Topic 8 Entity Tax Return: Check Figures C:11-61

Bottle Up, Inc. Problem C:11-61

Form 1120S, Page 1 -

- Total income, line 6: $1,011,000

- Total deductions, line 20*: $938,533

- You should have values on the following lines: 1a, 1b, 1c, 2, 3, 6, 7, 8, 9, 10, 11, 12, 13, 14, 16, 18, 19, 20, and 21. Do not complete lines 22-27.

*Attach a schedule to the tax return showing the items and amounts for line 20, other deductions.

- Be sure you are using Form 1120S and not Forms 1120 or 1065.

- Remember to use 2019 tax forms. Points will be deducted for 2018 or 2020 forms. Forms can be located at www.irs.gov. Use the find forms or search feature. Depending on the time of year, the 2019 forms may be in the prior year section.

Form 1120S, Page 2, Schedule B

- Answer lines 1 2 based on the information provided in the problem.

- Answer no to all items 3-11. If a field does not need to be completed, leave it blank. Points will be deducted for failing to complete this schedule.

Form 1120S, Pages 3 and 4 (i.e., Schedule K)

- You should have amounts on the line numbers: 1, 4, 5a, 5b, 8a, 9, 12a, 12b, 12d (include type of item), 15a, 16a, 16c, 16d, 17a, 17b, and 18. Note: Line 1 should be the same as line 21 from page 1.

- Line 17a should be the investment income items added together. Review the items on page 3 of Sch. K to determine the amount. For line 17b, the amount is provided in the textbook problem.

- Line 18 should be $122,733.

Form 1120S, Page 4 (Schedule L)

- Schedule L This is the balance sheet copied directly from the case in the textbook. Remember the assets should equal the liabilities and capital. Complete the values for the beginning and end of the year.

Note: Use column (a) for any items where you may have subtotals, such as net accounts receivable or plant assets. For example, line 10a should be $375,434 in column (a) and line 10b should be $161,318 also in column (a) with the net result reported on line 10b in column (b) of $214,116. The items from column (b) are added together (or subtracted, as applicable) to get your total assets, liabilities, and equity.

Form 1120S, Page 5 (Schedules M-1 and M-2)

- Schedule M-1 (optional and for extra points) use the information from the problem to complete this section. Line 8 should be the same net income you report on Page 3, line 18. Line 4 should be $147,862.

- Do not complete Schedule M-2.

Form 1120S, Schedule D

Complete the Schedule D for Form 1120S. Use the boxes on line 10 to report the information applicable to the capital transaction, as provided in the problem.

Form 1120S, Form 1125-A

- You should have values on lines 1, 2, 3, 5, 6, 7, and 8. Check the applicable boxes for lines 9a, 9e, and 9f.

- The information to calculate cost of goods sold is found in the problem. Be sure not to double count any expenses you report on 1125-A on page 1 of Form 120S.

Form 1120S, Form 4797

- Report the sale of the Sec. 1231 asset on this form in Part I.

Form 1120S, Schedule K-1

- You should have amounts in the same boxes as you reported on the Schedule K (pages 3 and 4 of Form 1120S).

- For lines 12, 16 and 17, be sure to include both the amounts and the applicable code. The codes are located on page 2 of the Sch. K-1 form.

- You are only required to prepare the Schedule K-1 for Herman. It is okay to ignore the second shareholder for purpose of this project.

- Herman is an individual. He has owned 50% of the S-corporation interest all year. See the tax return project instructions for his address and social security number.

Herman and Rebecca Hiebert

Form 1040

Taxable income, line 11b: $302,830a Total owed, line 23: $12,956 (use 2019 tax tables)b,c

______

a For purposes of this assignment, calculate the the Qualified Business Income Deduction. Refer to the instructions for Form 8995 to assist in the calculation of this item. bIgnore the 3.8% net investment income tax for high-wealth individuals. c Remember to take into consideration the items subject to the capital gain tax preference rate when calculating the total tax liability.

Schedule A

- For line 9, include the investment interest expense from the S-corporation.

- On line 11, remember to include the cash contributions from both the taxpayers and the amount allocated from the S-corporation.

Form 8949 -

- Line 2h (Part II), $14,000

Schedule D

Schedule E

Topic 8 Tax Return Problem Data Set A, Problem C:11-61

You will be working individually to complete an S-corporation tax return and an individual income tax return. The completed tax returns can be submitted in paper copy during class (if uploaded to LoudCloud please scan and upload one single document. Note if you upload multiple documents, the assignment will not be graded and you will be required to turn in a paper copy or resubmit a single document with possible late point deductions). Use 2019 forms only (points will be deducted for using 2018 or 2020 forms).

