Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10-) Ege Endstri ve Ticaret A.S. (EGEEN) is a Turkey-based company that sold axle and axle parts to Volkswagen Germany on credit and invoiced

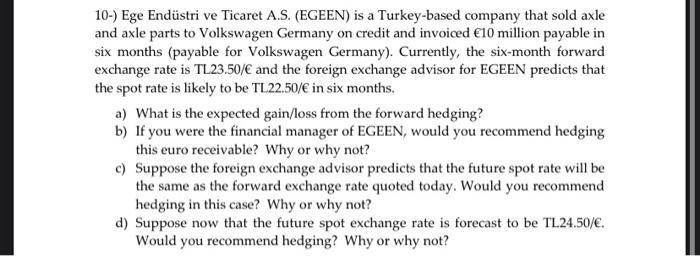

10-) Ege Endstri ve Ticaret A.S. (EGEEN) is a Turkey-based company that sold axle and axle parts to Volkswagen Germany on credit and invoiced 10 million payable in six months (payable for Volkswagen Germany). Currently, the six-month forward exchange rate is TL23.50/ and the foreign exchange advisor for EGEEN predicts that the spot rate is likely to be TL22.50/ in six months. a) What is the expected gain/loss from the forward hedging? b) If you were the financial manager of EGEEN, would you recommend hedging this euro receivable? Why or why not? c) Suppose the foreign exchange advisor predicts that the future spot rate will be the same as the forward exchange rate quoted today. Would you recommend hedging in this case? Why or why not? d) Suppose now that the future spot exchange rate is forecast to be TL24.50/. Would you recommend hedging? Why or why not?

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The expected gainloss from the forward hedging depends on the difference between the current forwa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started