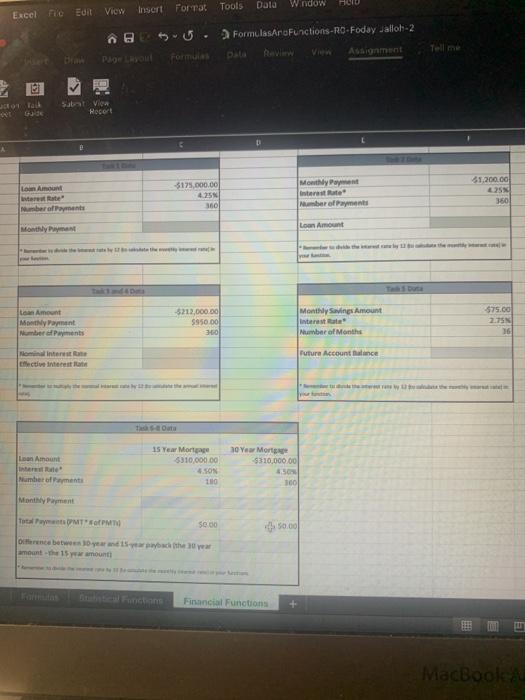

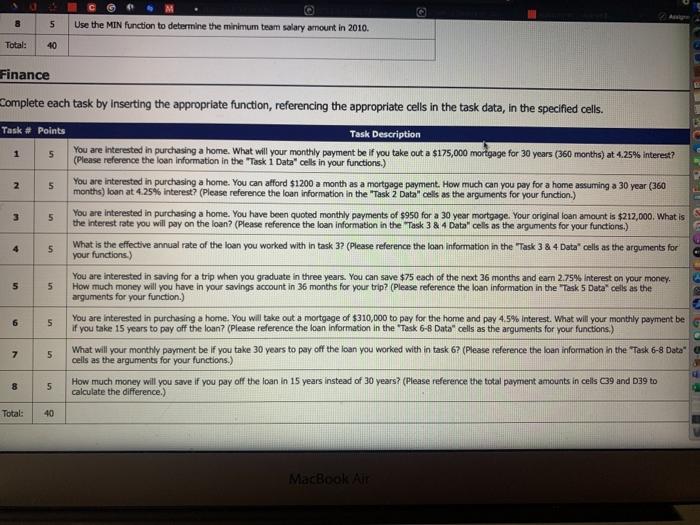

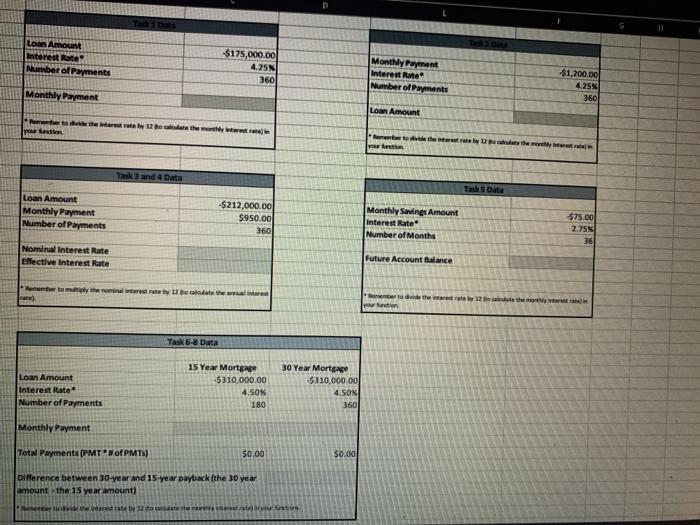

Tools Data Widow Excel file Insert Format Edit Vio OBU. Formulas no Functions-Ro-Foday walloh-2 to tell Subot view Recor Monty Pyt Lom Am strate Number of Payments -$175,000.00 25 360 81.200.00 SN 360 Number of Payment Monthly Loan Amount Lean met My Payment -3212,000.00 S950.00 3460 Monthly Savings Amount Interest Number of Months $75.00 2.75 16 Puture Account balance Nominierte flective interest w Ota Lon Amount 15 Year Mortgage 5310,000.00 4.SON 10 10 Year Morte $310,000.00 4.500 100 Number of Payment Monthly Payment TotaltMTFPT se.00 50.00 Ofference between 15-yarpathe year amount 15 amount Financial Functions MacBook Use the MIN function to determine the minimum team salary amount in 2010. Total: 40 Finance Complete each task by Inserting the appropriate function, referencing the appropriate cells in the task data, in the specified cells. Task # Points Task Description 1 You are interested in purchasing a home. What will your monthly payment be if you take out a $175,000 mortgage for 30 years (360 months) at 4.25% interest? 5 (Please reference the loan information in the "Task 1 Data" cells in your functions.) 2 5 You are interested in purchasing a home. You can afford $1200 a month as a mortgage payment. How much can you pay for a home assuming a 30 year (360 months) loen at 4.25% interest? (Please reference the loan information in the "Task 2 Data" cells as the arguments for your function.) 5 You are interested in purchasing a home. You have been quoted monthly payments of $950 for a 30 year mortgage. Your original loan amount is $212,000. What is the interest rate you will pay on the loan? (Please reference the loan information in the Task 3 & 4 Data" cells as the arguments for your functions.) 4 5 What is the effective annual rate of the loan you worked with in task 3? (Please reference the loan information in the Task 3 & 4 Data" cells as the arguments for your functions.) You are interested in saving for a trip when you graduate in three years. You can save $75 each of the next 36 months and earn 2.75% Interest on your money. 5 5 How much money will you have in your savings account in 36 months for your trip? (Please reference the loan information in the Task 5 Data" cells as the arguments for your function.) 6 5 You are interested in purchasing a home. You will take out a mortgage of $310,000 to pay for the home and pay 4.5% Interest. What will your monthly payment be if you take 15 years to pay off the loan? (Please reference the loan information in the "Task 6-8 Data" cells as the arguments for your functions) 7 5 What will your monthly payment be if you take 30 years to pay off the loan you worked with in task 6? (Please reference the loan information in the Task 6-8 Data cells as the arguments for your functions.) PO 5 es 5 How much money will you save if you pay off the loan in 15 years instead of 30 years? (Please reference the total payment amounts in cells C39 and D39 to calculate the difference.) Total: 40 MacBook Air D Loan Amount Interest Rate Number of Payments -$175,000.00 4.25 360 Monthly Payment Interest Rate Number of Payments $1,200.00 4.25 360 Monthly Payment Lom Amount de by the you fertion here thereby the your union Tak and 4 Data Tak Data Loan Amount Monthly Payment Number of Payments -$212,000.00 $950.00 360 Monthly Savings Amount Interest Rate Number of Months 575.00 2.75 36 Nominal Interest Rate Effective interest Rate Future Accountance Herbertom the nomineret te tyre te otherby 12th your action Task 6-8 Data Loan Amount Interest Rate Number of Payments 15 Year Mortgage $310,000.00 4.50X 180 30 Year Mortgage $310,000.00 4.50N 360 Monthly Payment Total Payments (PMT of PMTS) $0.00 $0.00 Difference between 30-year and 15-year payback the 30 year amount the 15 year amount) in die wererate by notes