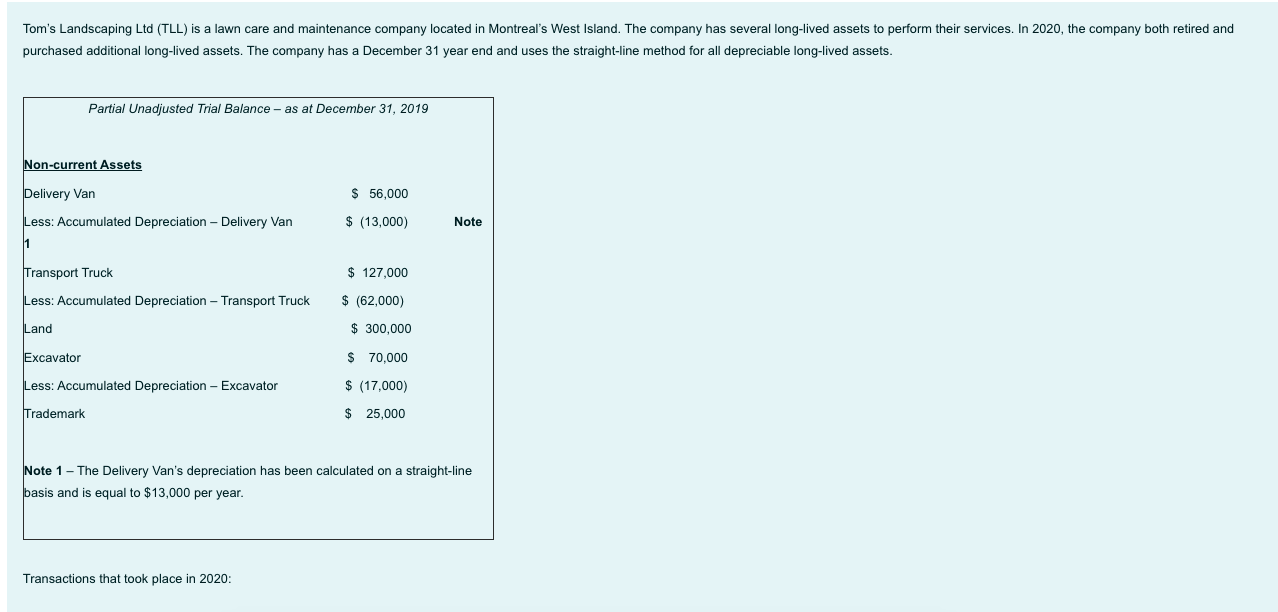

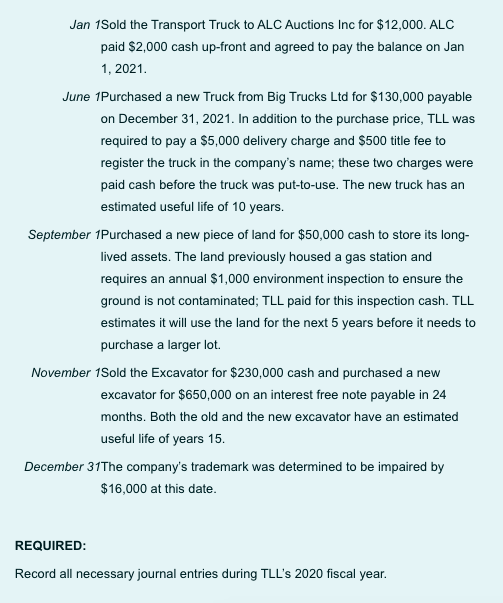

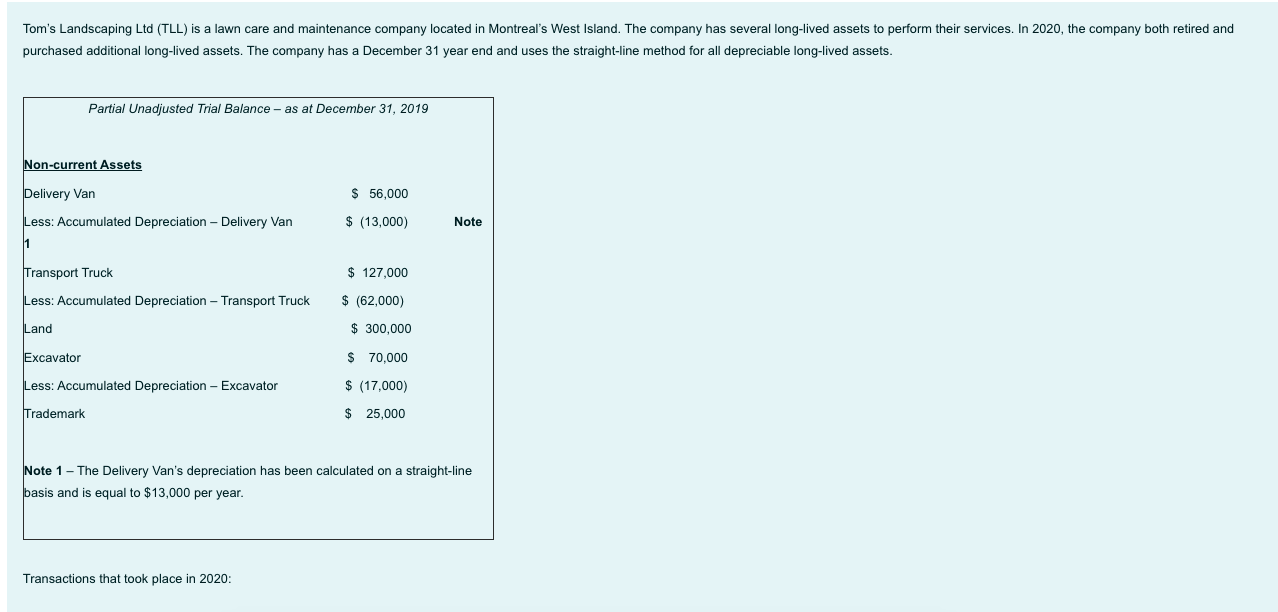

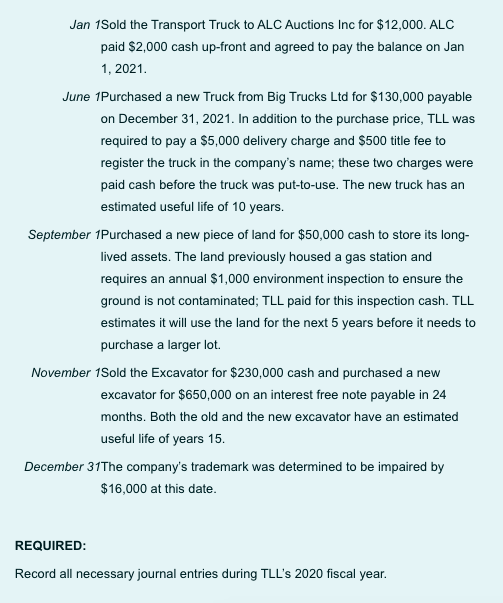

Tom's Landscaping Ltd (TLL) is a lawn care and maintenance company located in Montreal's West Island. The company has several long-lived assets to perform their services. In 2020, the company both retired and purchased additional long-lived assets. The company has a December 31 year end and uses the straight-line method for all depreciable long-lived assets. Partial Unadjusted Trial Balance - as at December 31, 2019 Non-current Assets Delivery Van $ 56,000 Less: Accumulated Depreciation - Delivery Van $ (13,000) Note 1 Transport Truck $ 127,000 $ (62,000) Less: Accumulated Depreciation - Transport Truck Land $ 300,000 Excavator $ 70,000 Less: Accumulated Depreciation - Excavator $ (17,000) Trademark $ 25,000 Note 1 - The Delivery Van's depreciation has been calculated on a straight-line basis and is equal to $13,000 per year. Transactions that took place in 2020: Jan 1Sold the Transport Truck to ALC Auctions Inc for $12,000. ALC paid $2,000 cash up-front and agreed to pay the balance on Jan 1, 2021 June 1Purchased a new Truck from Big Trucks Ltd for $130,000 payable on December 31, 2021. In addition to the purchase price, TLL was required to pay a $5,000 delivery charge and $500 title fee to register the truck in the company's name; these two charges were paid cash before the truck was put-to-use. The new truck has an estimated useful life of 10 years. September 1Purchased a new piece of land for $50,000 cash to store its long- lived assets. The land previously housed a gas station and requires an annual $1,000 environment inspection to ensure the ground is not contaminated; TLL paid for this inspection cash. TLL estimates it will use the land for the next 5 years before it needs to purchase a larger lot November 1Sold the Excavator for $230,000 cash and purchased a new excavator for $650,000 on an interest free note payable in 24 months. Both the old and the new excavator have an estimated useful life of years 15. December 31The company's trademark was determined to be impaired by $16,000 at this date. REQUIRED: Record all necessary journal entries during TLL's 2020 fiscal year