80% co-insurance factor. The amount of coverage they have hasn't changed and its equal to the cost of the home at time of purchase. The current replacement cost of the house is estimated at $1.2 million. Nat is in his final year of high school and will go to college in the fall. He's been accepted into the automotive program at a community college close to his home and plans on living with his parents until he finishes his studies. Sara, in grade 11, has indicated that she would like to study law. Although there are many great law schools in Canada, Sara would like to study in the US or the UK. Tom and Lauren set-up RESP's for both Nat and Sara. The market value of Nat's RESP is $48,357 and Sara's RESP is $32,400. Although working in sales has been hard, both Tom and Lauren have done well. Tom's employer provides all employees with group benefits, which Lauren and the children are enrolled in. Here is a summary of their insurance coverage. Current Insurance Coverage Tom's group benefits from his employer include the following: Life Insurance: Two times base salary (excludes bonuses and commissions) to a maximum of $300,000. Dependant Life Insurance: $25,000 employee spouse, $10,000 employee dependant child. Disability Insurance: Coverage for 70% of gross income, to a maximum of $7,000 a month. The coverage has a 180-day elimination period with a benefit payable until age 65. Extended Health Coverage: Plan covers spouse and children living in the same household. No deductibles or maximums. Coinsurance factor 80%, $100 annual deductible. Dental: Comprehensive, $25 deductible per claim. Vision: Covered with an annual maximum of $1,000 per claimant. In addition to the group insurance, Tom and Lauren have a $250,000, 20-year term, joint first-to-die life insurance policy. They purchased the policy when they married, and it expires in 1-year. Around that time, they bought disability insurance. Lauren's policy has a $2,500 monthly benefit and Tom's policy has a $2,000 monthly benefit. Lauren bought the policy because she is a self-employed realtor and wanted some income protection, Tom to top up coverage. Both policies have a 90-day elimination period, and pay a non-taxable benefit. Lauren does not have any insurance with her employer, including errors and omissions liability. When she was young, her parents bought her a permanent life insurance policy, with a $50,000 death benefit, and named themselves the beneficiaries. Children While it has been a challenge for Tom and Lauren to raise their children, they want them to succeed in life. Tom and Lauren want to support their children while they're in school. Sara's education is estimated to cost $60,000 a year, for 4-years. Nat's education is estimated to cost $20,000 a year for 3-years. To make the support equal, Tom and Lauren plan on buying Nat a car ($40,000) and giving him $100,000 when he graduates from his program to start a business. At first, Sara thought this was unfair but now understands what her parents are trying to do (or at least she says she understands). When Lauren's father died six months ago, she received $50,000 from a life insurance policy on his life. She put the funds into a one-year GIC, which she saw as a temporary move until she could figure out how best to invest the money long-term. Aside from the mortgage, that is insured by the bank, Tom and Lauren have no long-term debts. Over the years, they've saved money (see the assets below). Tom and Lauren believe that they can continue to earn a rate of return on their investments equal to 3% a year. They also tell you that if one of them should die, they want the other to receive all of the assets. Additionally, they state that they would need $50,000 annually if one of them were to die before retirement to cover expenses. Retirement Planning Issues Aside from the mortgage, which is insured with BMO, Tom and Adel have no debts. They want to retire in 20 years and enjoy their assets. Their "spendable" assets, in addition to government benefits, include the following: Tom S 182,725 $335,011 $195,685 $ 48,361 GIC Self-directed RRSP LIRA RPP Investment Portfolio CV Life Insurance Lauren $ 50,000 $143,275 $ 75,280 2 $ 13,964 Due to his salary (and subsequent RPP contributions) Jack's RRSP contributions are minimal. From her employment prior to working independently. Defined contribution plan. Contributions are 5% of salary and matched by employer. *Non-registered, diversified portfolio with focus on growth. Originated from an inheritance Tom received after the death of his parents. Included for information purposes only. Since Tom and Lauren view their life insurance policies as essential for meeting the financial needs of their kids, they don't plan to surrender them. Tom and Lauren manage their respective investment portfolios. They've been investing on their own since they started earning money. They feel confident and find it interesting. While there was a time they were willing to invest it in crypto, things have changes and they believe they can achieve a rate of return equal to 3% a year. Estate Planning Issues Tom and Lauren do not have wills. They've met with a lawyer last year, but COVID has prevented them from going back. They believe their final expenses, including a celebration of life (funeral), will cost $50,000 each. Tom's average tax rate is 39% and Lauren's average tax rate is 29% 4. Conduct a Capital Needs Analysis for Tom and Lauren, assuming they both die tomorrow. Make any reasonable assumptions. Include the assumptions in report and answer the following: Is their existing life insurance coverage adequate? If not, how much should they purchase and what type/s of life insurance would you recommend? State your reasons for selecting that type of life insurance. Explain the tax implications related to the following: a. The death benefit that Lauren received as a beneficiary of her father's policy. b. The annual increase in cash value in her whole life policy. c. The dividends she received this year from her whole life her policy. d. Tom's group life insurance premiums that are paid by his employer. Tom and Lauren have insured their mortgage through the bank when they bought the house. Explain the difference between Mortgage Life Insurance and Life Insurance. What are the drawbacks of "creditor" life insurance? Do you foresee any issues with their current life insurance coverage?

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer To conduct a Capital Needs Analysis for Tom and Lauren assuming they both die tomorrow lets outline some reasonable assumptions 1 Final Expenses As they estimate final expenses including funera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started