Question

Tony and Suzie graduate from college in May 2024 and begin developing their new business. They begin by offering clinics for basic outdoor activities such

Tony and Suzie graduate from college in May 2024 and begin developing their new business. They begin by offering clinics for basic outdoor activities such as mountain biking or kayaking. Upon developing a customer base, theyll hold their first adventure races. These races will involve four-person teams that race from one checkpoint to the next using a combination of kayaking, mountain biking, orienteering, and trail running. In the long run, they plan to sell outdoor gear and develop a ropes course for outdoor enthusiasts.

Tony and Suzie graduate from college in May 2024 and begin developing their new business. They begin by offering clinics for basic outdoor activities such as mountain biking or kayaking. Upon developing a customer base, theyll hold their first adventure races. These races will involve four-person teams that race from one checkpoint to the next using a combination of kayaking, mountain biking, orienteering, and trail running. In the long run, they plan to sell outdoor gear and develop a ropes course for outdoor enthusiasts.

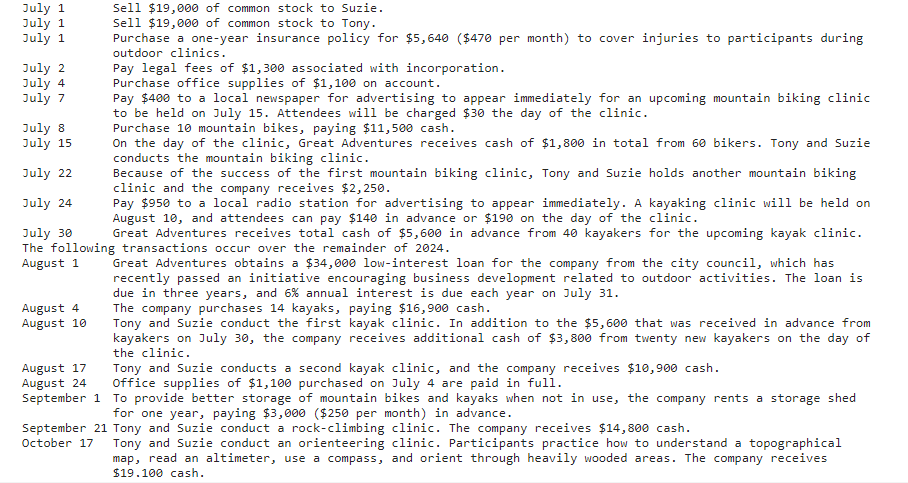

On July 1, 2024, Tony and Suzie organize their new company as a corporation, Great Adventures Incorporated The articles of incorporation state that the corporation will sell 38,000 shares of common stock for $1 each. Each share of stock represents a unit of ownership. Tony and Suzie will act as co-presidents of the company. The following business activities occur during July for Great Adventures.

