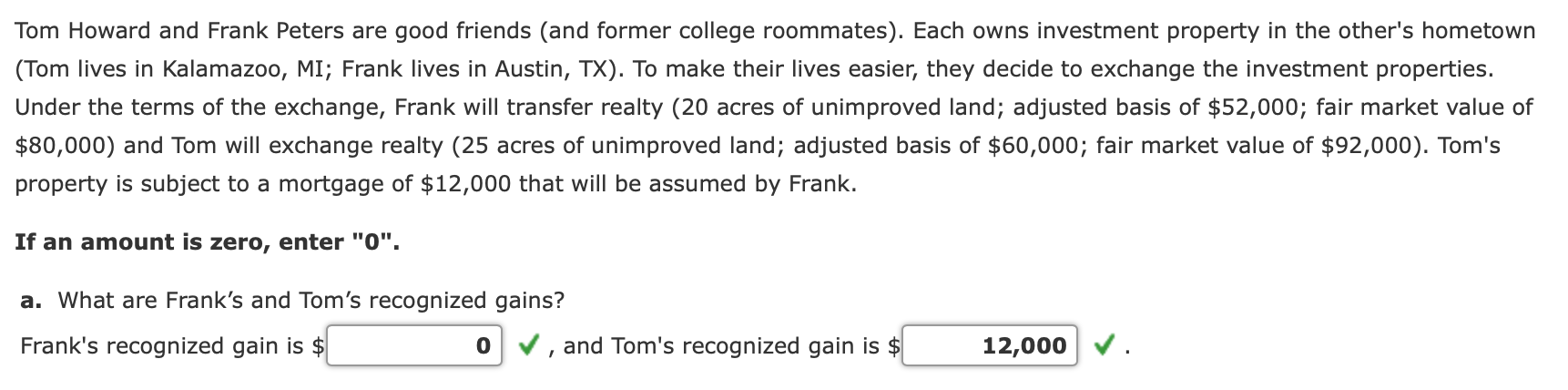

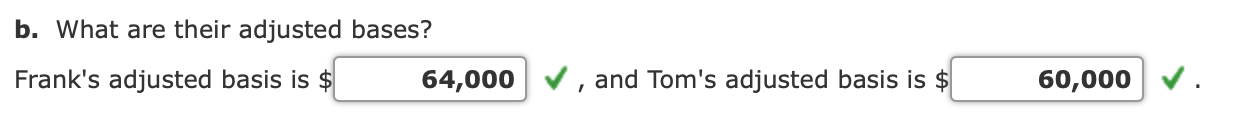

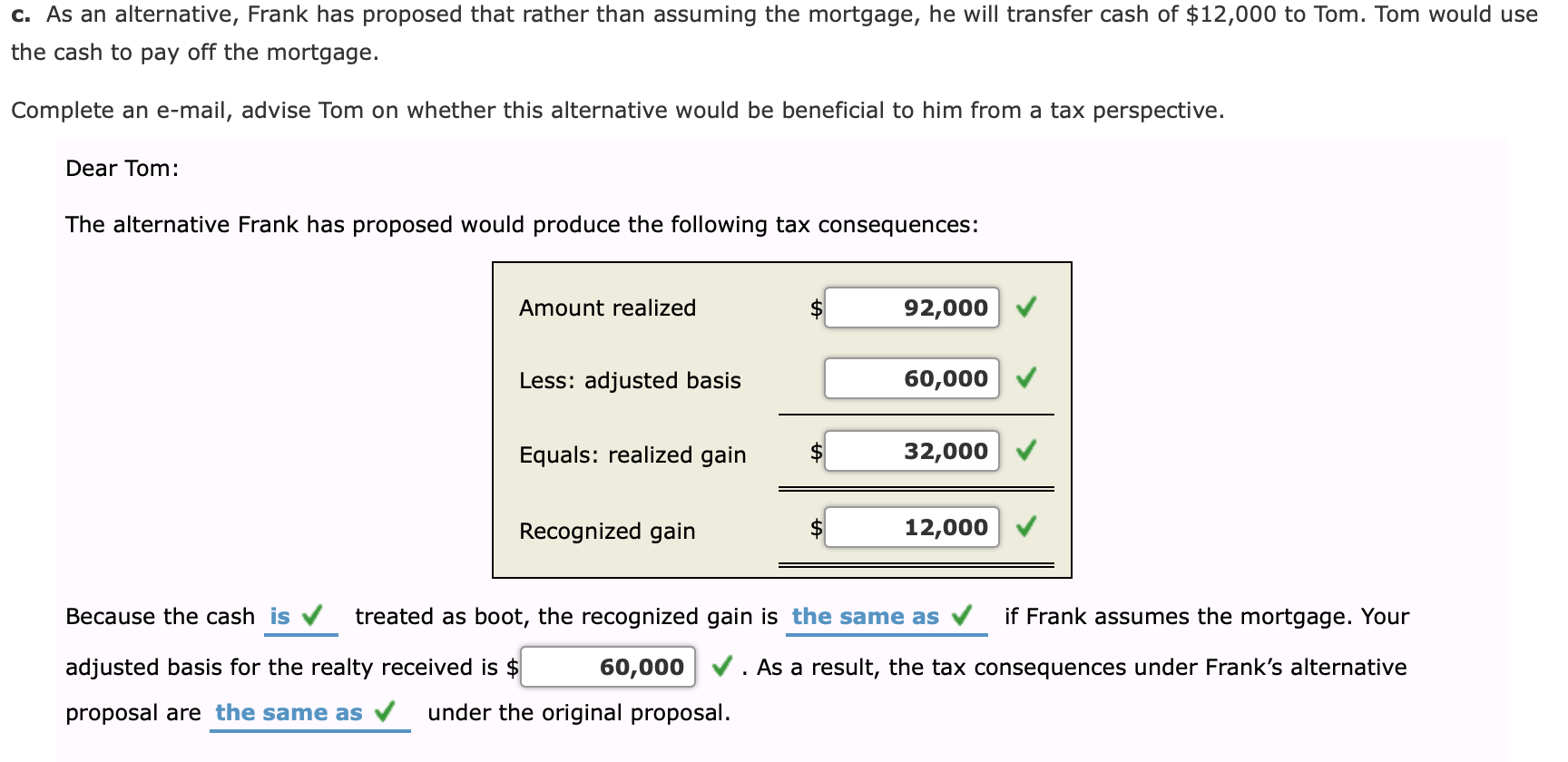

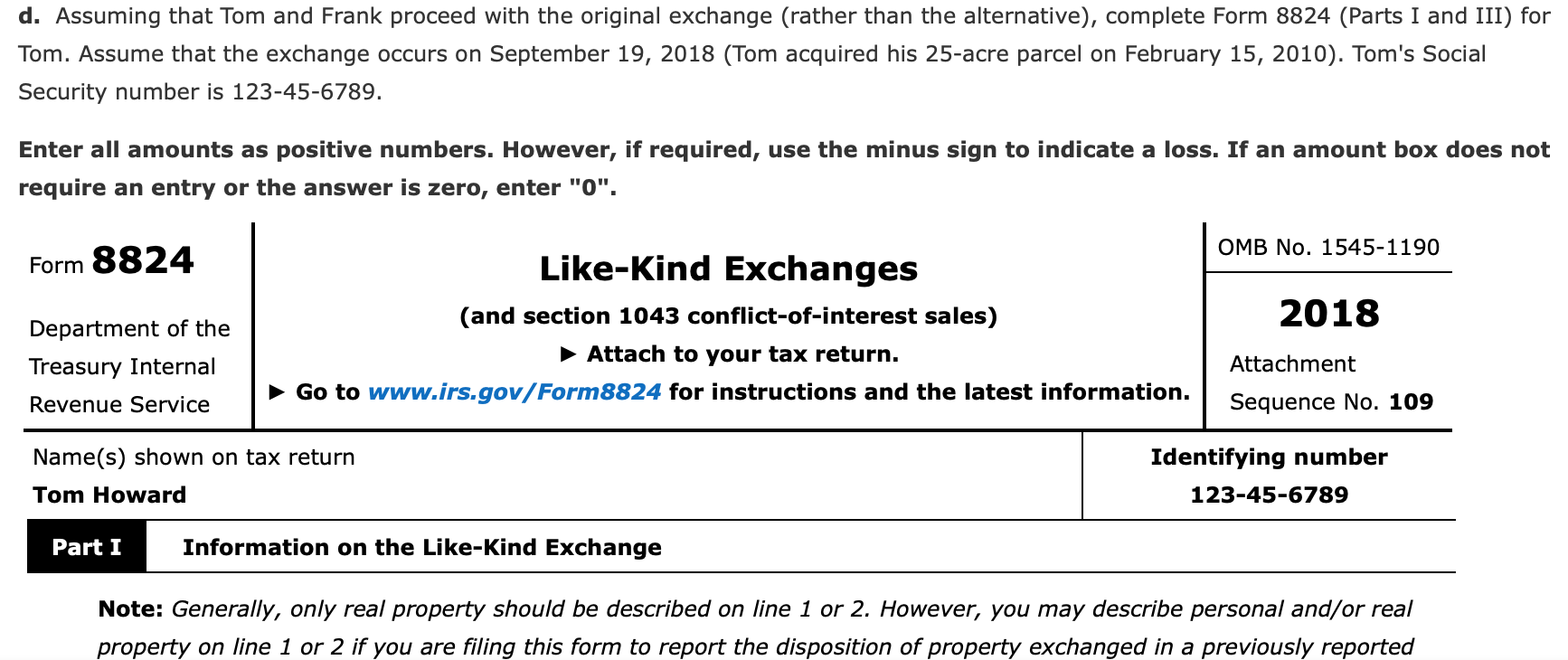

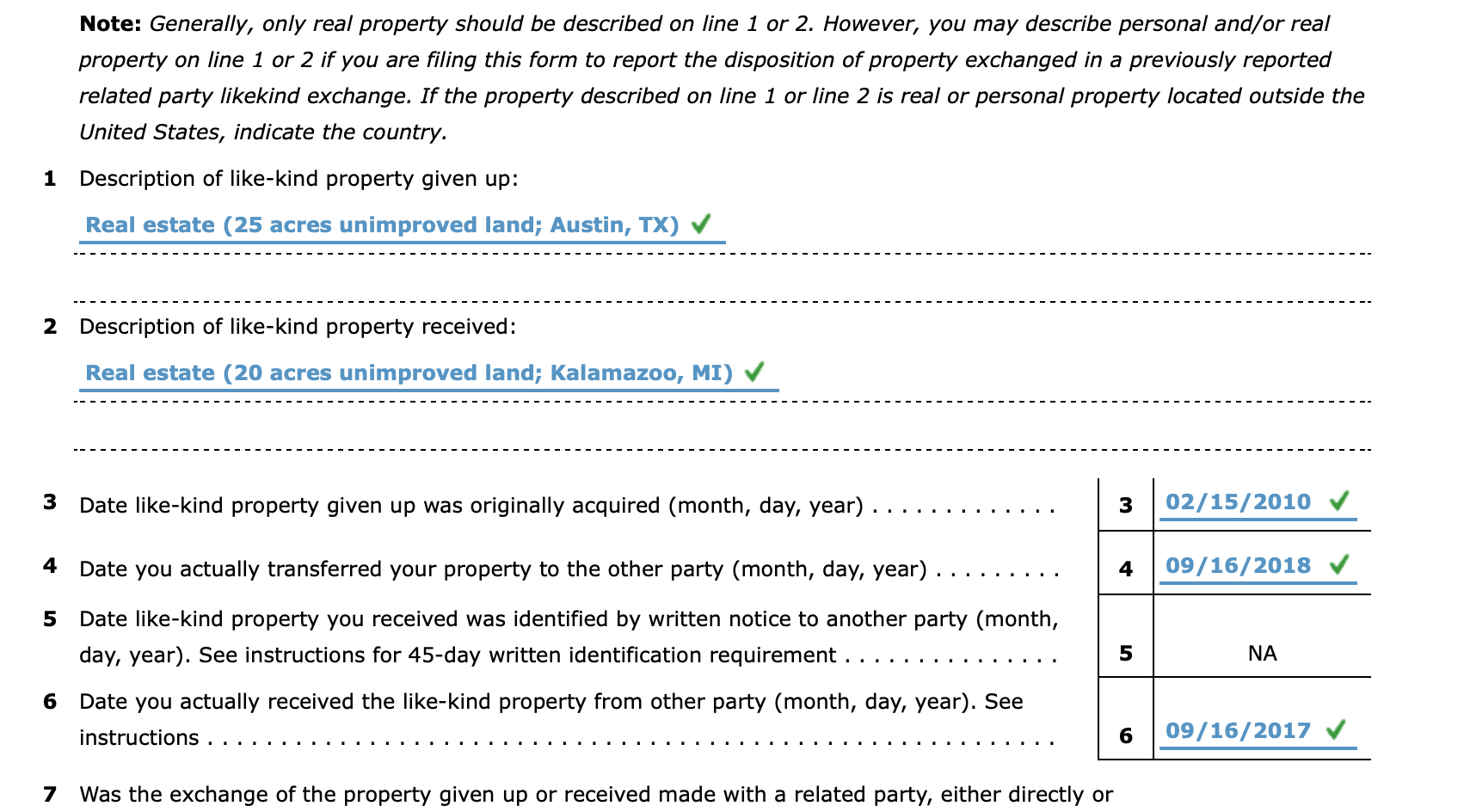

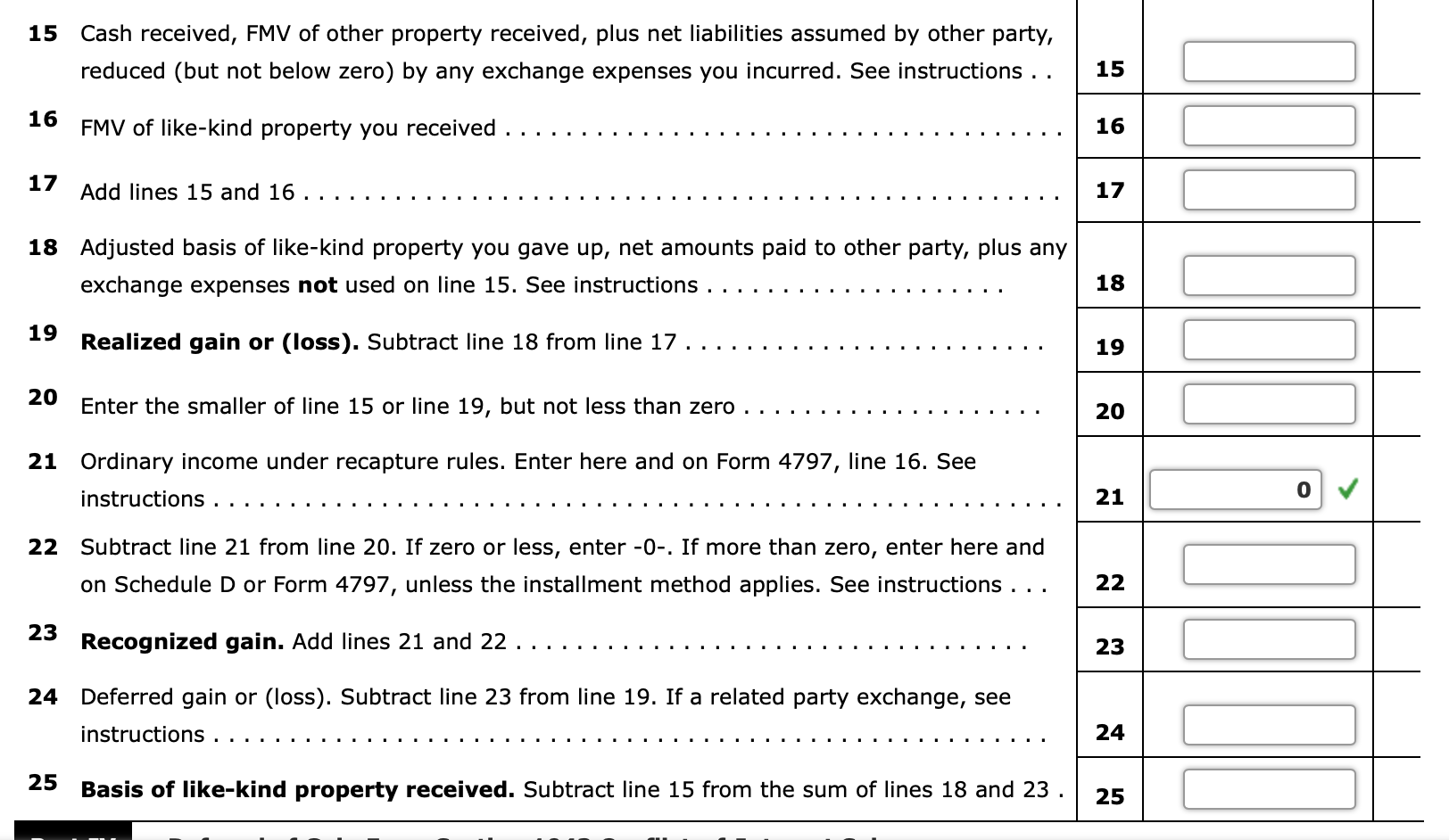

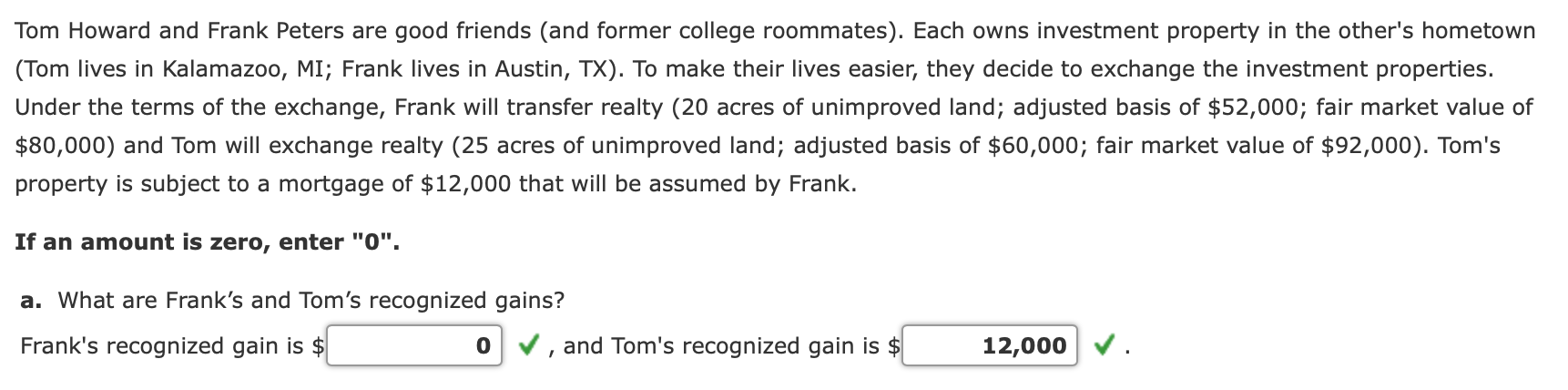

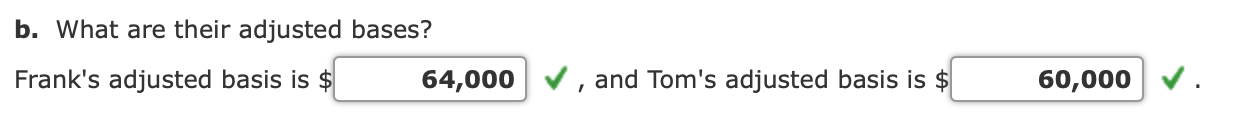

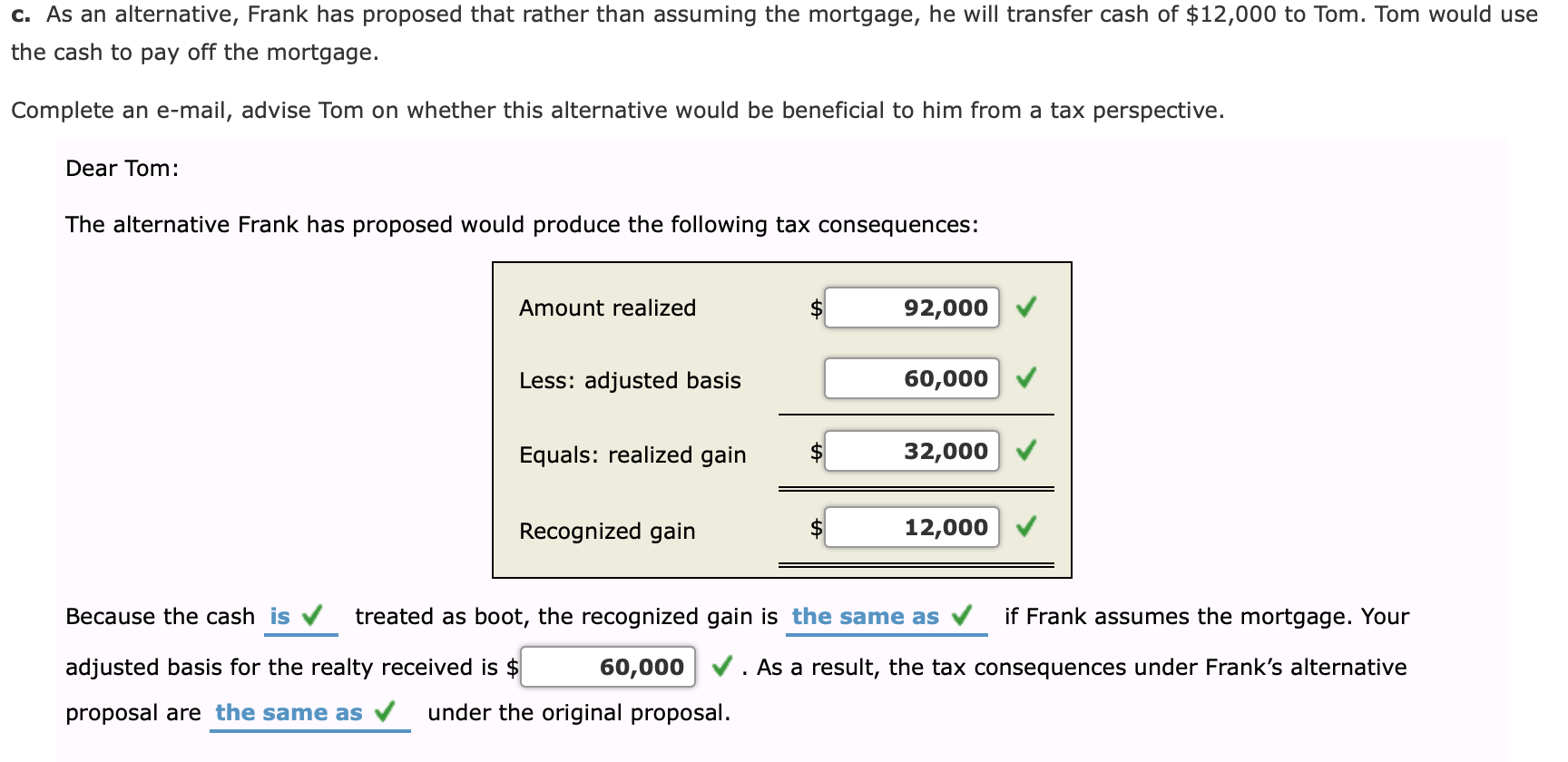

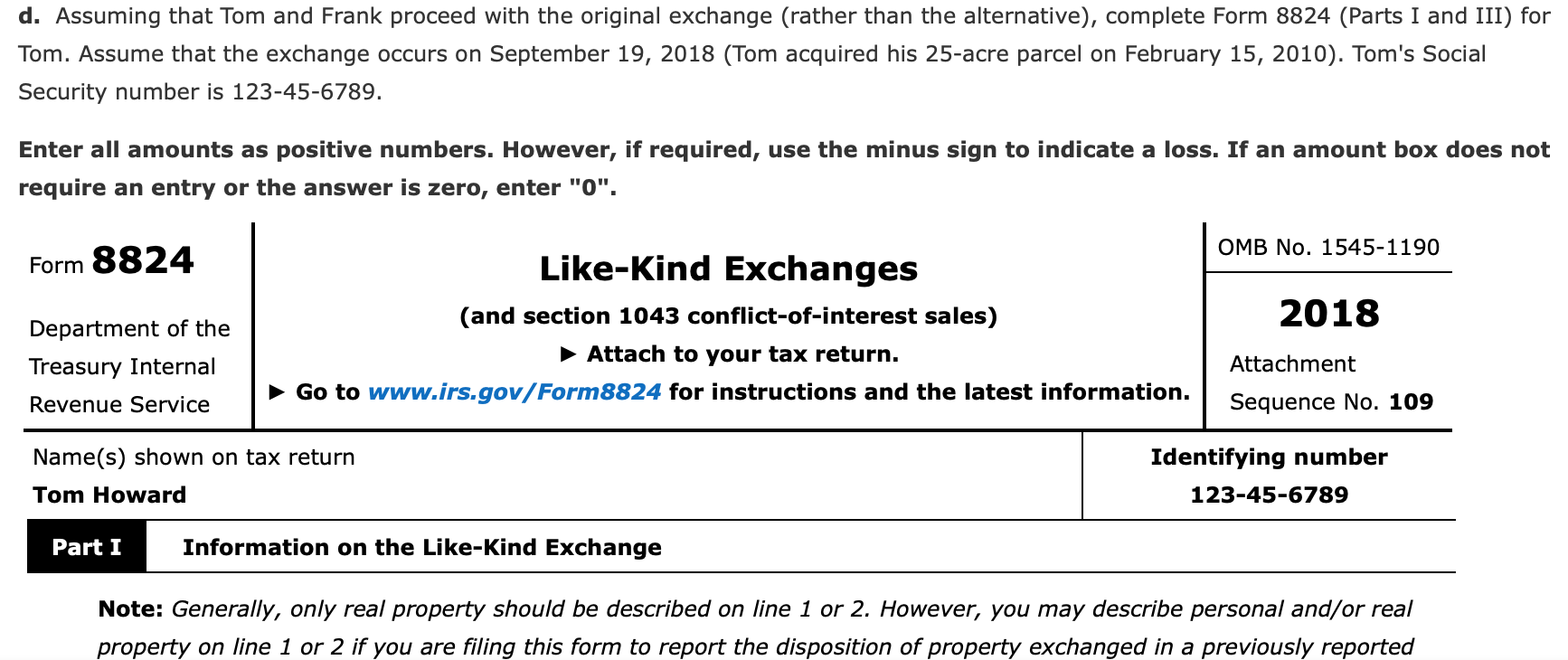

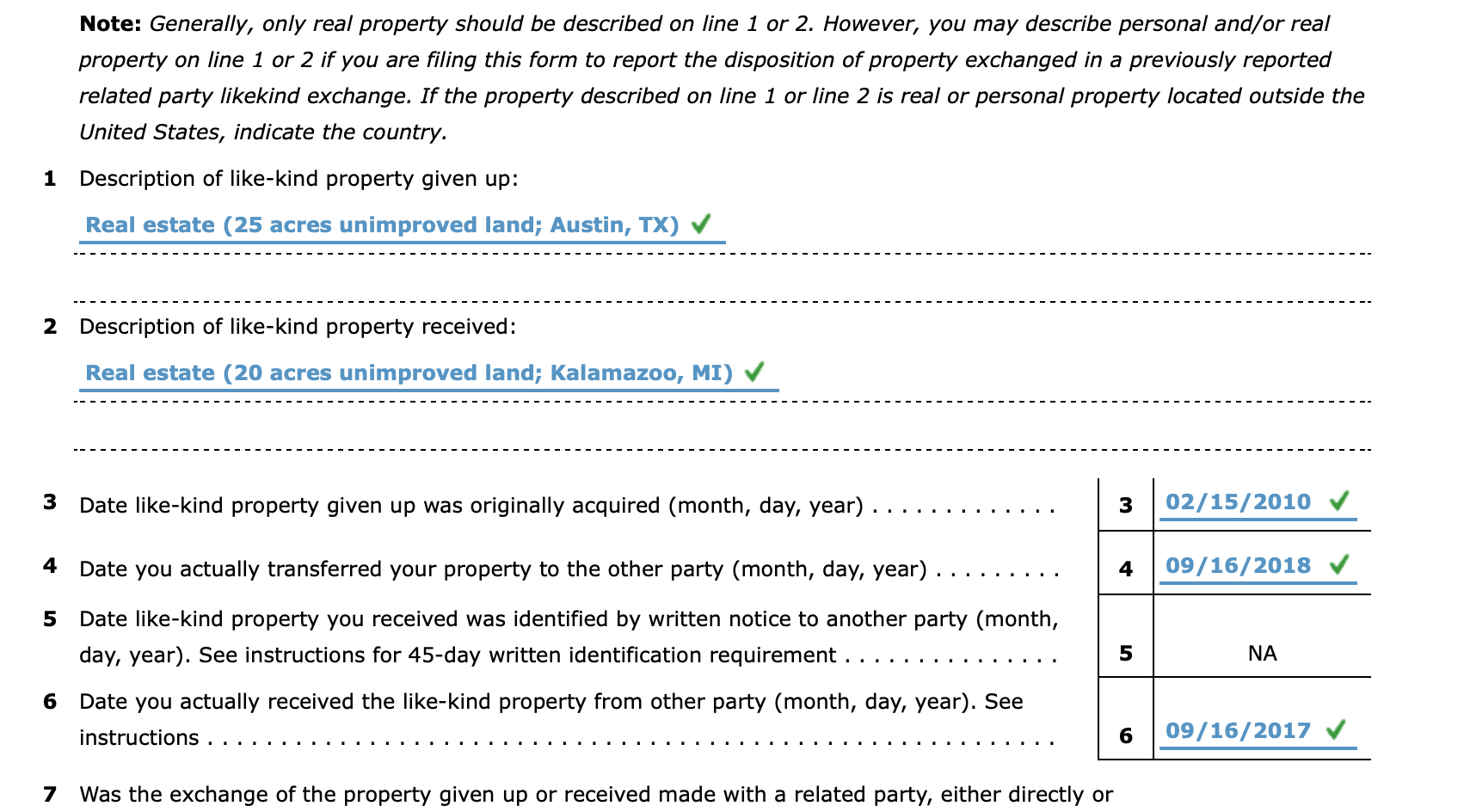

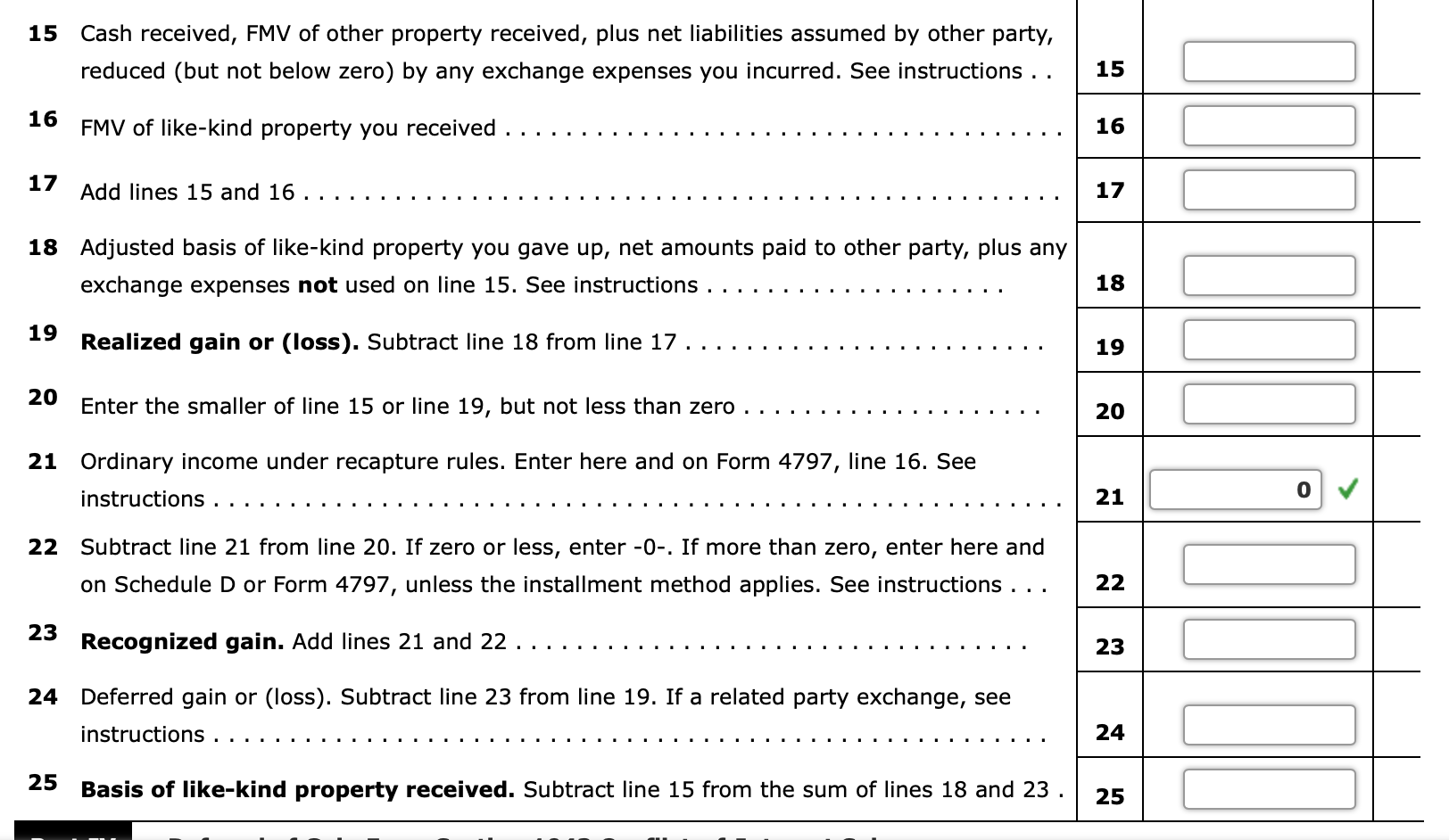

Tom Howard and Frank Peters are good friends (and former college roommates). Each owns investment property in the other's hometown (Tom lives in Kalamazoo, MI; Frank lives in Austin, TX). To make their lives easier, they decide to exchange the investment properties. Under the terms of the exchange, Frank will transfer realty (20 acres of unimproved land; adjusted basis of $52,000; fair market value of $80,000) and Tom will exchange realty (25 acres of unimproved land; adjusted basis of $60,000; fair market value of $92,000). Tom's property is subject to a mortgage of $12,000 that will be assumed by Frank. If an amount is zero, enter "0". a. What are Frank's and Tom's recognized gains? Frank's recognized gain is $ and Tom's recognized gain is $ 12,000 b. What are their adjusted bases? Frank's adjusted