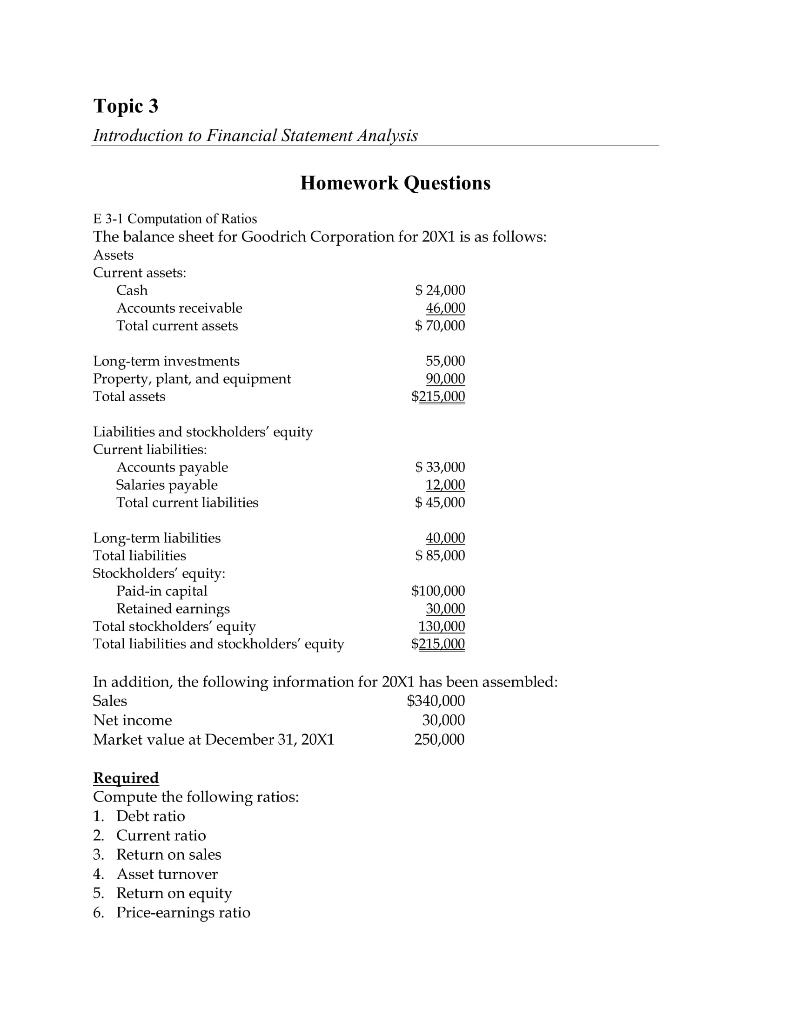

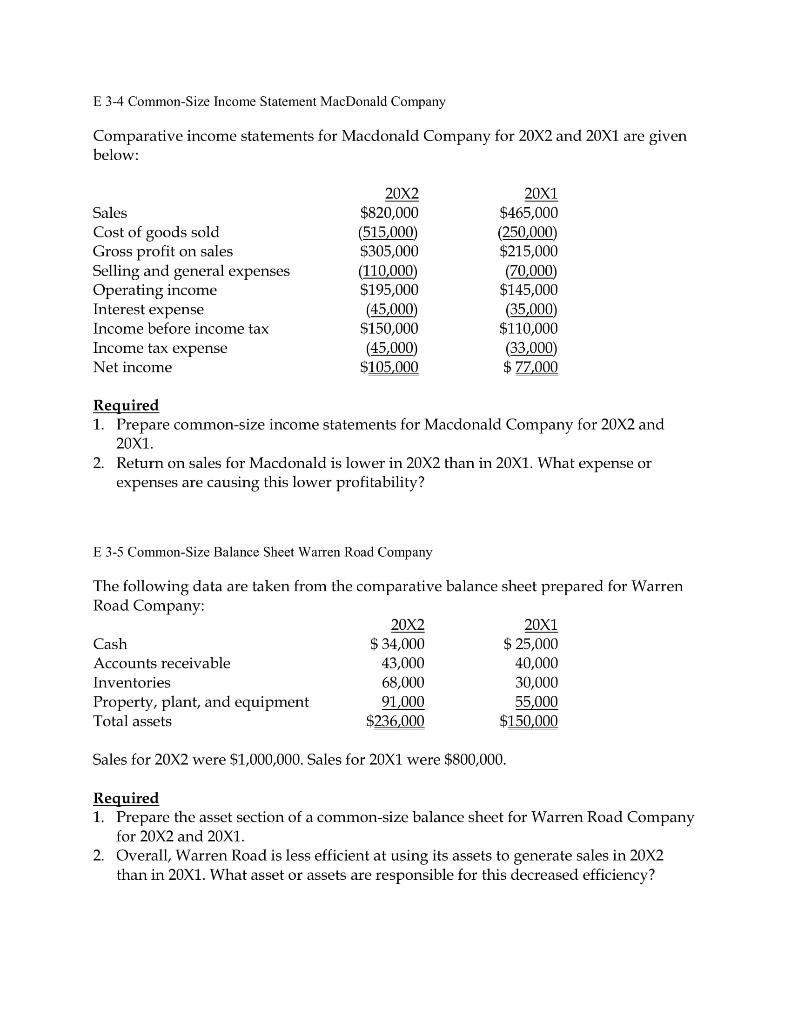

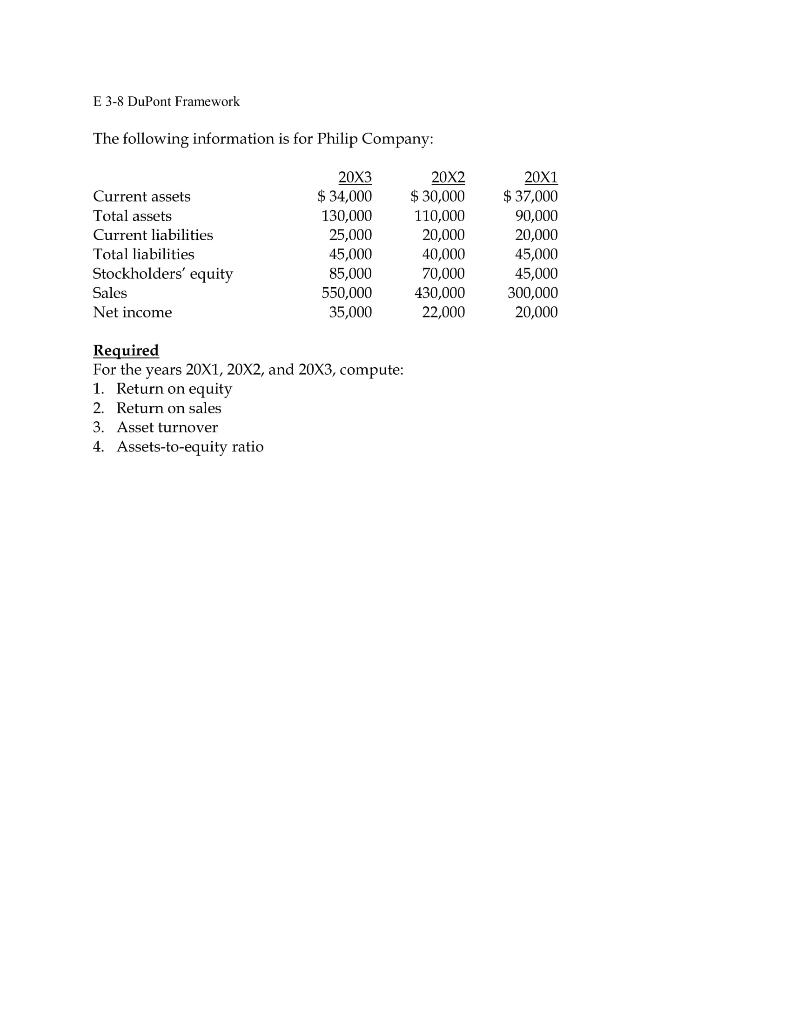

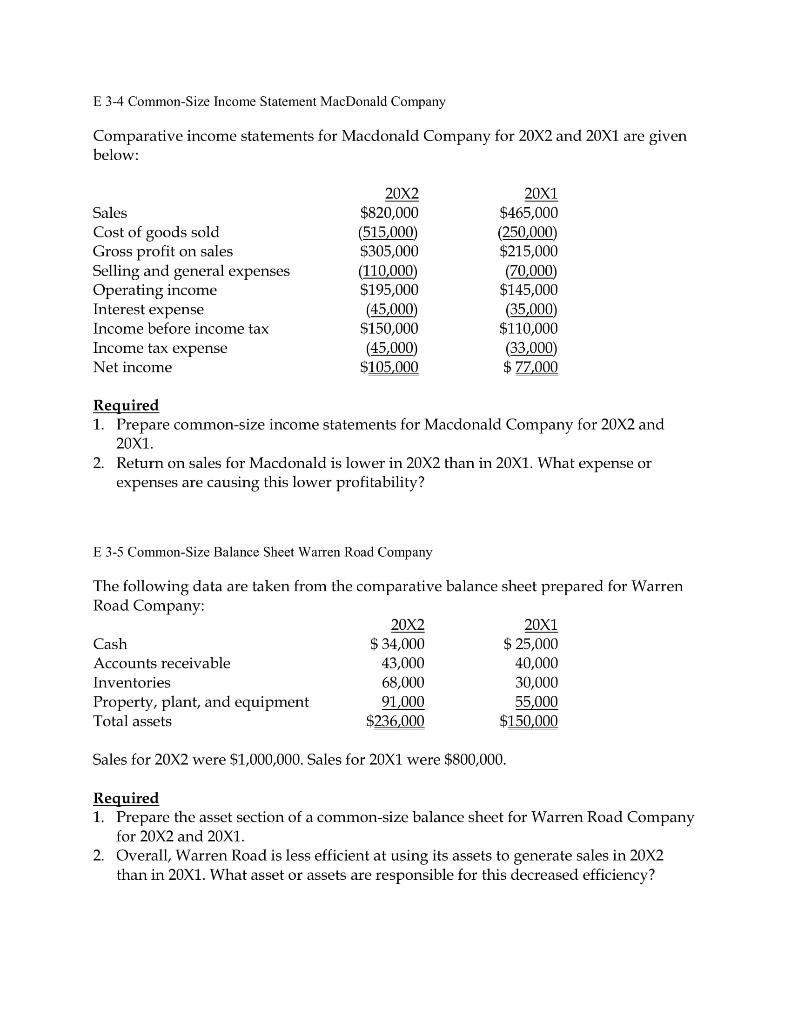

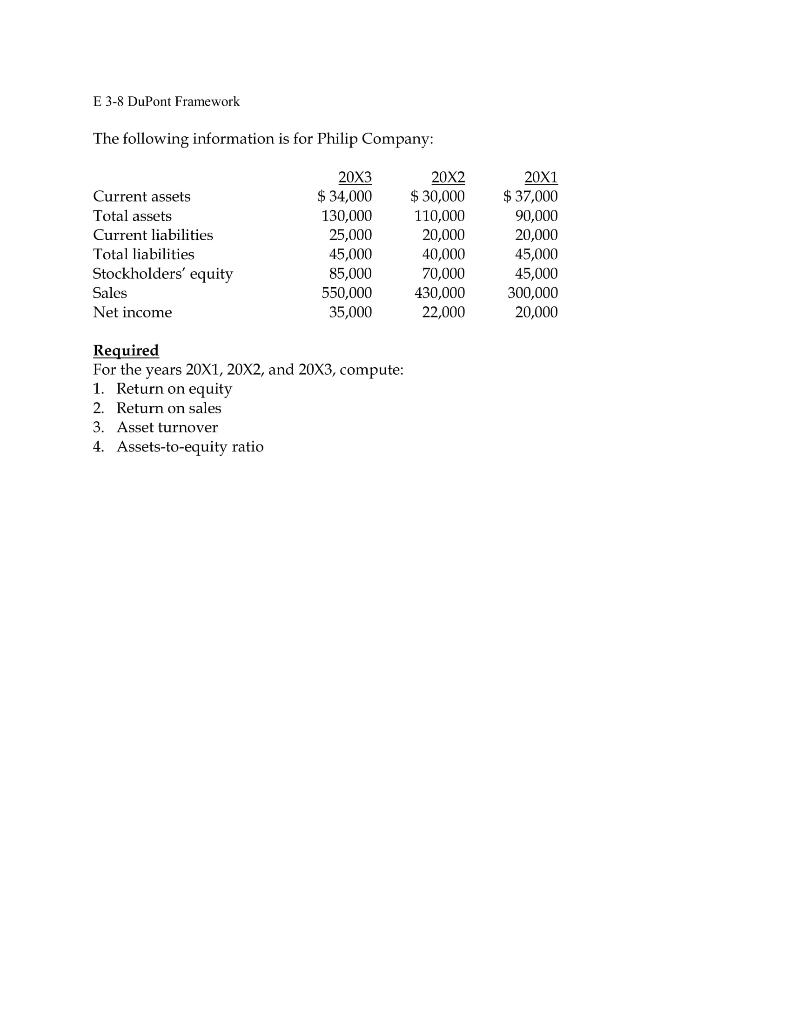

Topic 3 Introduction to Financial Statement Analysis Homework Questions E 3-1 Computation of Ratios The balance sheet for Goodrich Corporation for 20X1 is as follows: Assets Current assets: Cash S 24,000 Accounts receivable 46,000 Total current assets $ 70,000 Long-term investments Property, plant, and equipment Total assets 55,000 90,000 $215,000 Liabilities and stockholders' equity Current liabilities: Accounts payable Salaries payable Total current liabilities S 33,000 12,000 $ 45,000 40,000 S 85,000 Long-term liabilities Total