Answered step by step

Verified Expert Solution

Question

1 Approved Answer

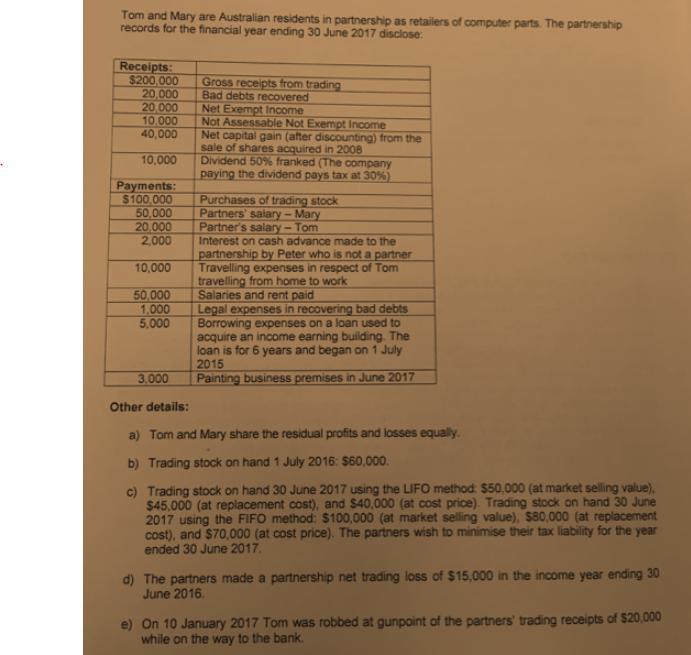

Tom and Mary are Australian residents in partnership as retailers of computer parts. The partnership records for the financial year ending 30 June 2017

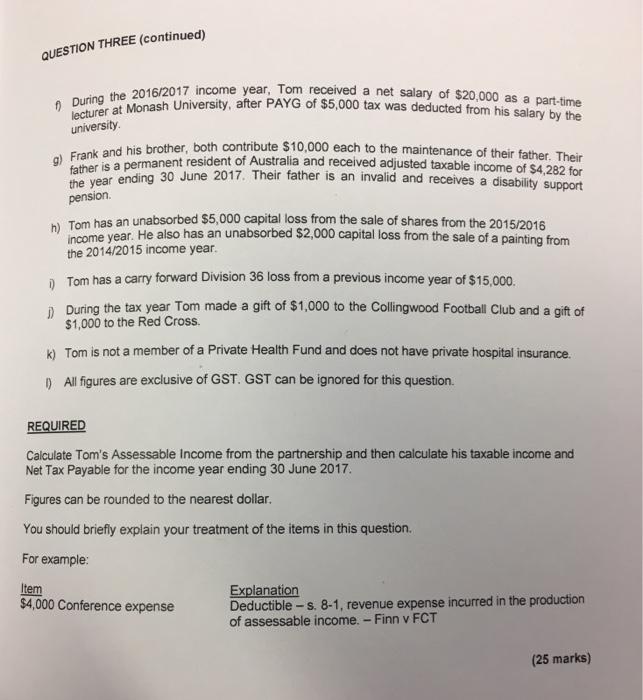

Tom and Mary are Australian residents in partnership as retailers of computer parts. The partnership records for the financial year ending 30 June 2017 disclose Receipts: $200,000 20,000 20,000 10,000 Gross receipts from trading Bad debts recovered Net Exempt Income Not Assessable Not Exempt Income Net capital gain (after discounting) from the sale of shares acquired in 2008 Dividend 50% franked (The company paying the dividend pays tax at 30%) 40,000 10,000 Payments: $100.000 50,000 20,000 2,000 Purchases of trading stock Partners' salary-Mary Partner's salary- Tom Interest on cash advance made to the partnership by Peter who is not a partner Travelling expenses in respect of Tom travelling from home to work Salaries and rent paid Legal expenses in recovering bad debts Borrowing expenses on a loan used to acquire an income earning building. The loan is for 6 years and began on 1 July 2015 Painting business premises in June 2017 10,000 50,000 1,000 5,000 3,000 Other details: a) Tom and Mary share the residual profits and losses equally. b) Trading stock on hand 1 July 2016: $60,000. c) Trading stock on hand 30 June 2017 using the LIFO method $50,000 (at market selling value). $45,000 (at replacement cost), and $40,000 (at cost price). Trading stock on hand 30 June 2017 using the FIFO method: $100,000 (at market selling value), $80,000 (at replacement cost), and $70,000 (at cost price). The partners wish to minimise their tax liability for the year ended 30 June 2017. d) The partners made a partnership net trading loss of $15,000 in the income year ending 30 June 2016. e) On 10 January 2017 Tom was robbed at gunpoint of the partners' trading receipts of $20,000 while on the way to the bank. 9) Frank and his brother, both contribute $10,000 each to the maintenance of their father. Their O During the 2016/2017 income year, Tom received a net salary of $20,000 as a part-time the year ending 30 June 2017. Their father is an invalid and receives a disability support lecturer at Monash University, after PAYG of $5,000 tax was deducted from his salary by the QUESTION THREE (continued) university. Frank a permanent resident of Australia and received adjusted taxable income of $4,282 for pension. D. Tom has an unabsorbed $5,000 capital loss from the sale of shares from the 2015/2016 income year. He also has an unabsorbed $2,000 capital loss from the sale of a painting from the 2014/2015 income year. D Tom has a carry forward Division 36 loss from a previous income year of $15,000. i During the tax year Tom made a gift of $1,000 to the Collingwood Football Club and a gift of $1,000 to the Red Cross. ) Tom is not a member of a Private Health Fund and does not have private hospital insurance. D All figures are exclusive of GST. GST can be ignored for this question. REQUIRED Calculate Tom's Assessable Income from the partnership and then calculate his taxable income and Net Tax Payable for the income year ending 30 June 2017. Figures can be rounded to the nearest dollar. You should briefly explain your treatment of the items in this question. For example: Item $4,000 Conference expense Explanation Deductible - s. 8-1, revenue expense incurred in the production of assessable income. - Finn v FCT (25 marks)

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Tom and Mary are Australian residents in partnership as retailers of computer parts The partnership ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started