Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Industrial Solutions Ltd (ISL) is a company which carries on business throughout the central North Island in New Zealand. ISL carries on the business

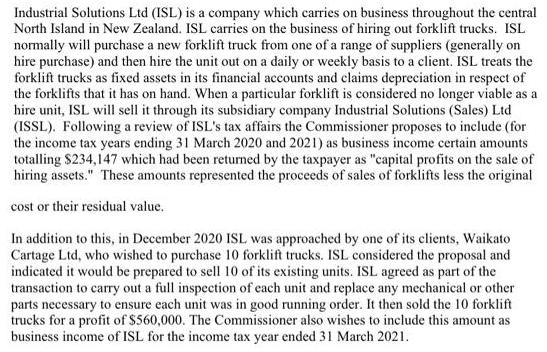

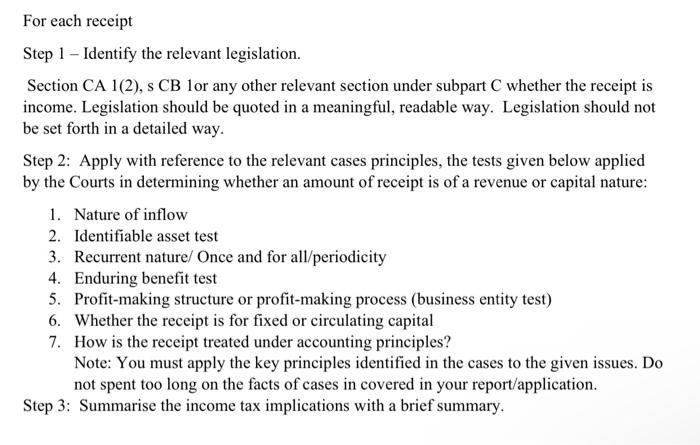

Industrial Solutions Ltd (ISL) is a company which carries on business throughout the central North Island in New Zealand. ISL carries on the business of hiring out forklift trucks. ISL normally will purchase a new forklift truck from one of a range of suppliers (generally on hire purchase) and then hire the unit out on a daily or weekly basis to a client. ISL treats the forklift trucks as fixed assets in its financial accounts and claims depreciation in respect of the forklifts that it has on hand. When a particular forklift is considered no longer viable as a hire unit, ISL will sell it through its subsidiary company Industrial Solutions (Sales) Ltd (ISSL). Following a review of ISL's tax affairs the Commissioner proposes to include (for the income tax years ending 31 March 2020 and 2021) as business income certain amounts totalling $234,147 which had been returned by the taxpayer as "capital profits on the sale of hiring assets." These amounts represented the proceeds of sales of forklifts less the original cost or their residual value. In addition to this, in December 2020 ISL was approached by one of its clients, Waikato Cartage Ltd, who wished to purchase 10 forklift trucks. ISL considered the proposal and indicated it would be prepared to sell 10 of its existing units. ISL agreed as part of the transaction to carry out a full inspection of each unit and replace any mechanical or other parts necessary to ensure each unit was in good running order. It then sold the 10 forklift trucks for a profit of $560,000. The Commissioner also wishes to include this amount as business income of ISL for the income tax year ended 31 March 2021. For each receipt Step 1 - Identify the relevant legislation. Section CA 1(2), S CB 1or any other relevant section under subpart C whether the receipt is income. Legislation should be quoted in a meaningful, readable way. Legislation should not be set forth in a detailed way. Step 2: Apply with reference to the relevant cases principles, the tests given below applied by the Courts in determining whether an amount of receipt is of a revenue or capital nature: 1. Nature of inflow 2. Identifiable asset test 3. Recurrent nature/ Once and for all/periodicity 4. Enduring benefit test 5. Profit-making structure or profit-making process (business entity test) 6. Whether the receipt is for fixed or circulating capital 7. How is the receipt treated under accounting principles? Note: You must apply the key principles identified in the cases to the given issues. Do not spent too long on the facts of cases in covered in your report/application. Step 3: Summarise the income tax implications with a brief summary.

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Income Tax Implications of Forklift Sales by Industrial Solutions Ltd ISL Legislation Income Tax Act 2007 ITA 2007 Section CA 12 Defines ordinary income Section CB 1 Defines income derived from a busi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started