Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tom died intestate in 2022. Tom and his predeceased wife, Wendy, had four children, namely Ayanda, Bongani, Charlotte (adopted) and Dumi. Ayanda had 3

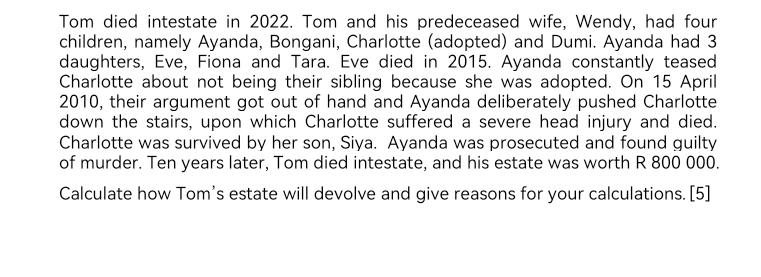

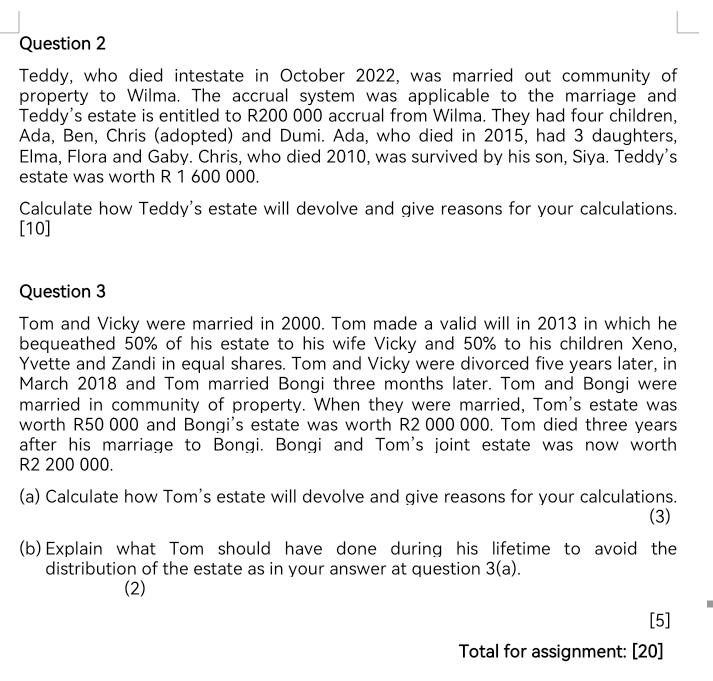

Tom died intestate in 2022. Tom and his predeceased wife, Wendy, had four children, namely Ayanda, Bongani, Charlotte (adopted) and Dumi. Ayanda had 3 daughters, Eve, Fiona and Tara. Eve died in 2015. Ayanda constantly teased Charlotte about not being their sibling because she was adopted. On 15 April 2010, their argument got out of hand and Ayanda deliberately pushed Charlotte down the stairs, upon which Charlotte suffered a severe head injury and died. Charlotte was survived by her son, Siya. Ayanda was prosecuted and found guilty of murder. Ten years later, Tom died intestate, and his estate was worth R 800 000. Calculate how Tom's estate will devolve and give reasons for your calculations. [5] Question 2 Teddy, who died intestate in October 2022, was married out community of property to Wilma. The accrual system was applicable to the marriage and Teddy's estate is entitled to R200 000 accrual from Wilma. They had four children, Ada, Ben, Chris (adopted) and Dumi. Ada, who died in 2015, had 3 daughters, Elma, Flora and Gaby. Chris, who died 2010, was survived by his son, Siya. Teddy's estate was worth R 1 600 000. Calculate how Teddy's estate will devolve and give reasons for your calculations. [10] Question 3 Tom and Vicky were married in 2000. Tom made a valid will in 2013 in which he bequeathed 50% of his estate to his wife Vicky and 50% to his children Xeno, Yvette and Zandi in equal shares. Tom and Vicky were divorced five years later, in March 2018 and Tom married Bongi three months later. Tom and Bongi were married in community of property. When they were married, Tom's estate was worth R50 000 and Bongi's estate was worth R2 000 000. Tom died three years after his marriage to Bongi. Bongi and Tom's joint estate was now worth R2 200 000. (a) Calculate how Tom's estate will devolve and give reasons for your calculations. (3) (b) Explain what Tom should have done during his lifetime to avoid the distribution of the estate as in your answer at question 3(a). (2) [5] Total for assignment: [20]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1a Since Tom is survived by his children instead of a spouse the children will inherit the intestate estate calculation of Toms childrens share of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started