Question

Tony has decided to end the Precision Computer Centre's first year as of July 31, 20XX, and has prepared the following: 1. Journalize the closing

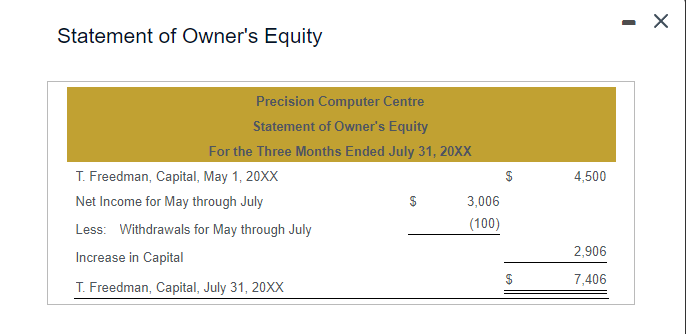

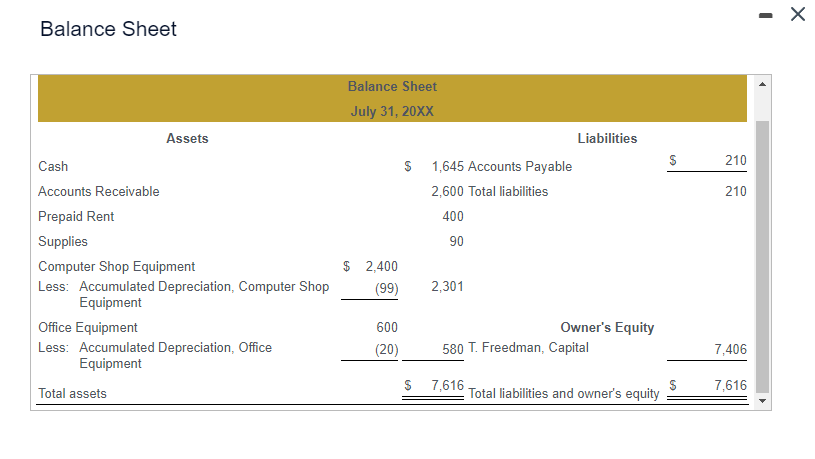

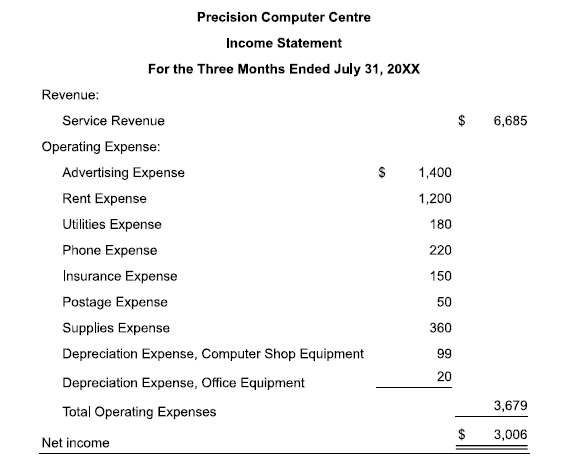

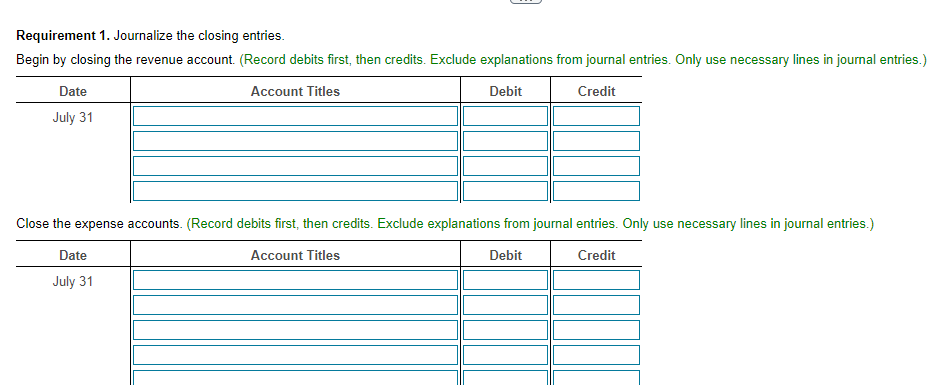

Tony has decided to end the Precision Computer Centre's first year as of July 31, 20XX, and has prepared the following: 1. Journalize the closing entries. 2. Post the closing entries to the ledger. 3. Prepare a post-closing trial balance.

