Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tom owns a business called Toms Band in Westfield Sydney selling musical instruments. Tom also teaches guitar on a casual basis at the Sydney Guitar

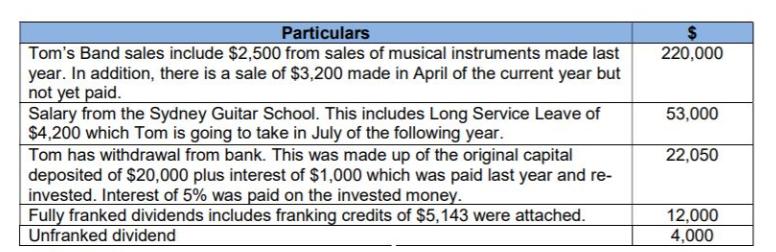

Tom owns a business called Tom’s Band in Westfield Sydney selling musical instruments. Tom also teaches guitar on a casual basis at the Sydney Guitar School a local musical college. The following are Tom’s receipts during the 2019-20 financial year:

Required:

Assuming Tom does not have allowable deductions, you are required to calculate Tom's taxable income and net tax payable.

%24 220,000 Particulars Tom's Band sales include $2,500 from sales of musical instruments made last year. In addition, there is a sale of $3,200 made in April of the current year but not yet paid. Salary from the Sydney Guitar School. This includes Long Service Leave of $4,200 which Tom is going to take in July of the following year. Tom has withdrawal from bank. This was made up of the original capital deposited of $20,000 plus interest of $1,000 which was paid last year and re- invested. Interest of 5% was paid on the invested money. Fully franked dividends includes franking credits of $5,143 were attached. Unfranked dividend 53,000 22,050 12,000 4,000

Step by Step Solution

★★★★★

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Franked dividend is already tax deducted Unfranked dividend is tax emepted Tom ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started