Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tomas began carrying on a home-based business as a sole proprietor on January 1, 2023. In 2023, he received $40,000 cash for services rendered

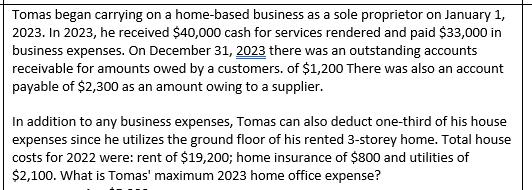

Tomas began carrying on a home-based business as a sole proprietor on January 1, 2023. In 2023, he received $40,000 cash for services rendered and paid $33,000 in business expenses. On December 31, 2023 there was an outstanding accounts receivable for amounts owed by a customers. of $1,200 There was also an account payable of $2,300 as an amount owing to a supplier. In addition to any business expenses, Tomas can also deduct one-third of his house expenses since he utilizes the ground floor of his rented 3-storey home. Total house costs for 2022 were: rent of $19,200; home insurance of $800 and utilities of $2,100. What is Tomas' maximum 2023 home office expense?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Tomas maximum 2023 home office expense we need to d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started