Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Too Much Debt Inc (TMD) is in financial distress. Assume that we are on 1/1/2022. The assets of TMD are expected to be worth

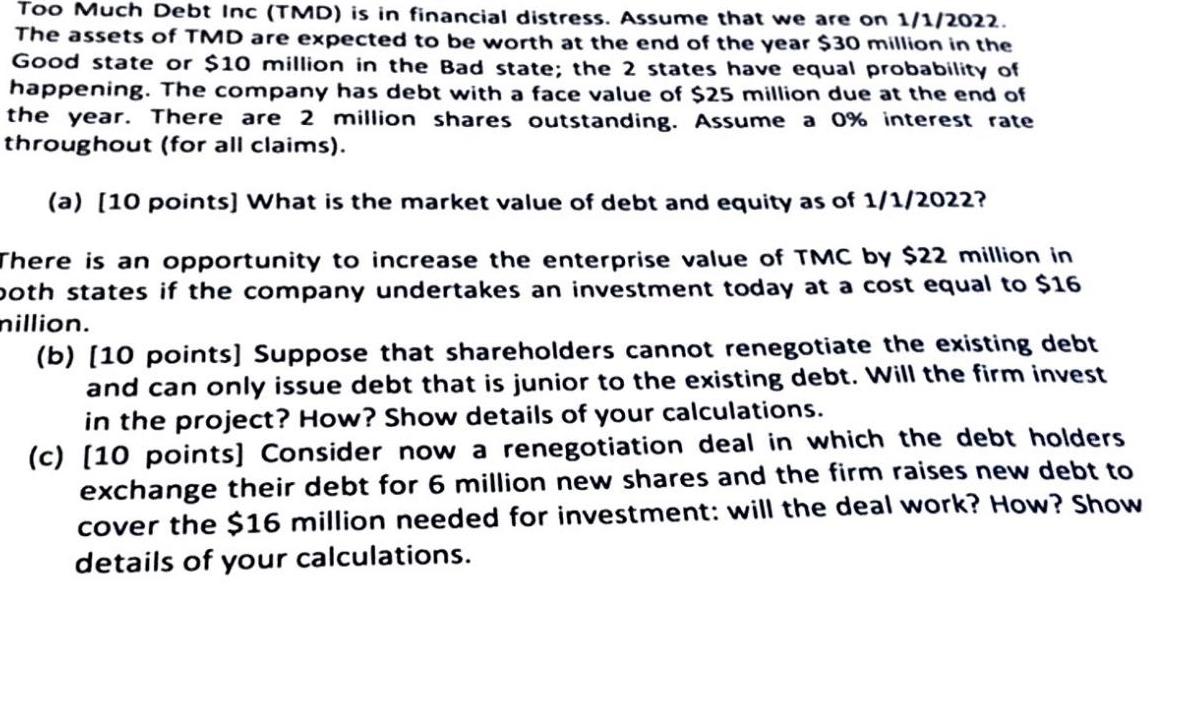

Too Much Debt Inc (TMD) is in financial distress. Assume that we are on 1/1/2022. The assets of TMD are expected to be worth at the end of the year $30 million in the Good state or $10 million in the Bad state; the 2 states have equal probability of happening. The company has debt with a face value of $25 million due at the end of the year. There are 2 million shares outstanding. Assume a 0% interest rate throughout (for all claims). (a) [10 points] What is the market value of debt and equity as of 1/1/2022? There is an opportunity to increase the enterprise value of TMC by $22 million in both states if the company undertakes an investment today at a cost equal to $16 million. (b) [10 points] Suppose that shareholders cannot renegotiate the existing debt and can only issue debt that is junior to the existing debt. Will the firm invest in the project? How? Show details of your calculations. (c) [10 points] Consider now a renegotiation deal in which the debt holders exchange their debt for 6 million new shares and the firm raises new debt to cover the $16 million needed for investment: will the deal work? How? Show details of your calculations.

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a As of 112022 the market value of debt and equity for TMD can be calculated as follows In the Good state the enterprise value of TMD is equal to the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started