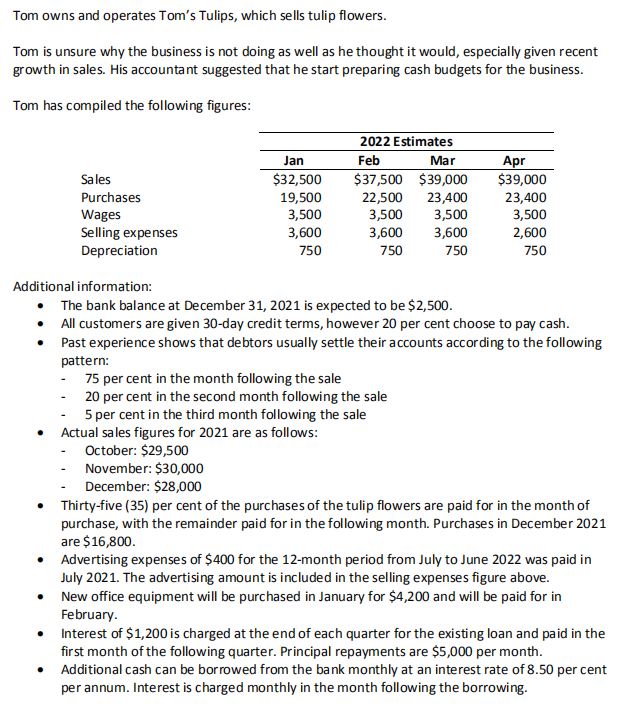

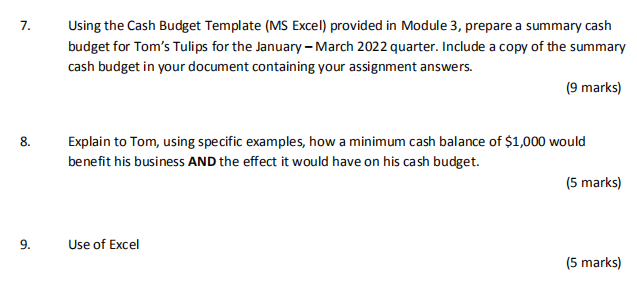

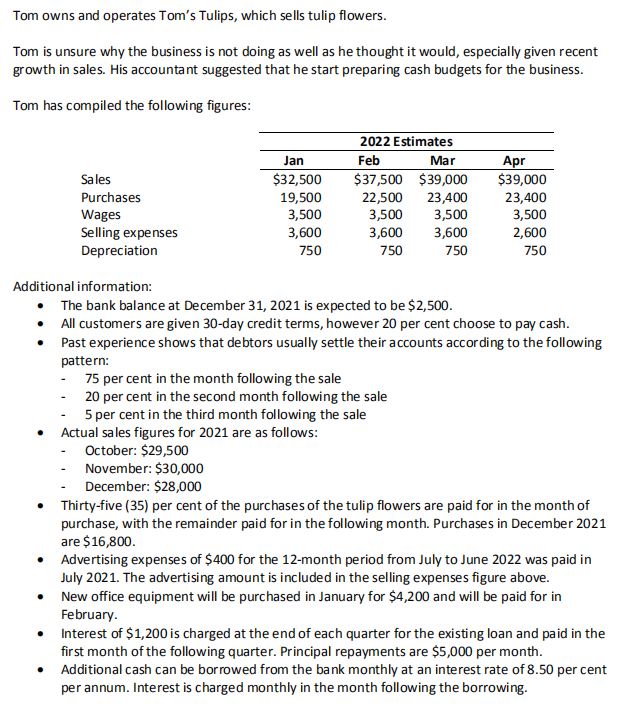

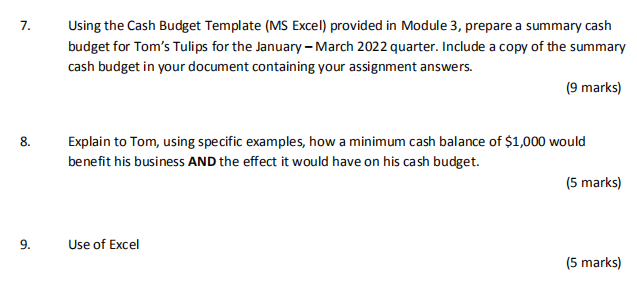

Tom owns and operates Tom's Tulips, which sells tulip flowers. Tom is unsure why the business is not doing as well as he thought it would, especially given recent growth in sales. His accountant suggested that he start preparing cash budgets for the business. Tom has compiled the following figures: Sales Purchases Wages Selling expenses Depreciation Jan $32,500 19,500 3,500 3,600 750 2022 Estimates Feb Mar $37,500 $39,000 22,500 23,400 3,500 3,500 3,600 3,600 750 750 Apr $39,000 23,400 3,500 2,600 750 Additional information: The bank balance at December 31, 2021 is expected to be $2,500. All customers are given 30-day credit terms, however 20 per cent choose to pay cash. Past experience shows that debtors usually settle their accounts according to the following pattern: - 75 per cent in the month following the sale 20 per cent in the second month following the sale 5 per cent in the third month following the sale Actual sales figures for 2021 are as follows: October: $29,500 November: $30,000 December: $28,000 Thirty-five (35) per cent of the purchases of the tulip flowers are paid for in the month of purchase, with the remainder paid for in the following month. Purchases in December 2021 are $ 16,800. Advertising expenses of $400 for the 12-month period from July to June 2022 was paid in July 2021. The advertising amount is included in the selling expenses figure above. New office equipment will be purchased in January for $4,200 and will be paid for in February Interest of $1,200 is charged at the end of each quarter for the existing loan and paid in the first month of the following quarter. Principal repayments are $5,000 per month. Additional cash can be borrowed from the bank monthly at an interest rate of 8.50 per cent per annum. Interest is charged monthly in the month following the borrowing. 7. Using the Cash Budget Template (MS Excel) provided in Module 3, prepare a summary cash budget for Tom's Tulips for the January - March 2022 quarter. Include a copy of the summary cash budget in your document containing your assignment answers. (9 marks) 8. 8. Explain to Tom, using specific examples, how a minimum cash balance of $1,000 would benefit his business AND the effect it would have on his cash budget. (5 marks) 9. 