Answered step by step

Verified Expert Solution

Question

1 Approved Answer

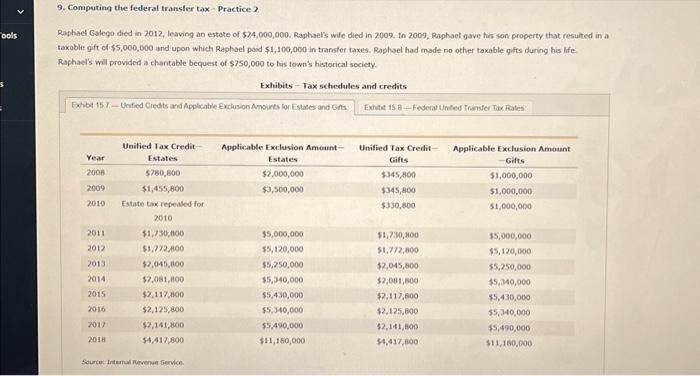

Tools 9. Computing the federal transfer tax Practice 2 Raphael Galego died in 2012, leaving an estate of $24,000,000. Raphael's wife died in 2009.

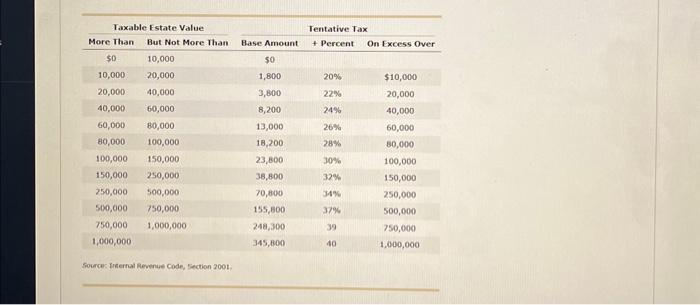

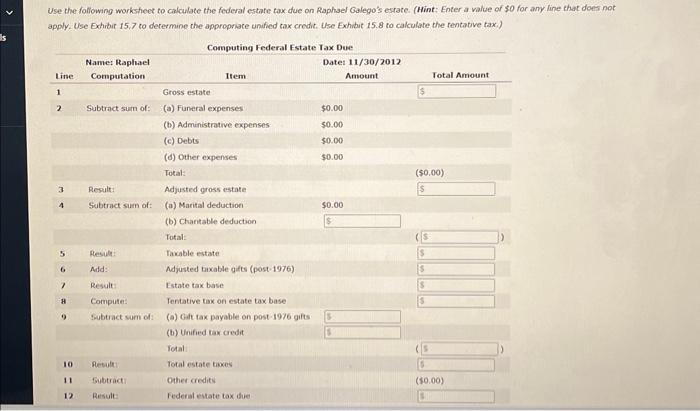

Tools 9. Computing the federal transfer tax Practice 2 Raphael Galego died in 2012, leaving an estate of $24,000,000. Raphael's wife died in 2009. In 2009, Raphael gave his son property that resulted in a taxable gift of $5,000,000 and upon which Raphael paid $1,100,000 in transfer taxes. Raphael had made no other taxable gifts during his life. Raphael's will provided a charitable bequest of $750,000 to his town's historical society. Exhibits Tax schedules and credits Exhibit 157-Unified Credits and Applicable Exclusion Amounts for Estates and Gifts Exhibit 15 8-Federal Unified Transfer Tax Rates: Unified Tax Credit- Year Estates Applicable Exclusion Amount Estates Unified Tax Credit- Gifts Applicable Exclusion Amount -Gifts 2008 $780,000 $2,000,000 $345,800 $1,000,000 2009 $1,455,800 $3,500,000 $345,800 $1,000,000 2010 Estate tax repealed for $330,800 $1,000,000 2010 2011 $1,730,000 $5,000,000 $1,730,8007 $5,000,000 2012 $1,772,800 $5,120,000 $1,772,800 $5,120,000 2013 $2,045,800 $5,250,000 $2,045,800 $5,250,000 2014 $2,081,800 $5,340,000 $2,081,800 $5,340,000 2015 $2,117,800 $5,430,000 $2,117,800 $5,430,000 2016 $2,125,800 $5,340,000 $2,125,800 $5,340,000 2017 $2,141,800 $5,490,000 $2,141,800 $5,490,000 2018 $4,417,800 $11,180,000 $4,417,800 $11,160,000 Source: Internal Revenue Service. Taxable Estate Value 1 Tentative Tax More Than But Not More Than Base Amount + Percent On Excess Over $0 10,000 50 10,000 20,000 1,800 20% $10,000 20,000 40,000 3,800 22% 20,000 40,000 60,000 8,200 24% 40,000 60,000 80,000 13,000 26% 60,000 80,000 100,000 18,200 28% 80,000 100,000 150,000 23,800 30% 100,000 150,000 250,000 38,800 32% 150,000 250,000 500,000 70,800 34% 250,000 500,000 750,000 155,800 37% 500,000 750,000 1,000,000 248,300 39 750,000 1,000,000 345,800 40 1,000,000 Source: Internal Revenue Code, Section 2001. Use the following worksheet to calculate the federal estate tax due on Raphael Galego's estate. (Hint: Enter a value of $0 for any line that does not apply. Use Exhibit 15.7 to determine the appropriate unified tax credit. Use Exhibit 15.8 to calculate the tentative tax.) Name: Raphael Computing Federal Estate Tax Due Date: 11/30/2012 Amount Total Amount Line Computation Item 1 Gross estate 2 Subtract sum of: (a) Funeral expenses $0.00 (b) Administrative expenses $0.00 (c) Debts $0.00 (d) Other expenses $0.00 Total: ($0.00) 3 Result: Adjusted gross estate 4 Subtract sum of: (a) Marital deduction $0.00 (b) Charitable deduction Total: 5 Result: 6 Add: 7 Result: H Compute: 9 Subtract sum of: Taxable estate Adjusted taxable gifts (post-1976) Estate tax base Tentative tax on estate tax base (a) Gift tax payable on post-1976 gifts (b) Unified tax credit Total $ 10 Result Total estate taxes 11 Subtract Other credits 12 Result: Federal estate tax due ($0.00)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started