basis is $ and Tom's adjusted basis is $ 64,000 60,000 c. As an alternative, Frank has proposed that rather than assuming the mortgage, he will transfer cash of $12,000 to Tom. Tom would use the cash to pay off the mortgage Complete an e-mail, advise Tom on whether this alternative would be beneficial to him from a tax perspective. Dear Tom The alternative Frank has proposed would produce the following tax consequences: Amount realized 92,000 60,000 Less: adjusted basis 32,000 Equals: realized gain 12,000 $ Recognized gain Because the cash is treated as boot, the recognized gain is the same as if Frank assumes the mortgage. Your adjusted basis for the realty received is $ . As a result, the tax consequences under Frank's alternative 60,000 under the original proposal proposal are the same as d. Assuming that Tom and Frank proceed with the original exchange (rather than the alternative), complete Form 8824 (Parts I and III) for Tom. Assume that the exchange occurs on September 19, 2018 (Tom acquired his 25-acre parcel on February 15, 2010). Tom's Social Security number is 123-45-6789. Enter all amounts as positive numbers. However, if required, use the minus sign to indicate a loss. If an amount box does not require an entry or the answer is zero, enter "0". OMB No. 1545-1190 Form 8824 Like-Kind Exchanges 2018 (and section 1043 conflict-of-interest sales) Department of the Attach to your tax return. Attachment Treasury Internal Go to www.irs.gov/Form8824 for instructions and the latest information. Sequence No. 109 Revenue Service Identifying number Name(s) shown on tax return Tom Howard 123-45-6789 Information on the Like-Kind Exchange Part I Note: Generally, only real property should be described on line 1 or 2. However, you may describe personal and/or real property on line 1 or 2 if you are filing this form to report the disposition of property exchanged in a previously reported Note: Generally, only real property should be described on line 1 or 2. However, you may describe personal and/or real property on line 1 or 2 if you are filing this form to report the disposition of property exchanged in a previously reported related party likekind exchange. If the property described on line 1 or line 2 is real or personal property located outside the United States, indicate the country 1 Description of like-kind property given up: Real estate (25 acres unimproved land; Austin, TX) V 2 Description of like-kind property received: Real estate (20 acres unimproved land; Kalamazoo, MI) 02/15/2010 Date like-kind property given up was originally acquired (month, day, year) 3 4 09/16/2018 