Answered step by step

Verified Expert Solution

Question

1 Approved Answer

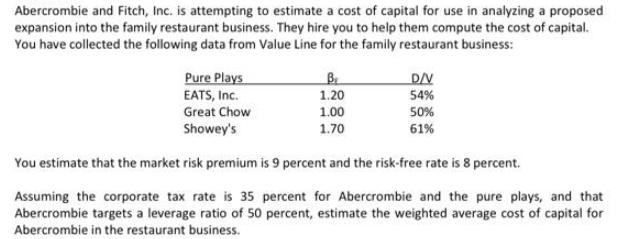

Abercrombie and Fitch, Inc. is attempting to estimate a cost of capital for use in analyzing a proposed expansion into the family restaurant business.

Abercrombie and Fitch, Inc. is attempting to estimate a cost of capital for use in analyzing a proposed expansion into the family restaurant business. They hire you to help them compute the cost of capital. You have collected the following data from Value Line for the family restaurant business: Pure Plays EATS, Inc. Great Chow Showey's B 1.20 1.00 1.70 D/V 54% 50% 61% You estimate that the market risk premium is 9 percent and the risk-free rate is 8 percent. Assuming the corporate tax rate is 35 percent for Abercrombie and the pure plays, and that Abercrombie targets a leverage ratio of 50 percent, estimate the weighted average cost of capital for Abercrombie in the restaurant business.

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

If the NPV of this project is positive they it should be Accepted Step1 Initial Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started