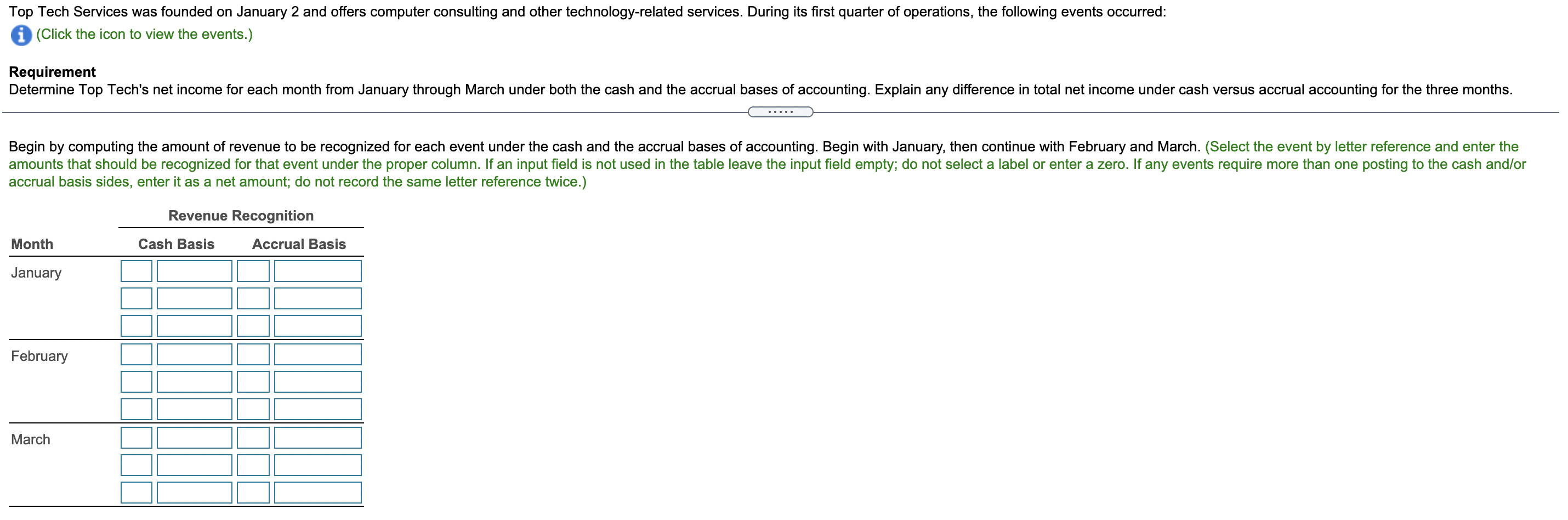

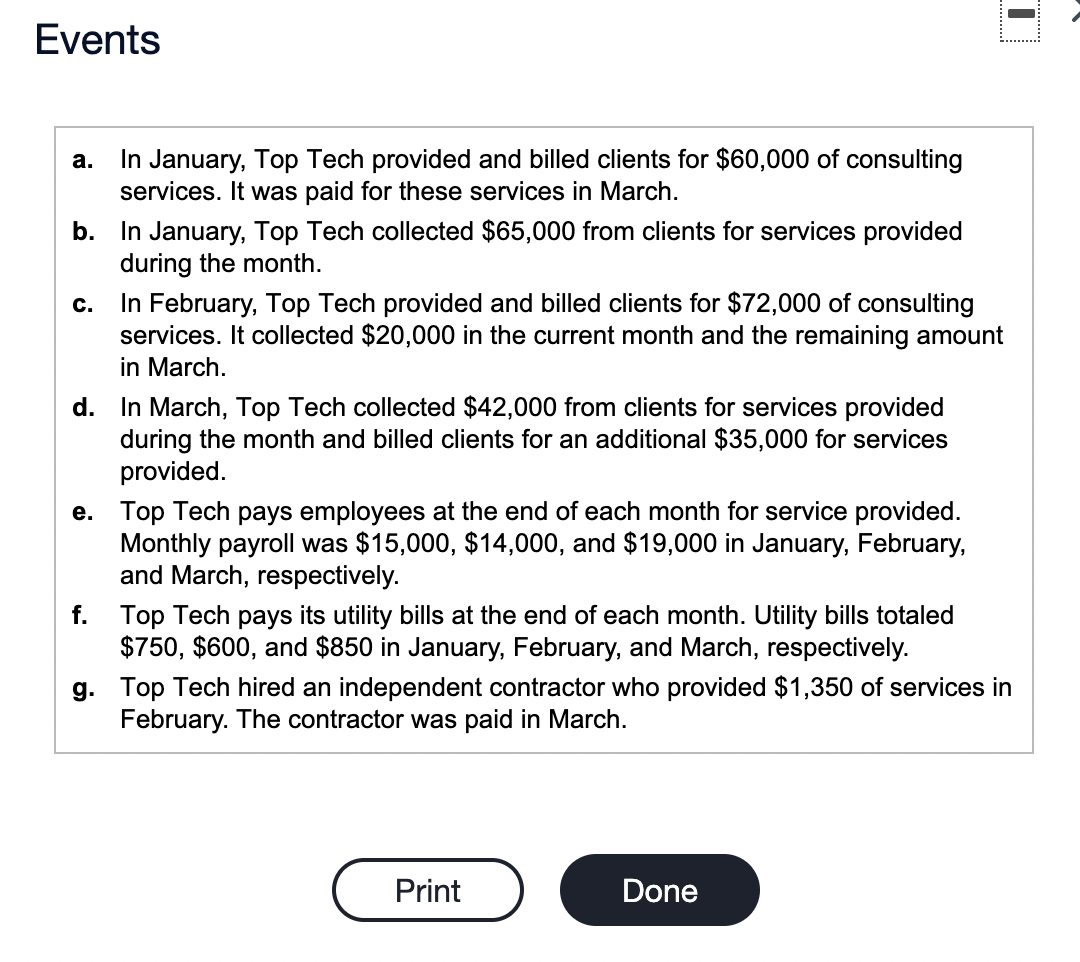

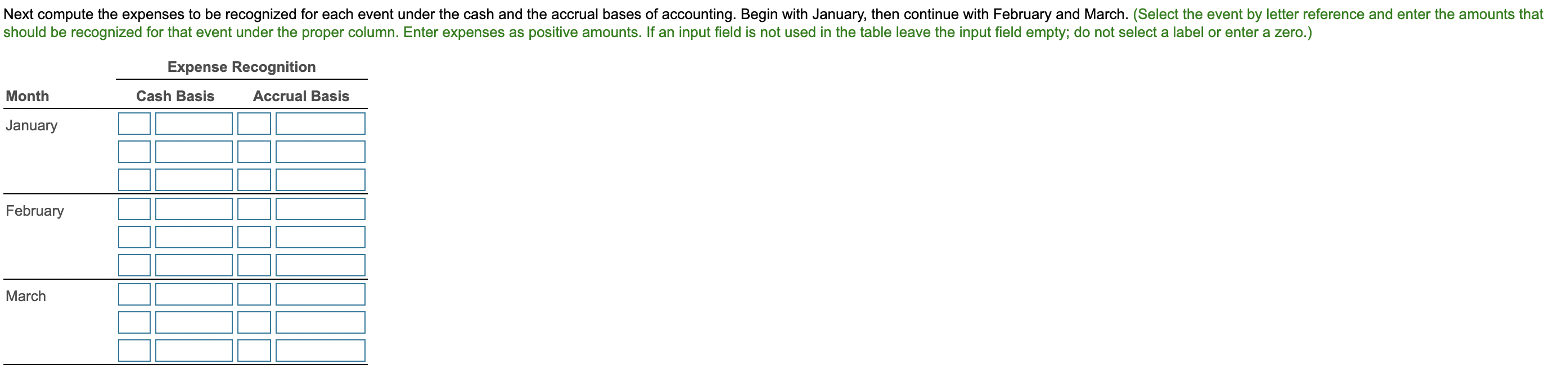

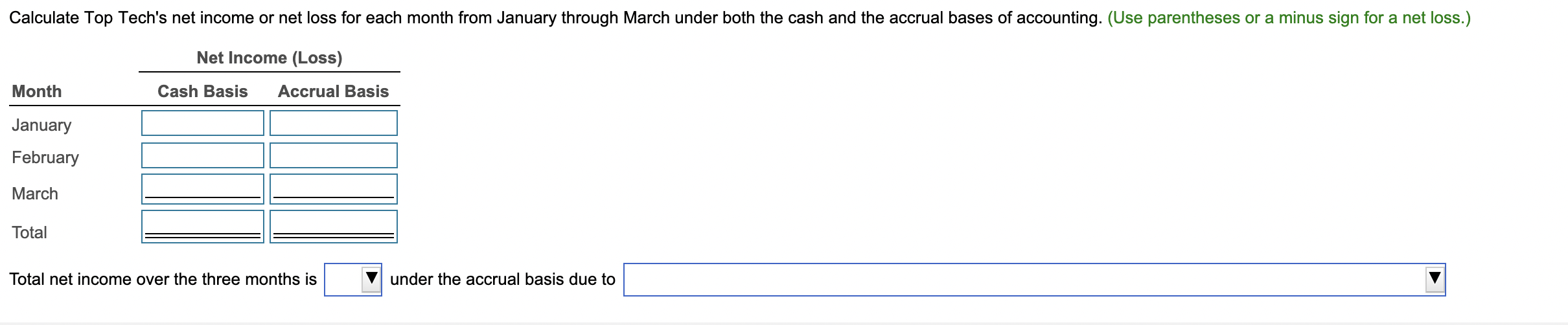

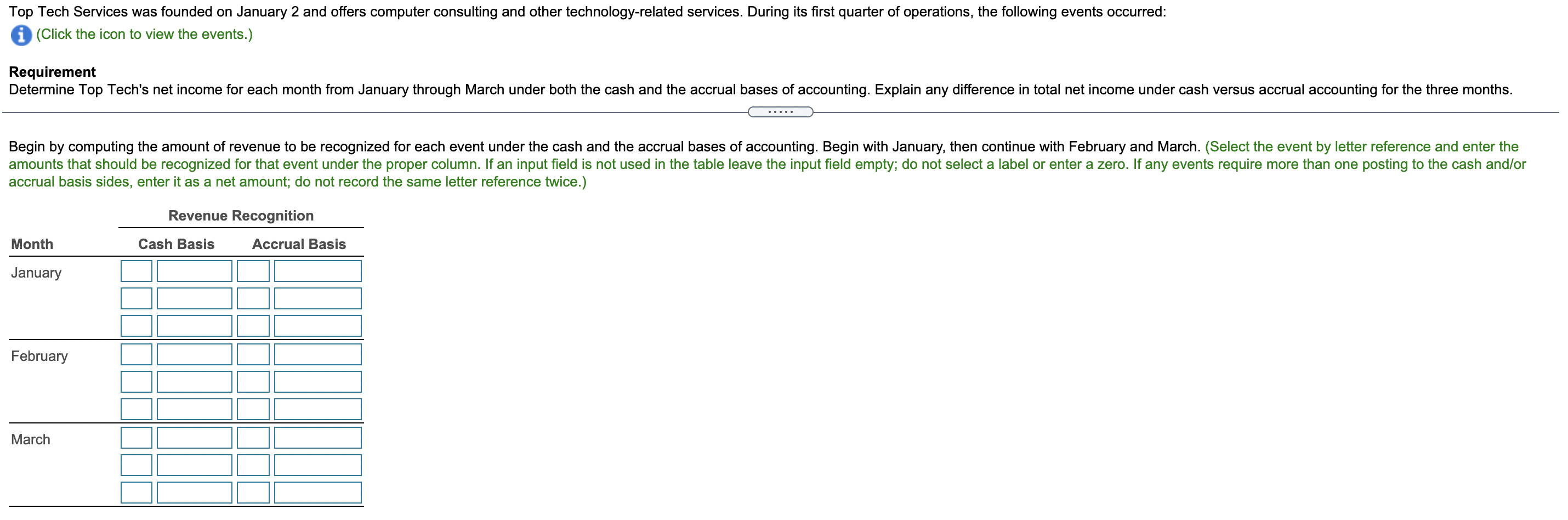

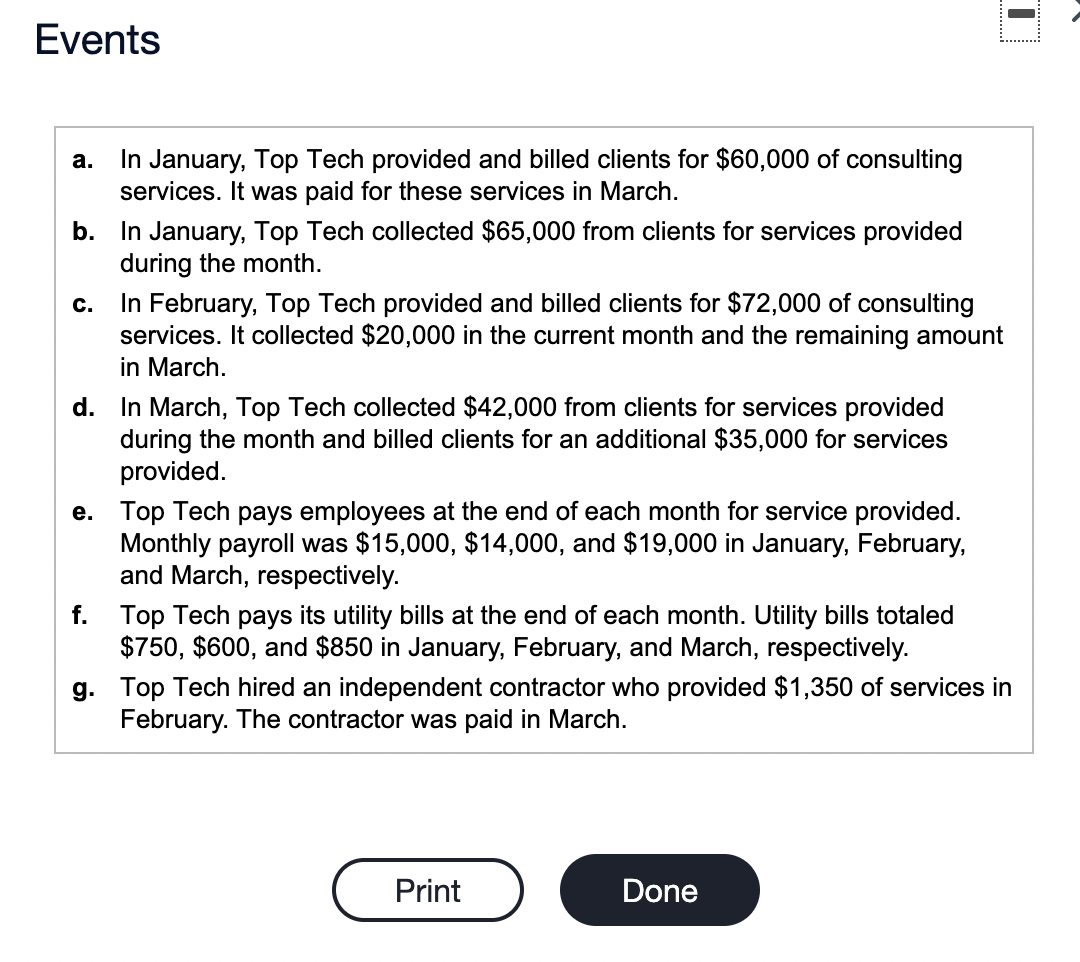

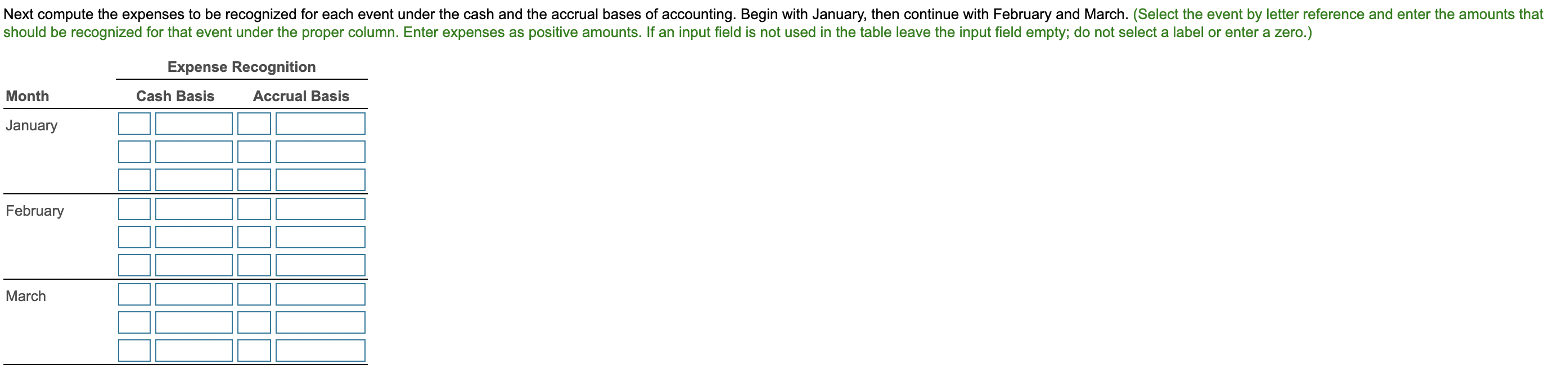

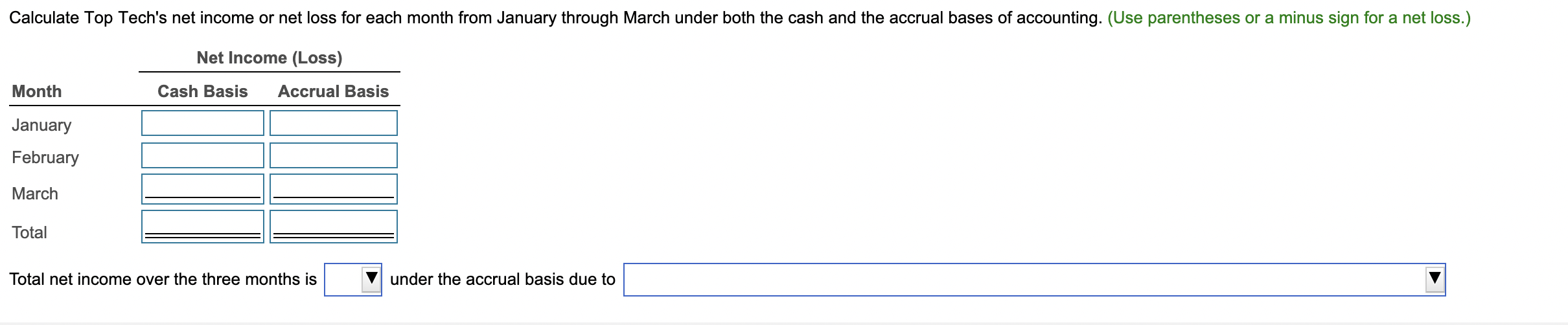

Top Tech Services was founded on January 2 and offers computer consulting and other technology-related services. During its first quarter of operations, the following events occurred: (Click the icon to view the events.) Requirement Determine Top Tech's net income for each month from January through March under both the cash and