Question

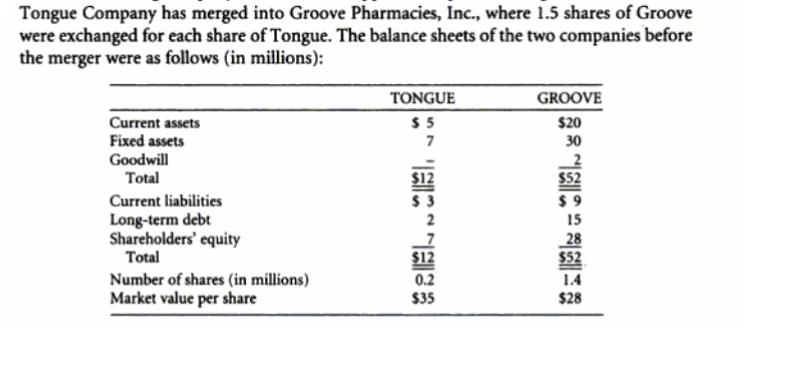

Tongue Company has merged into Groove Pharmacies, Inc., where 1.5 shares of Groove were exchanged for each share of Tongue. The balance sheets of

Tongue Company has merged into Groove Pharmacies, Inc., where 1.5 shares of Groove were exchanged for each share of Tongue. The balance sheets of the two companies before the merger were as follows (in millions): Current assets Fixed assets Goodwill Total Current liabilities Long-term debt Shareholders' equity Total Number of shares (in millions) Market value per share TONGUE $5 7 $12 $12 0.2 $35 GROOVE $20 30 $52 $9 15 28 $52 1.4 $28 The fair market value of Tongue's fixed assets is $400,000 higher than their book value. Construct the balance sheet for the company after the merger, using the purchase method of accounting.

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To construct the balance sheet for the company after the merger using the purchase method of account...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Advanced Accounting

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

6th edition

0-07-786223-6, 101259095592, 13: 978-0-07-7, 13978125909559, 978-0077862237

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App