Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tom is the finance manager of a medium sized supermarket chain store. He just obtains working capital information of his company and two close

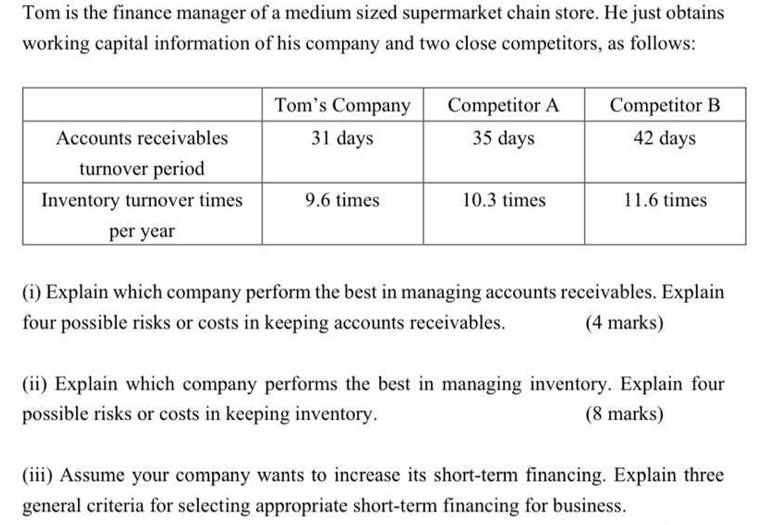

Tom is the finance manager of a medium sized supermarket chain store. He just obtains working capital information of his company and two close competitors, as follows: Tom's Company Accounts receivables 31 days Competitor A 35 days Competitor B 42 days turnover period Inventory turnover times per year 9.6 times 10.3 times 11.6 times (i) Explain which company perform the best in managing accounts receivables. Explain four possible risks or costs in keeping accounts receivables. (4 marks) (ii) Explain which company performs the best in managing inventory. Explain four possible risks or costs in keeping inventory. (8 marks) (iii) Assume your company wants to increase its short-term financing. Explain three general criteria for selecting appropriate short-term financing for business.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i In managing accounts receivables a lower turnover period indicates better efficiency in collecting payments from customers In this case Toms company ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started