liabilities Stockholders' equity: Paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $100,000 30,000 130,000 $215,000 In addition, the following information for 20X1 has been assembled: Sales $340,000 Net income 30,000 Market value at December 31, 20X1 250,000 Required Compute the following ratios: 1. Debt ratio 2. Current ratio 3. Return on sales 4. Asset nover 5. Return on equity 6. Price-earnings ratio E 3-4 Common-Size Income Statement MacDonald Company Comparative income statements for Macdonald Company for 20x2 and 20X1 are given below: 20X1 Sales Cost of goods sold Gross profit on sales Selling and general expenses Operating income Interest expense Income before income tax Income tax expense Net income 20X2 $820,000 (515,000) $305,000 (110,000 $195,000 (45,000 $150,000 (45,000 $105,000 $465,000 (250,000) $215,000 (70,000) $145,000 (35,000) $110,000 (33,000) $ 77,000 Required 1. Prepare common-size income statements for Macdonald Company for 20X2 and 20X1. 2. eturn on sales for Macdonald is lowe 20X2 than in 20X What expense or expenses are causing this lower profitability? E 3-5 Common-Size Balance Sheet Warren Road Company Cash The following data are taken from the comparative balance sheet prepared for Warren Road Company: 20X2 20X1 $ 34,000 $ 25,000 Accounts receivable 43,000 40,000 Inventories 68,000 30,000 Property, plant, and equipment 91,000 55,000 Total assets $236,000 $150,000 Sales for 20X2 were $1,000,000. Sales for 20X1 were $800,000. Required 1. Prepare the asset section of a common-size balance sheet for Warren Road Company for 20X2 and 20X1. 2. Overall, Warren Road is less efficient at using its assets to generate sales in 20X2 than in 20X1. What asset or assets are responsible for this decreased efficiency? E 3-8 DuPont Framework The following information is for Philip Company: Current assets Total assets Current liabilities Total liabilities Stockholders' equity Sales Net income 20X3 $ 34,000 130,000 25,000 45,000 85,000 550,000 35,000 20X2 $ 30,000 110,000 20,000 40,000 70,000 430,000 22,000 20X1 $ 37,000 90,000 20,000 45,000 45,000 300,000 20,000 Required For the years 20X1, 20X2, and 20X3, compute: 1. Return on equity 2. Return on sales 3. Asset turnover 4. Assets-to-equity ratio