Please solve the entire question as shown in the pictures, follow for the format. This is very confusing for me I need to learn how to solve this.

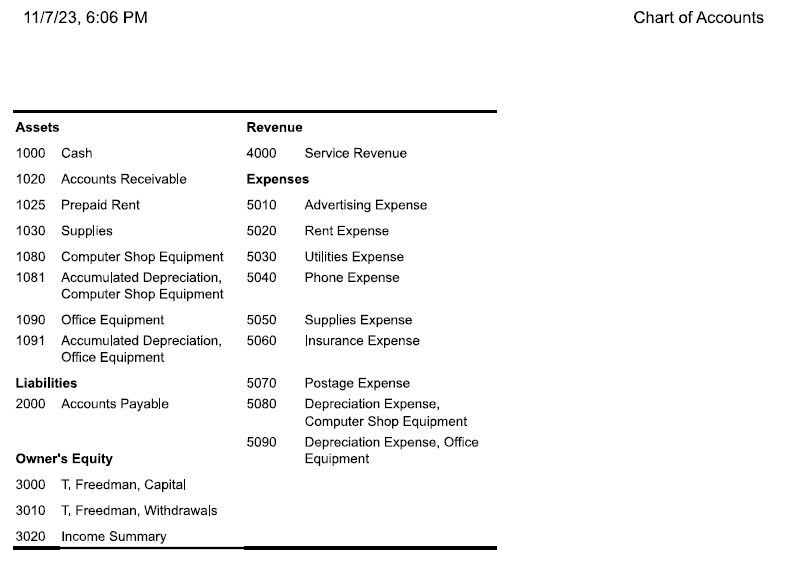

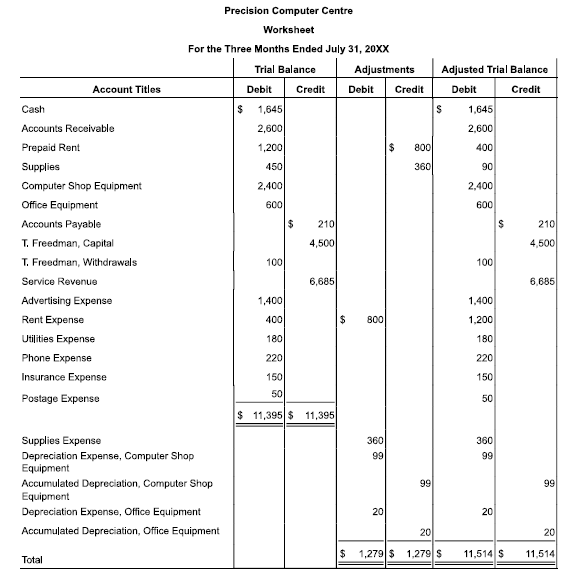

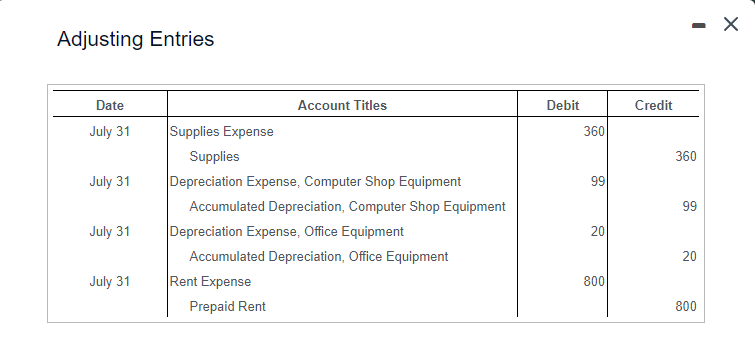

The following is the information given: (Chart of Accounts, Worksheet, Adjusting entries, Statement of Changes in Equity, Balance Sheet and Income Statement)

This is the question:

Thank you so much, please make sure it is correct.

