Question

Tom Riley's life is changing dramatically. He and his wife recently bought a new home and are expecting their second child in a few months.

Tom Riley's life is changing dramatically. He and his wife recently bought a new home and are expecting their second child in a few months. These new responsibilities have prompted Tom to think about some serious issues, including life insurance. Ten years ago, Tom purchased an insurance policy that provides a death benefit of $40,000. This policy is paid for in full and will remain in force for the rest of Tom's life. Alternatively, Tom can surrender this policy and receive an immediate payoff of approximately $6,000 from the insurance company.

Ten years ago, the $40,000 death benefit provided by the insurance policy seemed more than adequate. However, Tom now feels that he needs more coverage to care for his wife and children adequately in the event of his untimely death. Tom is investigating a different kind of insurance that would provide a death benefit of $350,000 but also would require on-going annual payments to keep the coverage in force. He received the following estimates of the annual premiums for this new policy in each of the next 10 years:

| Year | Premium |

| 1 | $ 423 |

| 2 | $ 457 |

| 3 | $ 489 |

| 4 | $ 516 |

| 5 | $ 530 |

| 6 | $ 558 |

| 7 | $ 595 |

| 8 | $ 618 |

| 9 | $ 660 |

| 10 | $ 716 |

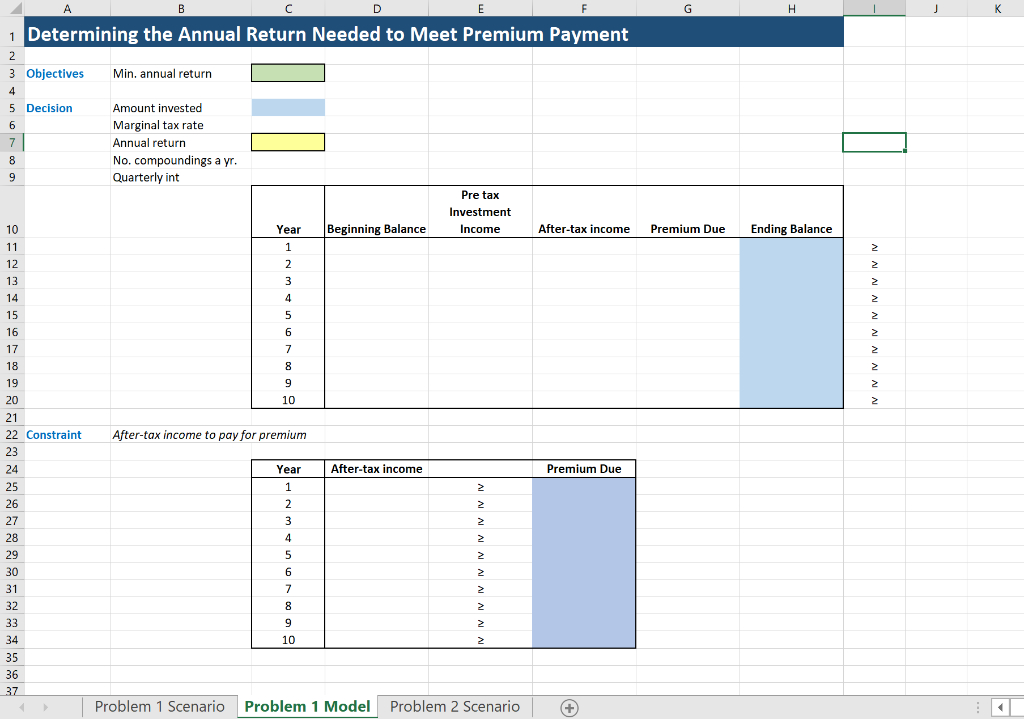

In order to pay the premiums for this new policy, one alternative Tom is considering involves surrendering his existing policy and investing the $6,000 he would receive to generate the after-tax income needed to pay the premiums on his new policy. However, to see if this is possible, he wants to determine the minimum annual rate of return (which is compounded quarterly) he would have to earn on his investment to generate after-tax investment income that would cover the premium payments for the new policy. Tom likes the idea of keeping the $6,000 in case of an emergency and does not want to use it to pay premiums. Tom's marginal tax rate is 28%.

Note: The following are some of the formula you will use to calculate:

(i) Annual investment income (based on quarterly return)

1+ 44Amount(1+(Annual return)/4)^4-Amount

(ii) Afte- tax income

1 (1-Tax rate)Income

Excel Model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started