Question

Top Glove Corporation Berhad (TGCB) is a leading rubber gloves manufacturer. During one of the after-office meet-ups with your old friend, Andy Pamelo, he asked

Top Glove Corporation Berhad (TGCB) is a leading rubber gloves manufacturer. During one of the after-office meet-ups with your old friend, Andy Pamelo, he asked for your help to enlighten him on the performance of TGCB. He was planning to buy shares of TGCB and has studied some essential sections in TGCB's 2021 Financial Statements.

Andy referred you to the section on assets in the TGCB's Statement of Financial Position, and he was puzzled why the TGCB's brand, which is well-known around the world, was not listed as an asset of the company. Additionally, he was curious about the item "Intangible assets". He wanted to know what intangible assets and why they were included as assets, even though they have no physical substance?

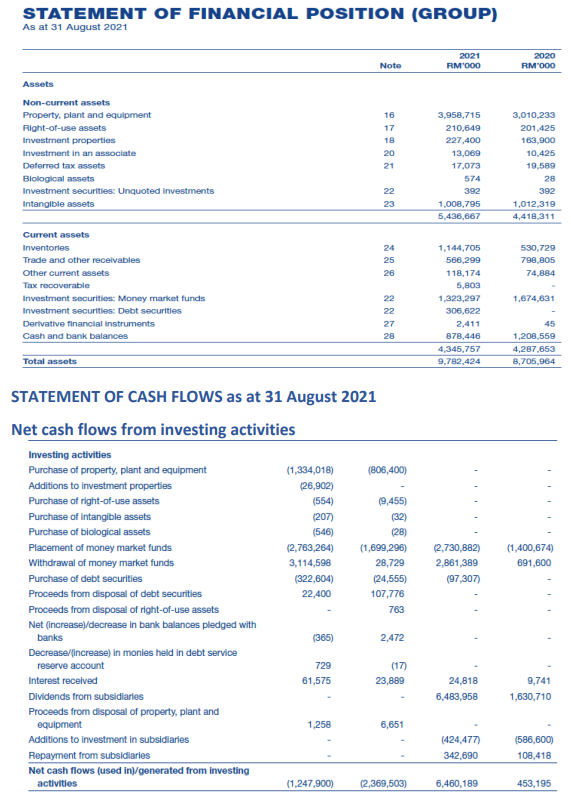

Andy recognised the importance of cash in any business organisation, and he was concerned when he saw that TGCB reported negative net cash flows from investing activities (for the group), as reported in the statement of cash flows. He was confused about this fact because TGCB is a profitable company. He wanted to know why a profitable company could report negative cash flows from investing activities.

Before both of you departed, Andy asked a final question about the independent auditor of TGCB when he referred to the opinion paragraphs of the report. In particular, he wanted to know the role of independent auditors in TGCB.

You had promised Andy to prepare a note addressing all the questions and will send it to his email.

- Explain why TGCB reported negative net cash flows from investing activities. Should Andy be concerned about this situation? Include in your explanation the importance of other sources of cash flows and an example of a company with negative net cash flows from investing. (Word limit: 150 words or less)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started