Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tom (Edison) and Nik (Tesla) both want to open a power plant to provide clectricity scrvices. Assume that they both face the same cost

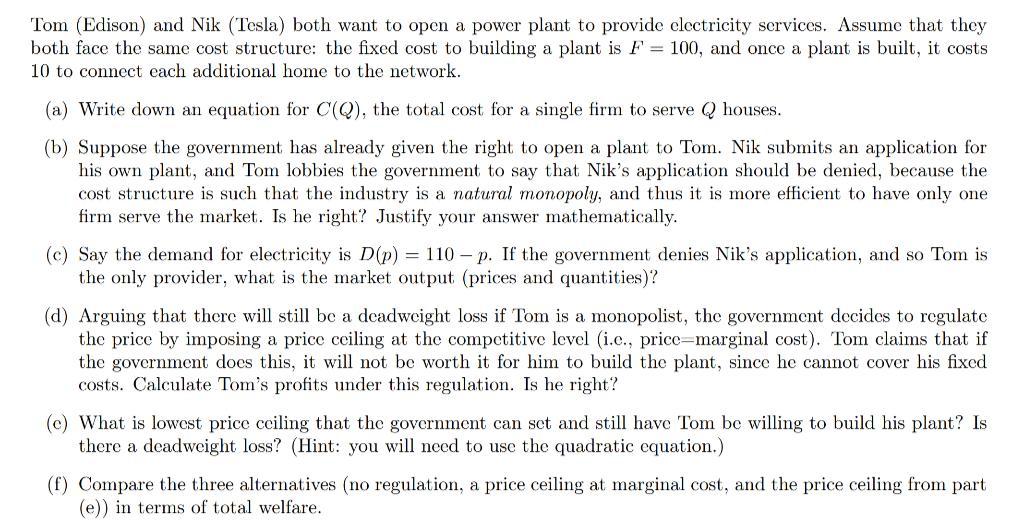

Tom (Edison) and Nik (Tesla) both want to open a power plant to provide clectricity scrvices. Assume that they both face the same cost structure: the fixed cost to building a plant is F = 100, and once a plant is built, it costs 10 to connect each additional home to the network. (a) Write down an equation for C(Q), the total cost for a single firm to serve Q houses. (b) Suppose the government has already given the right to open a plant to Tom. Nik submits an application for his own plant, and Tom lobbies the government to say that Nik's application should be denied, because the cost structure is such that the industry is a natural monopoly, and thus it is more efficient to have only one firm serve the market. Is he right? Justify your answer mathematically. (c) Say the demand for electricity is D(p) = 110 - p. If the government denies Nik's application, and so Tom is the only provider, what is the market output (prices and quantities)? (d) Arguing that there will still be a deadweight loss if Tom is a monopolist, the government decides to regulate the price by imposing a price ceiling at the competitive level (i.e., price=marginal cost). Tom claims that if the government does this, it will not be worth it for him to build the plant, since he cannot cover his fixed costs. Calculate Tom's profits under this regulation. Is he right? (c) What is lowest price ceiling that the government can sct and still have Tom be willing to build his plant? Is there a deadweight loss? (Hint: you will need to use the quadratic equation.) (f) Compare the three alternatives (no regulation, a price ceiling at marginal cost, and the price ceiling from part (e)) in terms of total welfare.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Given FC 100 VC loG by giving Mclo a TC FCVc 100 l0G C C ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started