Date you actually transferred your property to the other party (month, day, year) Date like-kind property you received was identified by written notice to another party (month, 5 day, year). See instructions for 45-day written identification requirement 5 NA 6 Date you actually received the like-kind property from other party (month, day, year). See 09/16/2017 instructions Was the exchange of the property given up or received made with a related party, either directly or 7 Cash received, FMV of other property received, plus net liabilities assumed by other party, 15 15 reduced (but not below zero) by any exchange expenses you incurred. See instructions . . 16 FMV of like-kind property you received 16 17 Add lines 15 and 16. 17 18 Adjusted basis of like-kind property you gave up, net amounts paid to other party, plus any 18 exchange expenses not used on line 15. See instructions 19 Realized gain or (loss). Subtract line 18 from line 17 19 20 Enter the smaller of line 15 or line 19, but not less than zero 20 21 Ordinary income under recapture rules. Enter here and on Form 4797, line 16. See 21 instructions. 22 Subtract line 21 from line 20. If zero or less, enter -0-. If more than zero, enter here and 22 on Schedule D or Form 4797, unless the installment method applies. See instructions . . . 23 Recognized gain. Add lines 21 and 22 . 23 24 Deferred gain or (loss). Subtract line 23 from line 19. If a related party exchange, see 24 instructions . 25 Basis of like-kind property received. Subtract line 15 from the sum of lines 18 and 23 25 Tom Howard and Frank Peters are good friends (and former college roommates). Each owns investment property in the other's hometown (Tom lives in Kalamazoo, MI; Frank lives in Austin, TX). To make their lives easier, they decide to exchange the investment properties. Under the terms of the exchange, Frank will transfer realty (20 acres of unimproved land; adjusted basis of $52,000; fair market value of $80,000) and Tom will exchange realty (25 acres of unimproved land; adjusted basis of $60,000; fair market value of $92,000). Tom's property is subject to a mortgage of $12,000 that will be assumed by Frank. If an amount is zero, enter "0". a. What are Frank's and Tom's recognized gains? Frank's recognized gain is $ and Tom's recognized gain is $ 12,000 b. What are their adjusted bases? Frank's adjusted basis is $ and Tom's adjusted basis is $ 64,000 60,000 c. As an alternative, Frank has proposed that rather than assuming the mortgage, he will transfer cash of $12,000 to Tom. Tom would use the cash to pay off the mortgage Complete an e-mail, advise