9 Use of Excel (5 marks) Tom owns and operates Tom's Tulips, which sells tulip flowers. Tom is unsure why the business is not doing as well as he thought it would, especially given recent growth in sales. His accountant suggested that he start preparing cash budgets for the business. Tom has compiled the following figures: Sales Purchases Wages Selling expenses Depreciation Jan $32,500 19,500 3,500 3,600 750 2022 Estimates Feb Mar $37,500 $39,000 22,500 23,400 3,500 3,500 3,600 3,600 750 750 Apr $39,000 23,400 3,500 2,600 750 Additional information: The bank balance at December 31, 2021 is expected to be $2,500. All customers are given 30-day credit terms, however 20 per cent choose to pay cash. Past experience shows that debtors usually settle their accounts according to the following pattern: - 75 per cent in the month following the sale 20 per cent in the second month following the sale 5 per cent in the third month following the sale Actual sales figures for 2021 are as follows: October: $29,500 November: $30,000 December: $28,000 Thirty-five (35) per cent of the purchases of the tulip flowers are paid for in the month of purchase, with the remainder paid for in the following month. Purchases in December 2021 are $ 16,800. Advertising expenses of $400 for the 12-month period from July to June 2022 was paid in July 2021. The advertising amount is included in the selling expenses figure above. New office equipment will be purchased in January for $4,200 and will be paid for in February Interest of $1,200 is charged at the end of each quarter for the existing loan and paid in the first month of the following quarter. Principal repayments are $5,000 per month. Additional cash can be borrowed from the bank monthly at an interest rate of 8.50 per cent per annum. Interest is charged monthly in the month following the borrowing. 7. Using the Cash Budget Template (MS Excel) provided in Module 3, prepare a summary cash budget for Tom's Tulips for the January - March 2022 quarter. Include a copy of the summary cash budget in your document containing your assignment answers. (9 marks) 8. 8. Explain to Tom, using specific examples, how a minimum cash balance of $1,000 would benefit his business AND the effect it would have on his cash budget. (5 marks) 9. 9 Use of Excel