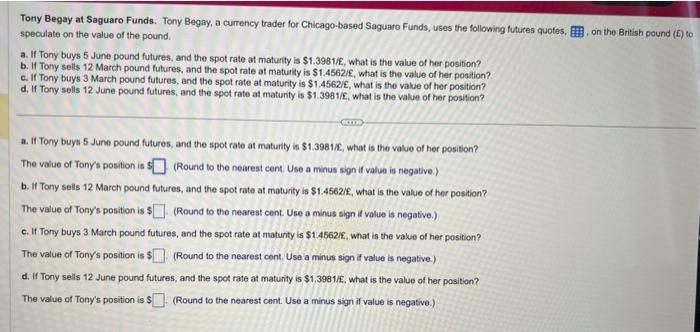

Tony Begay at Saguaro Funds. Tony Begay, a currency trader for Chicago-based Saguaro Funds, uses the follo speculate on the value of the pound. a. If Tony buys 5 June pound futures, and the spot rate at maturity is $1.3981/L, what is the value of her position? b. If Tony sells 12 March pound futures, and the spot rate at matuity is $1.4562/, what is the value of her position? c. If Tony buys 3 March pound futures, and the spot rate at maturity is $1.4562/2, what is the value of her position? d. If Tony selis 12 June pound futures, and the spot rate at maturity is $1.3981/L, what is the value of her position? on the British pound ( (t) to a. If Tony buys 5 June pound futures, and the spot rate at maturity is $1.3981L, what is the value of her position? The value of Tony's position is $ (Round to the nearest cent. Use a minus sign if value is negative.) b. If Tony selis 12 March pound futures, and the spot rate at maturity is $1.4562/f, what is the value of her position? The value of Tony's position is $ (Round to the nearest cent. Use a minus sign it value is negative.) c. If Tony buys 3 March pound futures, and the spot rate at maturity is $1.45621, what is the value of her position? The value of Tony's position is $ (Round to the nearest cent, Use a minus sign it value is negative.) d. If Tony sells 12 June pound futures, and the spot rate at maturity is $1.3981/, what is the value of her position? The value of Tony's position is $ (Round to the nearest cont. Use a minus sign if value is negative.) Tony Begay at Saguaro Funds. Tony Begay, a currency trader for Chicago-based Saguaro Funds, uses the follo speculate on the value of the pound. a. If Tony buys 5 June pound futures, and the spot rate at maturity is $1.3981/L, what is the value of her position? b. If Tony sells 12 March pound futures, and the spot rate at matuity is $1.4562/, what is the value of her position? c. If Tony buys 3 March pound futures, and the spot rate at maturity is $1.4562/2, what is the value of her position? d. If Tony selis 12 June pound futures, and the spot rate at maturity is $1.3981/L, what is the value of her position? on the British pound ( (t) to a. If Tony buys 5 June pound futures, and the spot rate at maturity is $1.3981L, what is the value of her position? The value of Tony's position is $ (Round to the nearest cent. Use a minus sign if value is negative.) b. If Tony selis 12 March pound futures, and the spot rate at maturity is $1.4562/f, what is the value of her position? The value of Tony's position is $ (Round to the nearest cent. Use a minus sign it value is negative.) c. If Tony buys 3 March pound futures, and the spot rate at maturity is $1.45621, what is the value of her position? The value of Tony's position is $ (Round to the nearest cent, Use a minus sign it value is negative.) d. If Tony sells 12 June pound futures, and the spot rate at maturity is $1.3981/, what is the value of her position? The value of Tony's position is $ (Round to the nearest cont. Use a minus sign if value is negative.)