Answered step by step

Verified Expert Solution

Question

1 Approved Answer

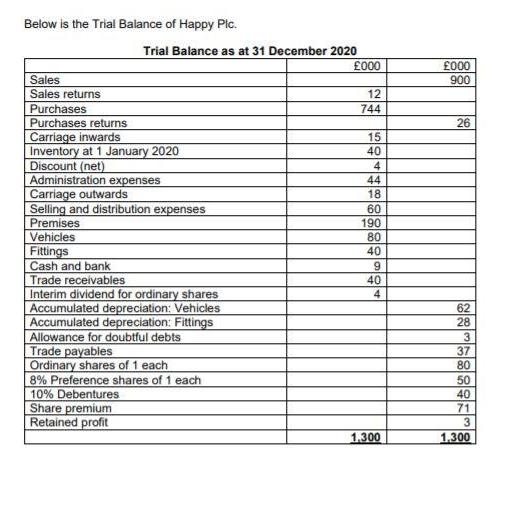

Below is the Trial Balance of Happy Plc. Trial Balance as at 31 December 2020 Sales Sales returns Purchases Purchases returns Carriage inwards Inventory

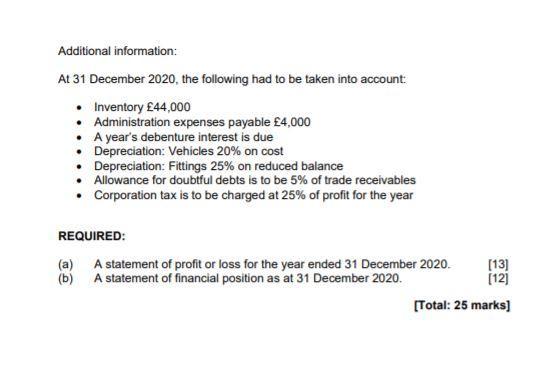

Below is the Trial Balance of Happy Plc. Trial Balance as at 31 December 2020 Sales Sales returns Purchases Purchases returns Carriage inwards Inventory at 1 January 2020 Discount (net) Administration expenses Carriage outwards Selling and distribution expenses Premises Vehicles Fittings Cash and bank Trade receivables Interim dividend for ordinary shares Accumulated depreciation: Vehicles Accumulated depreciation: Fittings Allowance for doubtful debts Trade payables Ordinary shares of 1 each 8% Preference shares of 1 each 10% Debentures Share premium Retained profit 000 12 744 15 40 4 44 18 1818181 60 190 80 40 9 40 4 1.300 000 900 26 62 28 3 37 80 50 40 71 3 300 Additional information: At 31 December 2020, the following had to be taken into account: Inventory 44,000 Administration expenses payable 4,000 A year's debenture interest is due Depreciation: Vehicles 20% on cost Depreciation: Fittings 25% on reduced balance Allowance for doubtful debts is to be 5% of trade receivables Corporation tax is to be charged at 25% of profit for the year REQUIRED: (a) A statement of profit or loss for the year ended 31 December 2020. (b) A statement of financial position as at 31 December 2020. [13] [12] [Total: 25 marks]

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

5 0 20 25 Praveen Group Consolidated Statement of financial position March 2022 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started