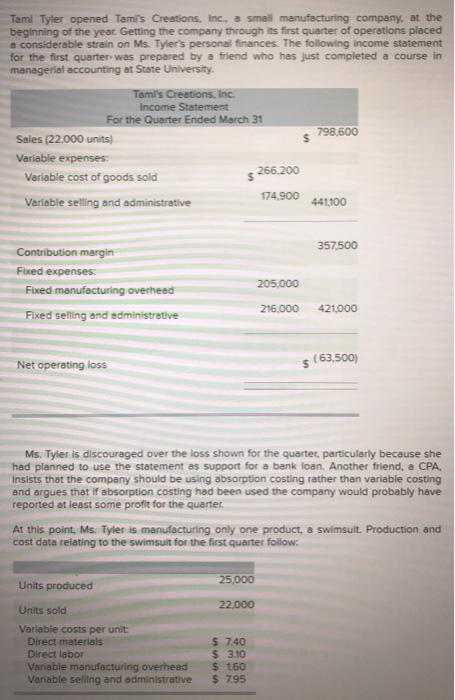

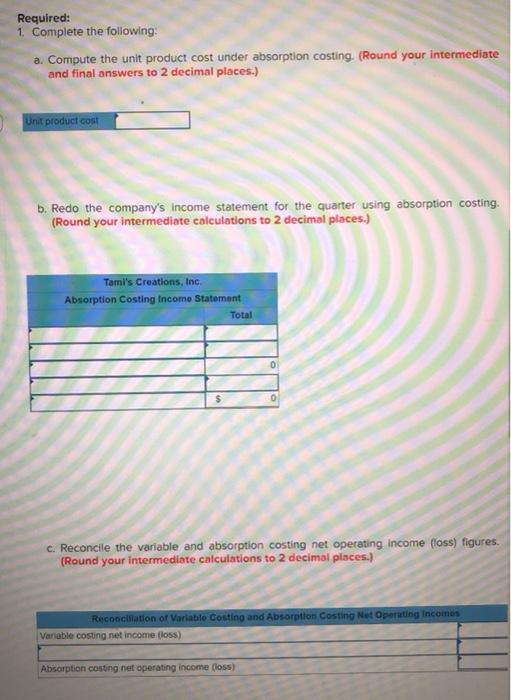

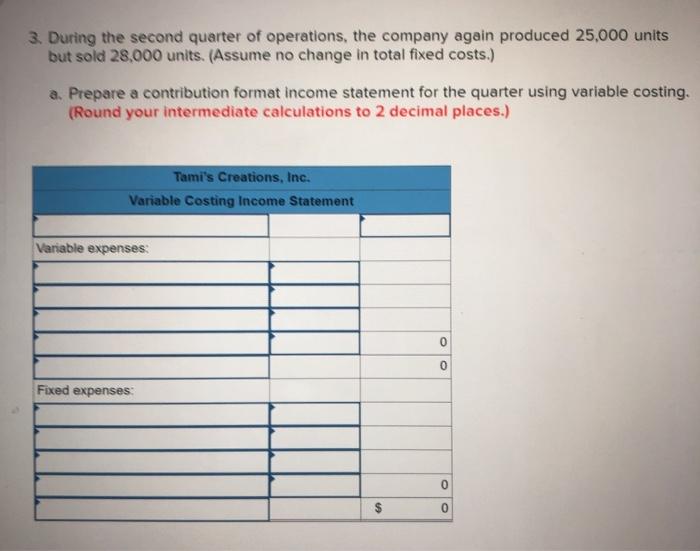

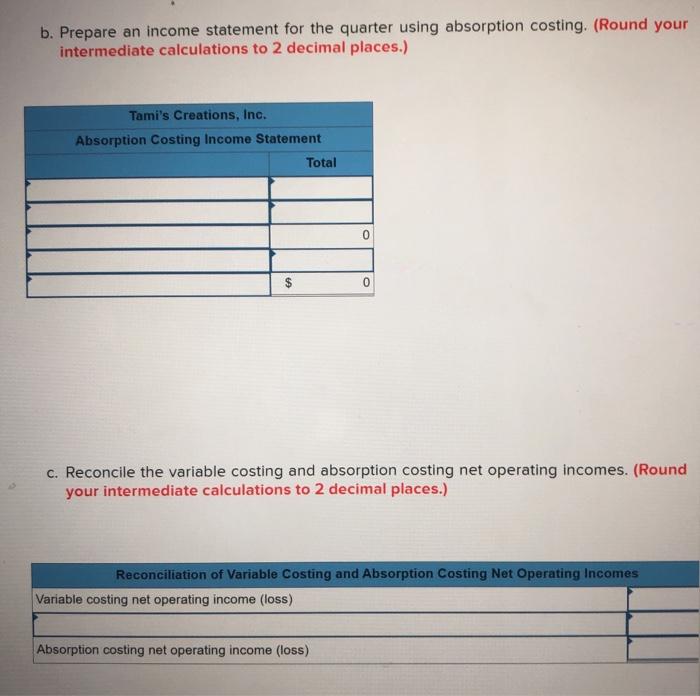

Tomi Tyler opened Temi's Creations, Inc, a small manufacturing company, at the beginning of the year Getting the company through its first quarter of operations placed considerable strain on Ms. Tyler's personal finances. The following income statement for the first quarter was prepared by a friend who has just completed a course in managerial accounting at State University 798.600 Tami's Creations, Inc. Income Statement For the Quarter Ended March 31 Sales (22,000 units) Variable expenses 266.200 Variable cost of goods sold Variable selling and administrative 174.900 441.100 357,500 Contribution margin Fored expenses Fixed manufacturing overhead Fixed selling and administrative 205.000 216.000 421.000 Net operating loss $ (63,500) Ms. Tyler is discouraged over the loss shown for the quarter particularly because she had planned to use the statement as support for a bank loan. Another friend, a CPA. Insists that the company should be using absorption costing rather than variable costing and argues that if absorption costing had been used the company would probably have reported at least some profit for the quarter. At this point. Ms. Tyler is manufacturing only one product, a swimsuit. Production and cost data relating to the swimsuit for the first quarter follow 25.000 Units produced 22.000 Units sold Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative $ 7,40 $ 3.10 $ 160 $ 7.95 Required: 1. Complete the following: a. Compute the unit product cost under absorption costing. (Round your intermediate and final answers to 2 decimal places.) Unit product cost b. Redo the company's income statement for the quarter using absorption costing. (Round your intermediate calculations to 2 decimal places.) Tami's Creations, Inc. Absorption Costing Income Statement Total 0 c. Reconcile the variable and absorption costing net operating income (loss) figures. (Round your intermediate calculations to 2 decimal places.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net income foss) Absorption costing net operating income (oss) 3. During the second quarter of operations, the company again produced 25,000 units but sold 28,000 units. (Assume no change in total fixed costs.) a. Prepare a contribution format income statement for the quarter using variable costing. (Round your intermediate calculations to 2 decimal places.) Tami's Creations, Inc. Variable Costing Income Statement Variable expenses: 0 0 Fixed expenses 0 $ 0 b. Prepare an income statement for the quarter using absorption costing. (Round your intermediate calculations to 2 decimal places.) Tami's Creations, Inc. Absorption Costing Income Statement Total $ c. Reconcile the variable costing and absorption costing net operating incomes. (Round your intermediate calculations to 2 decimal places.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income (loss) Absorption costing net operating income (loss)