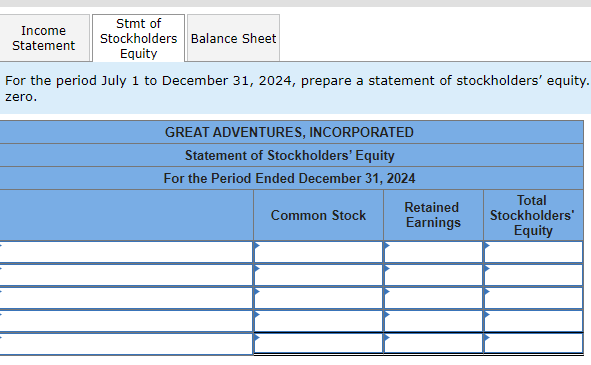

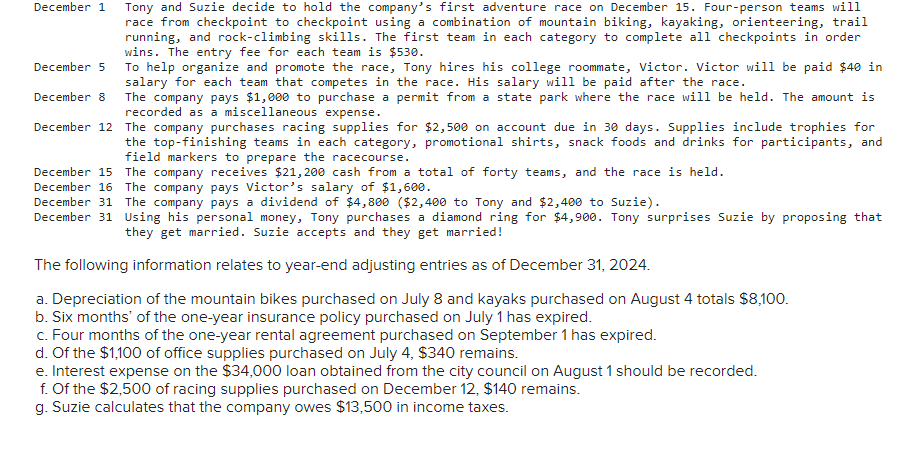

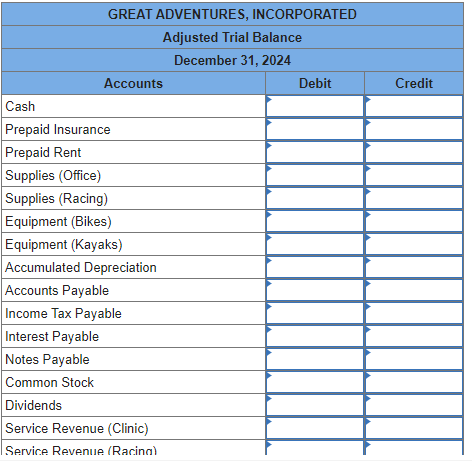

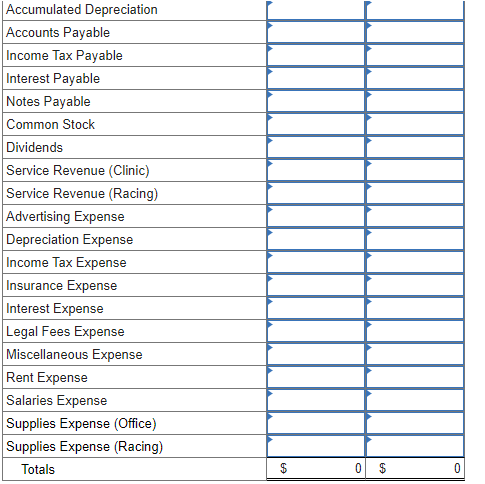

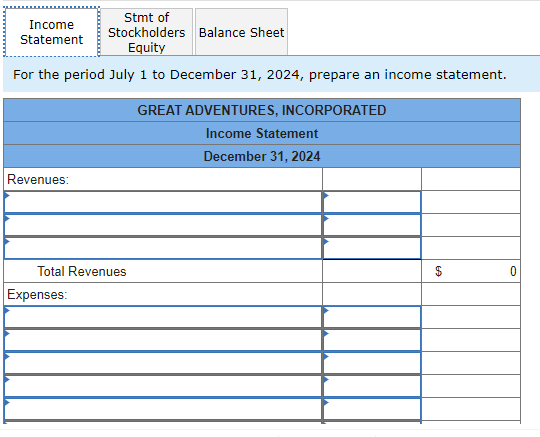

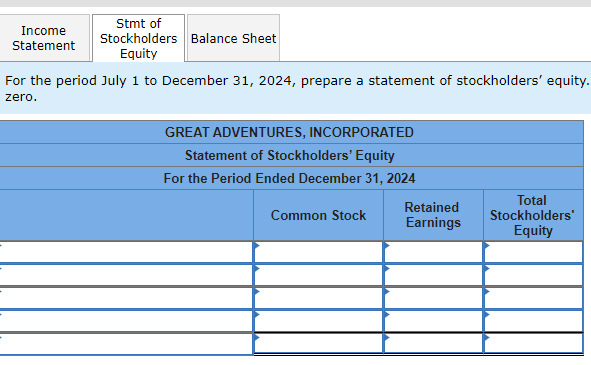

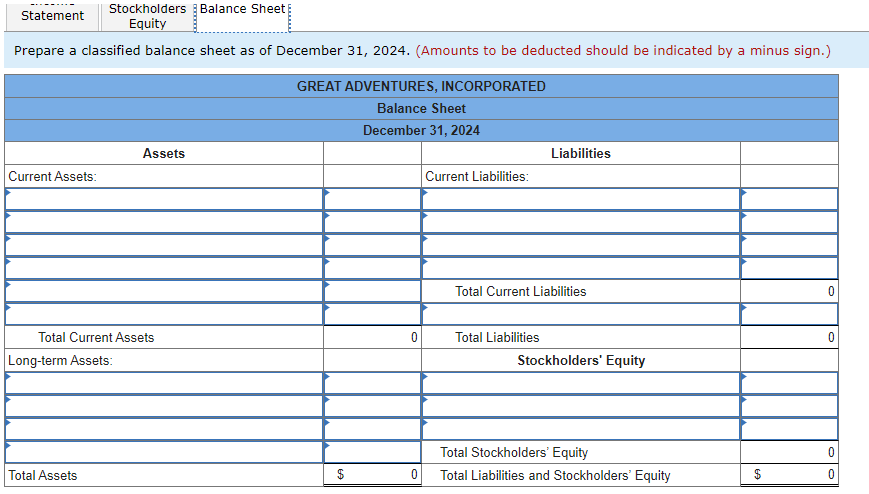

For the period July 1 to December 31,2024 , prepare a statement of stockholders' equity. zero. December 1 Tony and Suzie decide to hold the company's first adventure race on December 15 . Four-person teams will race from checkpoint to checkpoint using a combination of mountain biking, kayaking, orienteering, trail running, and rock-climbing skills. The first team in each category to complete all checkpoints in order wins. The entry fee for each team is $530. December 5 To help organize and promote the race, Tony hires his college roommate, Victor. Victor will be paid $40 in salary for each team that competes in the race. His salary will be paid after the race. December 8 The company pays $1,000 to purchase a permit from a state park where the race will be held. The amount is recorded as a miscellaneous expense. December 12 The company purchases racing supplies for $2,500 on account due in 30 days. Supplies include trophies for the top-finishing teams in each category, promotional shirts, snack foods and drinks for participants, and field markers to prepare the racecourse. December 15 The company receives $21,200 cash from a total of forty teams, and the race is held. December 16 The company pays Victor's salary of $1,600. December 31 The company pays a dividend of $4,800 ( $2,460 to Tony and $2,460 to Suzie). December 31 Using his personal money, Tony purchases a diamond ring for $4,900. Tony surprises Suzie by proposing that they get married. Suzie accepts and they get married! The following information relates to year-end adjusting entries as of December 31, 2024. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $8,100. b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,100 of office supplies purchased on July 4,$340 remains. e. Interest expense on the $34,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,500 of racing supplies purchased on December 12 , $140 remains. g. Suzie calculates that the company owes $13,500 in income taxes. For the period July 1 to December 31,2024 , prepare an income statement. For the period July 1 to December 31,2024 , prepare a statement of stockholders' equity. zero

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started