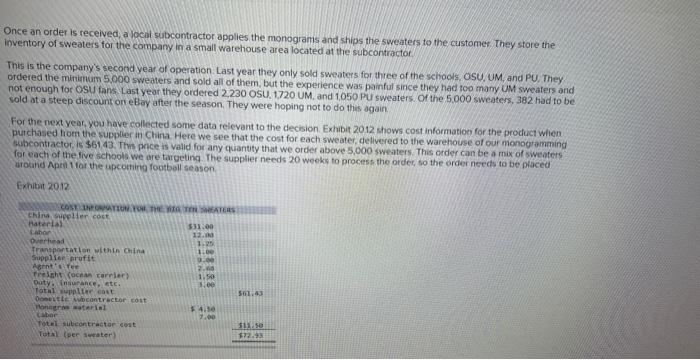

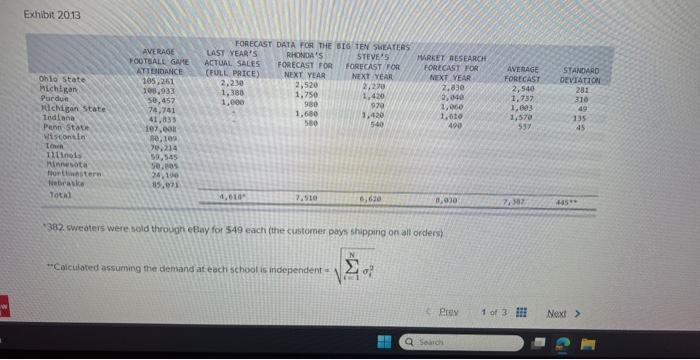

Ton Conference whin tree yesrs principal in the future. You majored in vupply chain (operatons) management in school and had a great infermap at a big retaifer that. procrams und a ioyal fan base Once an order is received; a local subcontractor applies the monograms and ships the sweaters to the customer. They store the inventory of sweaters for the company in a small warehouse area located at the subcontractor. This is the company's second year of operation. Last year they only sold sweaters for three of the sehools, OSU. UM, and PU. They ordered the minimum 5.000 sweaters and sold all of them, but the experience was painful since they had too many UM swoaters and not enough for OSU fans. Last yeor they ordered 2,230 OSU, 1,720 UM, and 1,050 PU sweaters. Of the 5.000 sweaters, 382 had to be sold at a steep discount on elfor after the season. They were hoping not to do this again. For the next year you have collected some data felevant to the decision. Exhibit 2012 shows cost information for the product when purchased hom the supplier in China. Here we see that the cost for each sweater, dellvered to the warehouse of our monogramming subcontractor, is $61.43. This price is valid for any quantity that we order above 5,000 sweaters. This order can be a mox of sweaters for each of the five schoold we are targeting. The supplier needs 20 weeks to process the order, so the order needs to be placed arobind Apen ifor the upcothing football season. Exhibit 2012 Exhibit 2013 1382. sweaters were sold throuph eElay for 549 each (the customer pays shipping on all orden "Coiculated assuming thie demand at each school is independent =i=1N1N Der monogramming subcontractor gets $1150 for each sweater. Shipping cost is paid by the custorner when the order is placed: In addition to the cost data; you also have some demand information, as shown in Exhibit 20 13. The exact sales numbers for fost year the end of the season were sold through eBay for $49 each and were not monogramrned. Kecp in inind that the fetal sales numbers do rot accurately reflect actual demand since they stocked out of the OSU sweaters toward the end of the season. As for advertising the sweaters for next season, Rtionda is committed to using the same approach used tast yoar The fim piaced ads in the fogtbal program sold at each game. These worked very well for feaching those astending the games, but yhe reainzed thete might ber ways to abvertise that would open sales to more alumini. She has hired a market research firm to help wfentry other ndvortigne outiets but has ifecided to wat at least another year to try something different. Focecasting dersand is a major problern for the company You have acked fhonda and Steve to predict what they think nales mogt be Basyd on advicy from the market reseach fum, you have decided to use the aggregate domand forecosi and standard deviation for elen schoor was consideted individually. You are cunous os to how much finonda and Steve made in their business last year, You do not hive as the dota. but you know that moct of their expenses relate to buying the sweaters and having them monoghinmed. You know they paid themseives s50.000 each 6. What was the net pee-tak profa for thes busines fast yeder, affer deductang salary and overhead? (Do not round intermediate colculations. Pound your answer to the nearest dollar amount. b. If they must pay 50% in taxes after deducting their venture capital firm payment, what was the increase in cash that their business accrued last year? (Do not round intermediate calculations. Round your answer to the nearest dollar omount.)