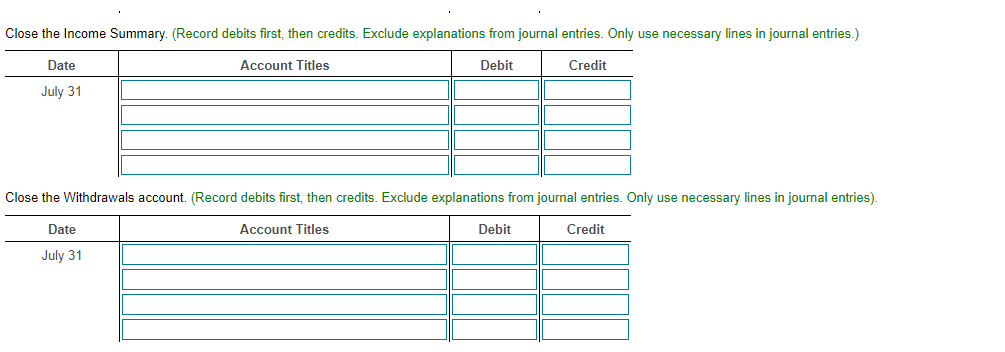

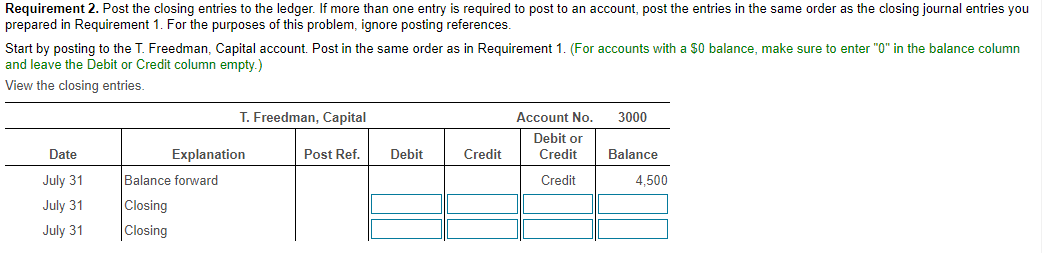

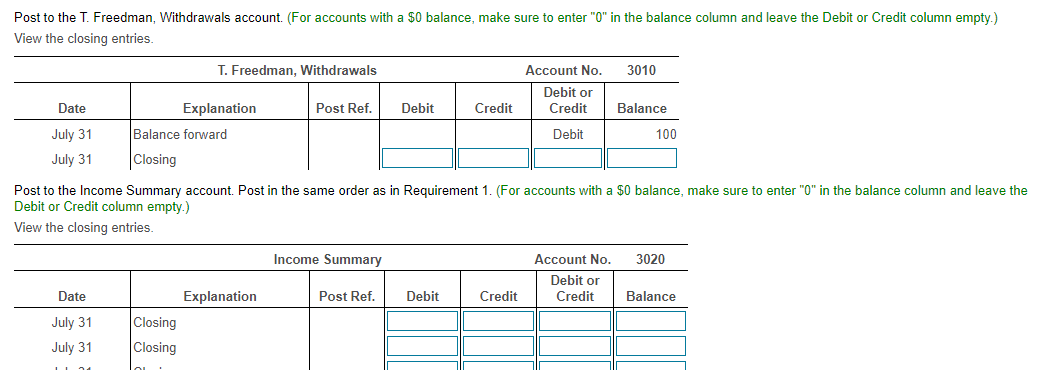

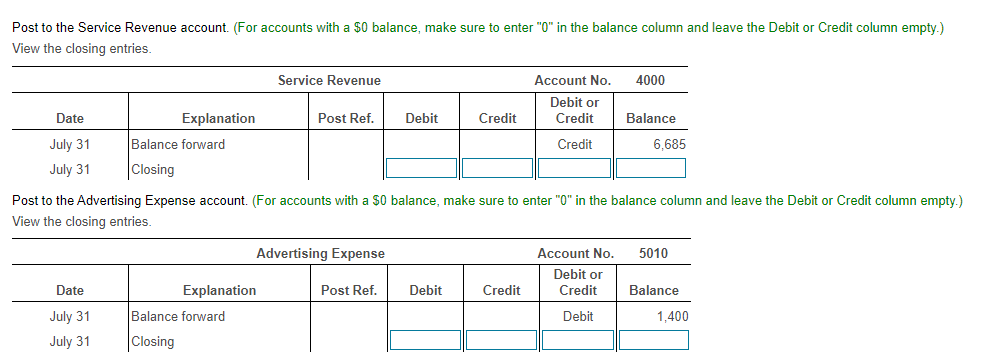

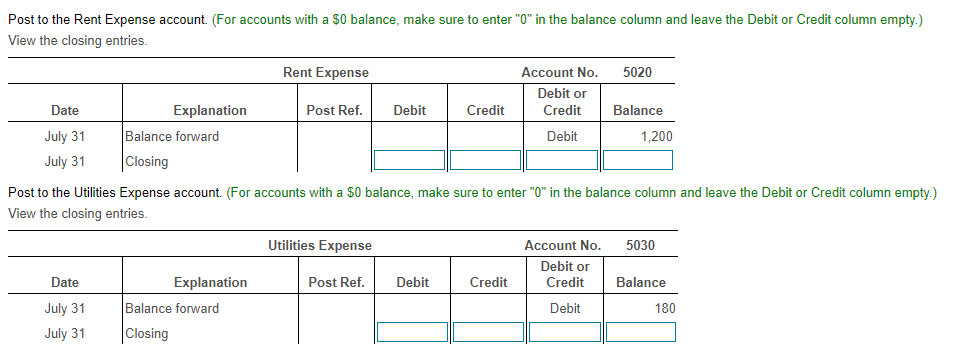

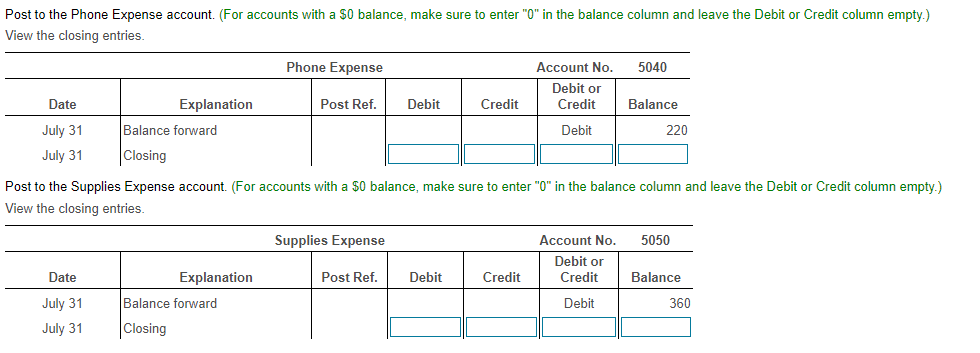

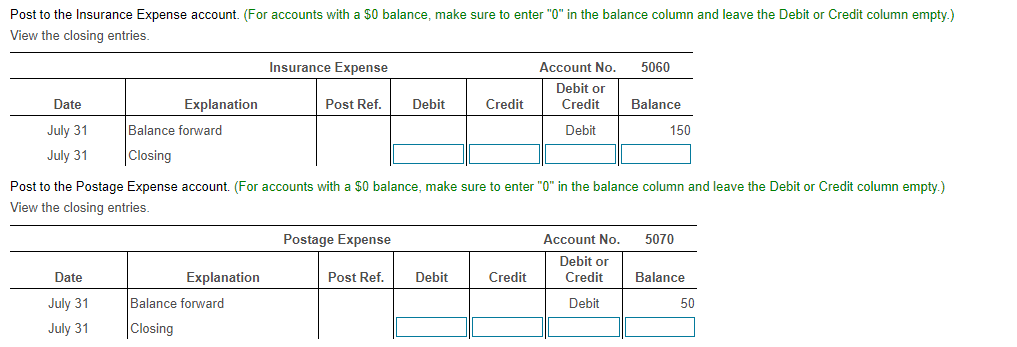

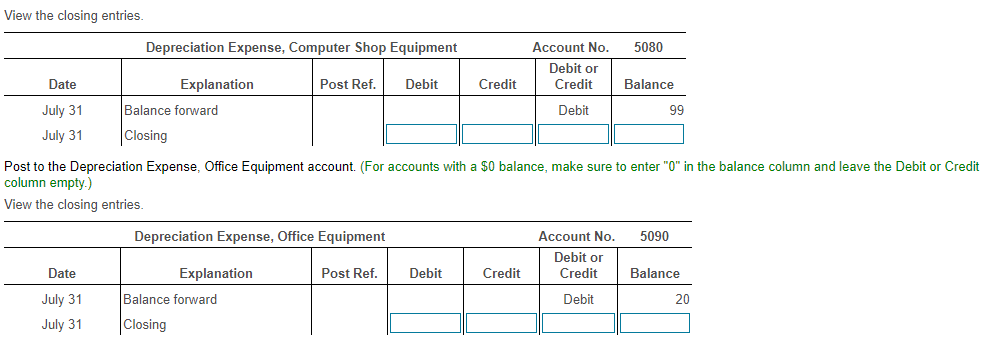

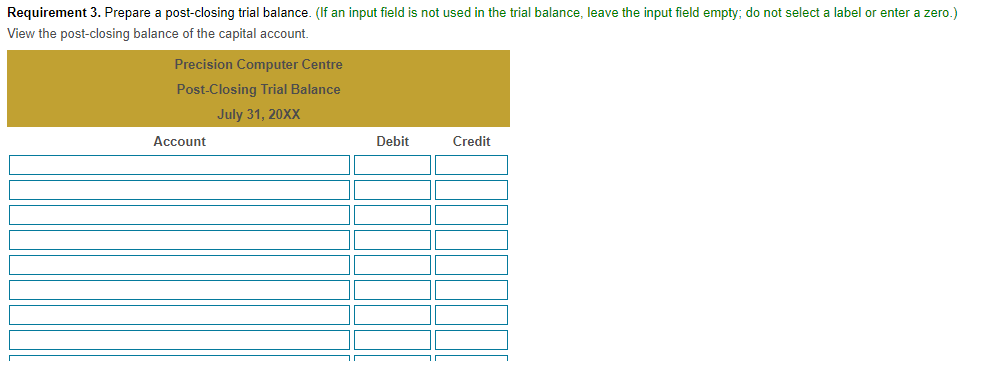

Adjusting Entries Post to the Service Revenue account. (For accounts with a $0 balance, make sure to enter " 0 " in the balance column and leave the Debit or Credit column empty.) View the closing entries. Requirement 3. Prepare a post-closing trial balance. (If an input field is not used in the trial balance, leave the input field empty; do not select a label or enter a zero.) View the post-closing balance of the capital account. ost to the Supplies Expense account. (For accounts with a $0 balance, make sure to enter " 0 " in the balance column and liew the closing entries. Precision Computer Centre Income Statement For the Three Months Ended July 31, 20xX Revenue: Service Revenue Operating Expense: Advertising Expense Rent Expense Utilities Expense Phone Expense Insurance Expense Postage Expense Supplies Expense Depreciation Expense, Computer Shop Equipment Depreciation Expense, Office Equipment Total Operating Expenses Net income $6,685 $1,400 1,200 180 220 150 50 360 99 20 \begin{tabular}{l} 3,679 \\ \hline$3,006 \\ \hline \hline \end{tabular} Close the Income Summary. (Record debits first, then credits. Exclude explanations from journal entries. Only use necessary lines in journal entries.) \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|l|}{ July 31} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Close the Withdrawals account. (Record debits first, then credits. Exclude explanations from journal entries. Only use necessary lines in journal entries). \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|l|}{ July 31} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Precision Computer Centre Worksheet For the Three Months Ended July 31, 20XX \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Account Titles } & \multicolumn{2}{|c|}{ Trial Balance } & \multicolumn{2}{|c|}{ Adjustments } & \multicolumn{2}{|c|}{ Adjusted Trial Balance } \\ \hline & Debit & Credit & Debit & Credit & Debit & Credit \\ \hline Cash & $1,645 & & & & 1,645 & \\ \hline Accounts Receivable & 2,600 & & & & 2,600 & \\ \hline Prepaid Rent & 1,200 & & & 800 & 400 & \\ \hline Supplies & 450 & & & 360 & 90 & \\ \hline Computer Shop Equipment & 2,400 & & & & 2,400 & \\ \hline Office Equipment & 600 & & & & 600 & \\ \hline Accounts Payable & & 210 & & & & 210 \\ \hline T. Freedman, Capital & & 4,500 & & & & 4,500 \\ \hline T. Freedman, Withdrawals & 100 & & & & 100 & \\ \hline Service Revenue & & 6,685 & & & & 6,685 \\ \hline Advertising