the accrual bases of accounting. Explain any difference in total net income under cash versus accrual accounting for the three months. Begin by computing the amount of revenue to be recognized for each event under the cash and the accrual bases of accounting. Begin with January, then continue with February and March. (Select the event by letter reference and enter the amounts that should be recognized for that event under the proper column. If an input field is not used in the table leave the input field empty; do not select a label or enter a zero. If any events require more than one posting to the cash and/or accrual basis sides, enter it as a net amount; do not record the same letter reference twice.) Revenue Recognition Month Cash Basis Accrual Basis January February March Events a. In January, Top Tech provided and billed clients for $60,000 of consulting services. It was paid for these services in March. b. In January, Top Tech collected $65,000 from clients for services provided during the month. c. In February, Top Tech provided and billed clients for $72,000 of consulting services. It collected $20,000 in the current month and the remaining amount in March. d. In March, Top Tech collected $42,000 from clients for services provided during the month and billed clients for an additional $35,000 for services provided. e. Top Tech pays employees at the end of each month for service provided. Monthly payroll was $15,000, $14,000, and $19,000 in January, February, and March, respectively. f. Top Tech pays its utility bills at the end of each month. Utility bills totaled $750, $600, and $850 in January, February, and March, respectively. g. Top Tech hired an independent contractor who provided $1,350 of services in February. The contractor was paid in March. Print Done Next compute the expenses to be recognized for each event under the cash and the accrual bases of accounting. Begin with January, then continue with February and March. (Select the event by letter reference and enter the amounts that should be recognized for that event under the proper column. Enter expenses as positive amounts. If an input field is not used in the table leave the input field empty; do not select a label or enter a zero.) Expense Recognition Month Cash Basis Accrual Basis January February March Calculate Top Tech's net income or net loss for each month from January through March under both the cash and the accrual bases of accounting. (Use parentheses or a minus sign for a net loss.) Net Income (Loss) Month Cash Basis Accrual Basis January February March Total Total net income over the three months is under the accrual basis due to