Tom on whether this alternative would be beneficial to him from a tax perspective. Dear Tom The alternative Frank has proposed would produce the following tax consequences: Amount realized 92,000 60,000 Less: adjusted basis 32,000 Equals: realized gain 12,000 $ Recognized gain Because the cash is treated as boot, the recognized gain is the same as if Frank assumes the mortgage. Your adjusted basis for the realty received is $ . As a result, the tax consequences under Frank's alternative 60,000 under the original proposal proposal are the same as d. Assuming that Tom and Frank proceed with the original exchange (rather than the alternative), complete Form 8824 (Parts I and III) for Tom. Assume that the exchange occurs on September 19, 2018 (Tom acquired his 25-acre parcel on February 15, 2010). Tom's Social Security number is 123-45-6789. Enter all amounts as positive numbers. However, if required, use the minus sign to indicate a loss. If an amount box does not require an entry or the answer is zero, enter "0". OMB No. 1545-1190 Form 8824 Like-Kind Exchanges 2018 (and section 1043 conflict-of-interest sales) Department of the Attach to your tax return. Attachment Treasury Internal Go to www.irs.gov/Form8824 for instructions and the latest information. Sequence No. 109 Revenue Service Identifying number Name(s) shown on tax return Tom Howard 123-45-6789 Information on the Like-Kind Exchange Part I Note: Generally, only real property should be described on line 1 or 2. However, you may describe personal and/or real property on line 1 or 2 if you are filing this form to report the disposition of property exchanged in a previously reported Note: Generally, only real property should be described on line 1 or 2. However, you may describe personal and/or real property on line 1 or 2 if you are filing this form to report the disposition of property exchanged in a previously reported related party likekind exchange. If the property described on line 1 or line 2 is real or personal property located outside the United States, indicate the country 1 Description of like-kind property given up: Real estate (25 acres unimproved land; Austin, TX) V 2 Description of like-kind property received: Real estate (20 acres unimproved land; Kalamazoo, MI) 02/15/2010 Date like-kind property given up was originally acquired (month, day, year) 3 4 09/16/2018 Date you actually transferred your property to the other party (month, day, year) Date like-kind property you received was identified by written notice to another party (month, 5 day, year). See instructions for 45-day written identification requirement 5 NA 6 Date you actually received the like-kind property from other party (month, day, year). See 09/16/2017 instructions Was the exchange of the property given up or received made with a related party, either directly or 7 Cash received, FMV of other property received, plus net liabilities assumed by other party, 15 15 reduced (but not below zero) by any exchange expenses you incurred. See instructions . . 16 FMV of like-kind property you received 16 17 Add lines 15 and 16. 17 18 Adjusted basis of like-kind property you gave up, net amounts paid to other party, plus any 18 exchange expenses not used on line 15. See instructions 19 Realized gain or (loss). Subtract line 18 from line 17 19 20 Enter the smaller of line 15 or line 19, but not less than zero 20 21 Ordinary income under recapture rules. Enter here and on Form 4797, line 16. See 21 instructions. 22 Subtract line 21 from line 20. If zero or less, enter -0-. If more than zero, enter here and 22 on Schedule D or Form 4797, unless the installment method applies. See instructions . . . 23 Recognized gain. Add lines 21 and 22 . 23 24 Deferred gain or (loss). Subtract line 23 from line 19. If a related party exchange, see 24 instructions . 25 Basis of like-kind property received. Subtract line 15 from the sum of lines 18 and 23 25