Expense & 1,400 & & & & 1,400 & \\ \hline Rent Expense & 400 & & 800 & & 1,200 & \\ \hline Utilities Expense & 180 & & & & 180 & \\ \hline Phone Expense & 220 & & & & 220 & \\ \hline Insurance Expense & 150 & & & & 150 & \\ \hline Postage Expense & 50 & & & & 50 & \\ \hline & $11,395 & $11,395 & & & & \\ \hline Supplies Expense & & & 360 & & 360 & \\ \hline \begin{tabular}{l} Depreciation Expense, Computer Shop \\ Equipment \end{tabular} & & & 99 & & 99 & \\ \hline \begin{tabular}{l} Accumulated Depreciation, Computer Shop \\ Equipment \end{tabular} & & & & 99 & & 99 \\ \hline Depreciation Expense, Office Equipment & & & 20 & & 20 & \\ \hline Accumulated Depreciation, Office Equipment & & & & 20 & & 20 \\ \hline Total & & & $1,279 & $1,279 & 11,514 & 11,514 \\ \hline \end{tabular} View the closing entries. Post to the Depreciation Expense, Office Equipment account. (For accounts with a $0 balance, make sure to enter "0" in the balance column and leave the Debit or Credit column empty.) View the closing entries. Requirement 1. Journalize the closing entries. Begin by closing the revenue account. (Record debits first, then credits. Exclude explanations from journal entries. Only use necessary lines in journal entries.) Post to the T. Freedman, Withdrawals account. (For accounts with a $0 balance, make sure to enter " 0 " in the balance column and leave the Debit or Credit column empty.) View the closing entries. Post to the Income Summary account. Post in the same order as in Requirement 1. (For accounts with a $0 balance, make sure to enter "0" in the balance column and leave the Debit or Credit column empty.) View the closing entries. 11/7/23, 6:06 PM Chart of Accounts Statement of Owner's Equity Balance Sheet Post to the Insurance Expense account. (For accounts with a $0 balance, make sure to enter " 0 " in the balance column and leave the Debit or Credit column empty.) View the closing entries. Requirement 2. Post the closing entries to the ledger. If more than one entry is required to post to an account, post the entries in the same order as the closing journal entries you prepared in Requirement 1. For the purposes of this problem, ignore posting references. Start by posting to the T. Freedman, Capital account. Post in the same order as in Requirement 1. (For accounts with a $0 balance, make sure to enter "0" in the balance column and leave the Debit or Credit column empty.) Post to the Rent Expense account. (For accounts with a $0 balance, make sure to enter "0" in the balance column and leave the Debit or Credit column empty.) View the closing entries. Post to the Utilities Expense account. (For accounts with a $0 balance, make sure to enter " 0 " in the balance column and leave the Debit or Credit column empty.) View the closing entriesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started