Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Topic 6 - Taxation of Non - Residents Question 1 F 1 Solutions Company ( F 1 Solutions ) , a non - resident

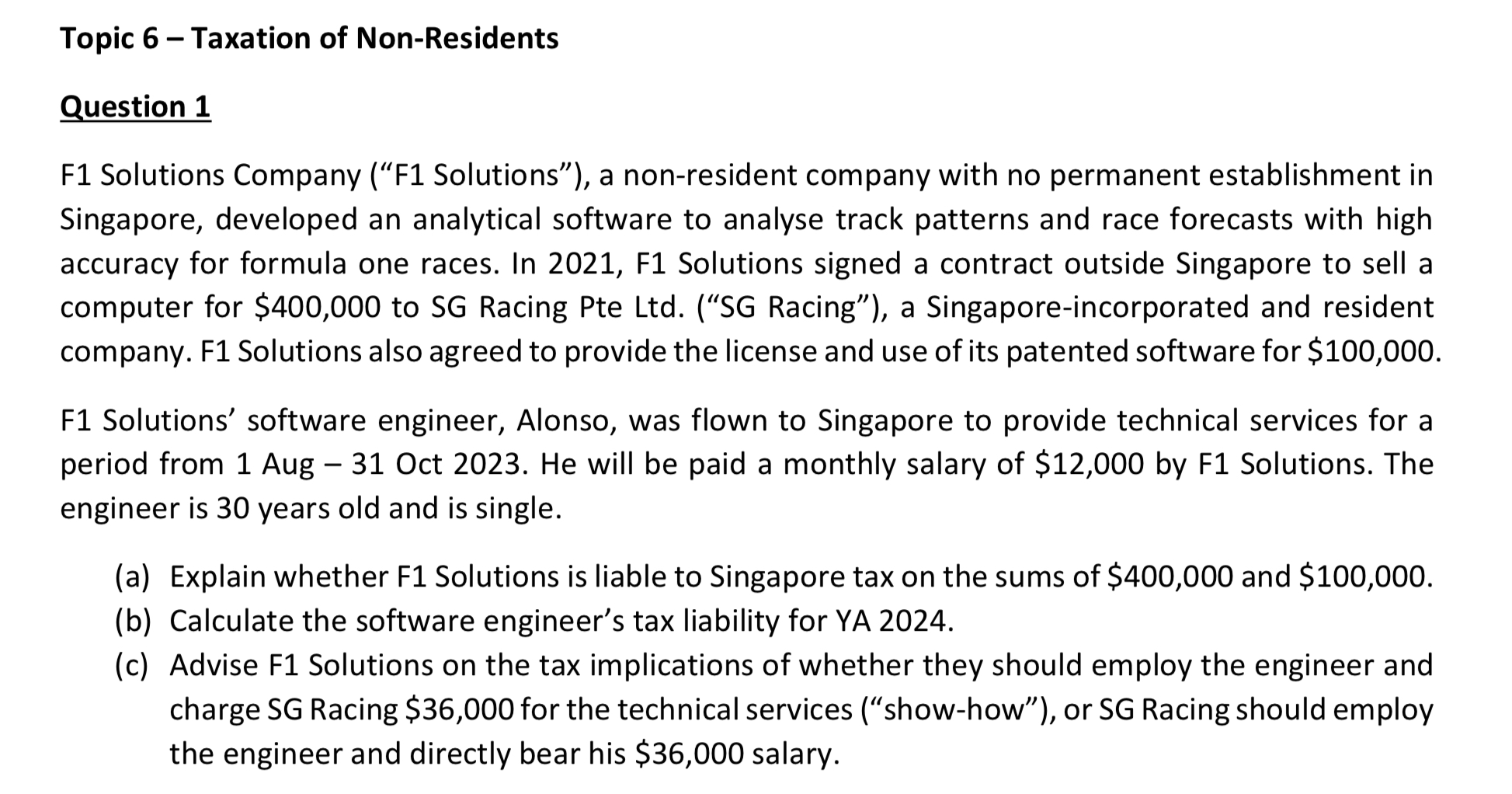

Topic Taxation of NonResidents

Question

F Solutions Company F Solutions" a nonresident company with no permanent establishment in

Singapore, developed an analytical software to analyse track patterns and race forecasts with high

accuracy for formula one races. In F Solutions signed a contract outside Singapore to sell a

computer for $ to SG Racing Pte LtdSG Racing" a Singaporeincorporated and resident

company. F Solutions also agreed to provide the license and use of its patented software for $

F Solutions' software engineer, Alonso, was flown to Singapore to provide technical services for a

period from Aug Oct He will be paid a monthly salary of $ by F Solutions. The

engineer is years old and is single.

a Explain whether F Solutions is liable to Singapore tax on the sums of $ and $

b Calculate the software engineer's tax liability for YA

c Advise F Solutions on the tax implications of whether they should employ the engineer and

charge SG Racing $ for the technical services showhow" or SG Racing should employ

the engineer and directly bear his $ salary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started