Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tony Soprano who is 35 year old would like to obtain $250,000 life insurance coverage from now until the age of 50. He is

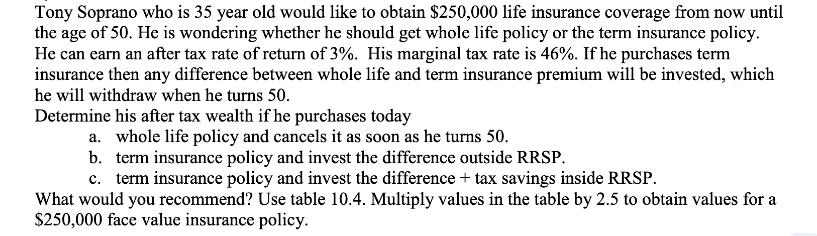

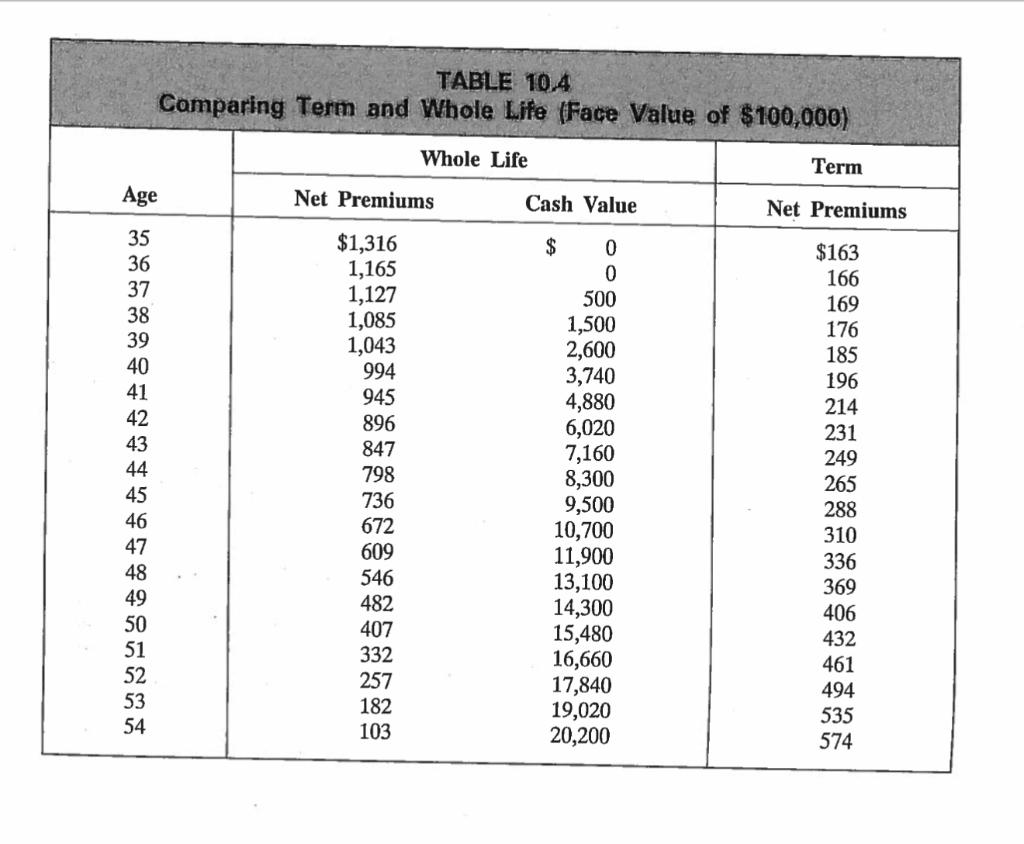

Tony Soprano who is 35 year old would like to obtain $250,000 life insurance coverage from now until the age of 50. He is wondering whether he should get whole life policy or the term insurance policy. He can earn an after tax rate of return of 3%. His marginal tax rate is 46%. If he purchases term insurance then any difference between whole life and term insurance premium will be invested, which he will withdraw when he turns 50. Determine his after tax wealth if he purchases today a. whole life policy and cancels it as soon as he turns 50. b. term insurance policy and invest the difference outside RRSP. c. term insurance policy and invest the difference + tax savings inside RRSP. What would you recommend? Use table 10.4. Multiply values in the table by 2.5 to obtain values for a $250,000 face value insurance policy. Age 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 TABLE 10.4 Comparing Term and Whole Life (Face Value of $100,000) Net Premiums $1,316 1,165 1,127 1,085 1,043 994 945 896 847 798 736 672 609 546 482 Whole Life 407 332 257 182 103 Cash Value $ 0 0 500 1,500 2,600 3,740 4,880 6,020 7,160 8,300 9,500 10,700 11,900 13,100 14,300 15,480 16,660 17,840 19,020 20,200 Term Net Premiums $163 166 169 176 185 196 214 231 249 265 288 310 336 369 406 432 461 494 535 574

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To determine the aftertax wealth of Tony Soprano under different scenarios we need to consider the premiums paid cash value accumulated investment returns tax savings and the tax implications Lets go ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started