Required

Prepare an S-corporation tax return. See data below. You will need the following forms:

- Form 1120S and corresponding schedules, including Schedules L and M-1

- Schedule K-1 for Herman Hiebert (from Problem C:11-61)

- For the Schedule K-1, use the address and SSN information below for Herman.

Individual Taxpayer Information

Individual tax forms required:

- Form 1040

- Schedule 1

- Schedule 3

- Schedule A

- Schedule B

- Schedule D

- Schedule E

- Form 8949

- Form 8995

- Form 4797 (see item 2.i. below)

- Herman Hieberts social security number is XYZ-12-3789. He is married but does not have any dependents. His wifes name is Rebecca and her social security number is XYZ-45-6789. They live at 1345 E. 44th Street, City, ST 85017

- Additional information to complete the tax returns:

- Rebecca works at Intel Corporation and earned $160,000 during the tax year.

- Her federal tax withholding was $30,000 and Arizona income taxes withheld were $8,000. Herman made federal estimated tax payments of $15,000 and Arizona estimated payments of $1,500

- Mortgage interest on their personal residence was $15,200 and property taxes were $5,150.

- Additional charitable contributions of $10,500 were paid during the year.

- On July 10, 2018, they sold 1,000 shares of Intel Corporation stock for $70 per shar They purchased the stock on May 1, 2012, for $56 per share.

- The taxpayers have a long-term capital loss carry forward of $10,000.

- Assume AMT does not apply.

- Apply any refund to estimated tax payments for the next year.

- Instead of preparing Form 4797 (since it was already prepared for the S-corporation), input any gain/loss from the Sec. 1231 asset on Form 1040, Schedule 1, line 14.

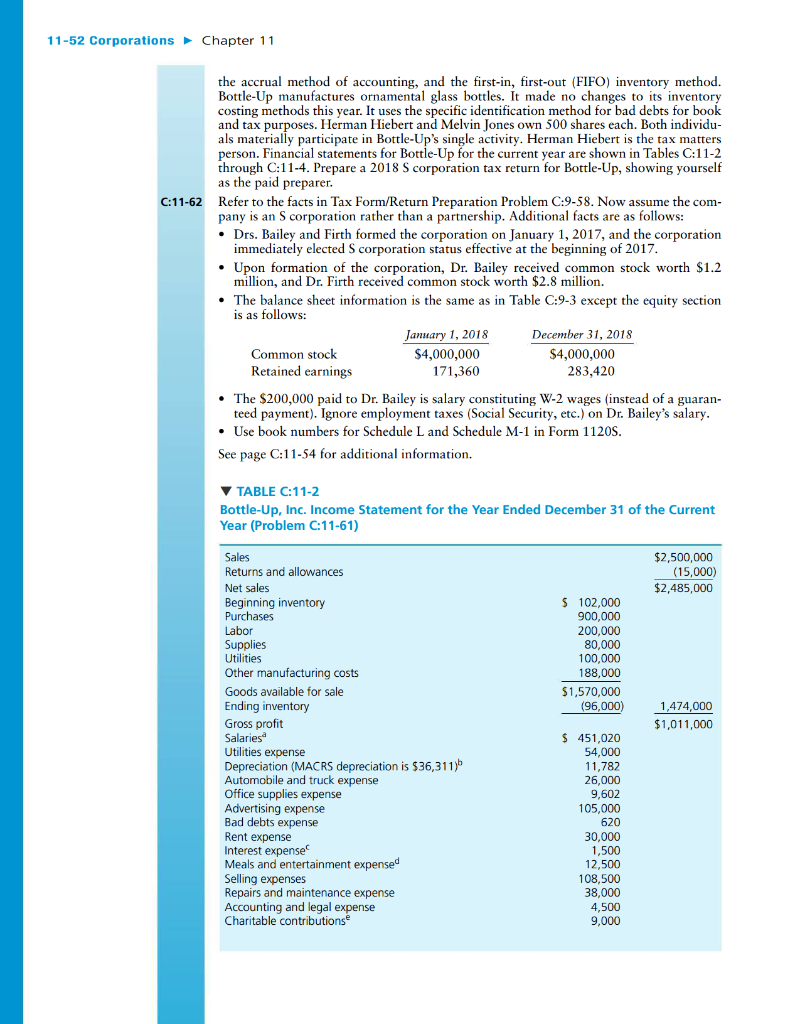

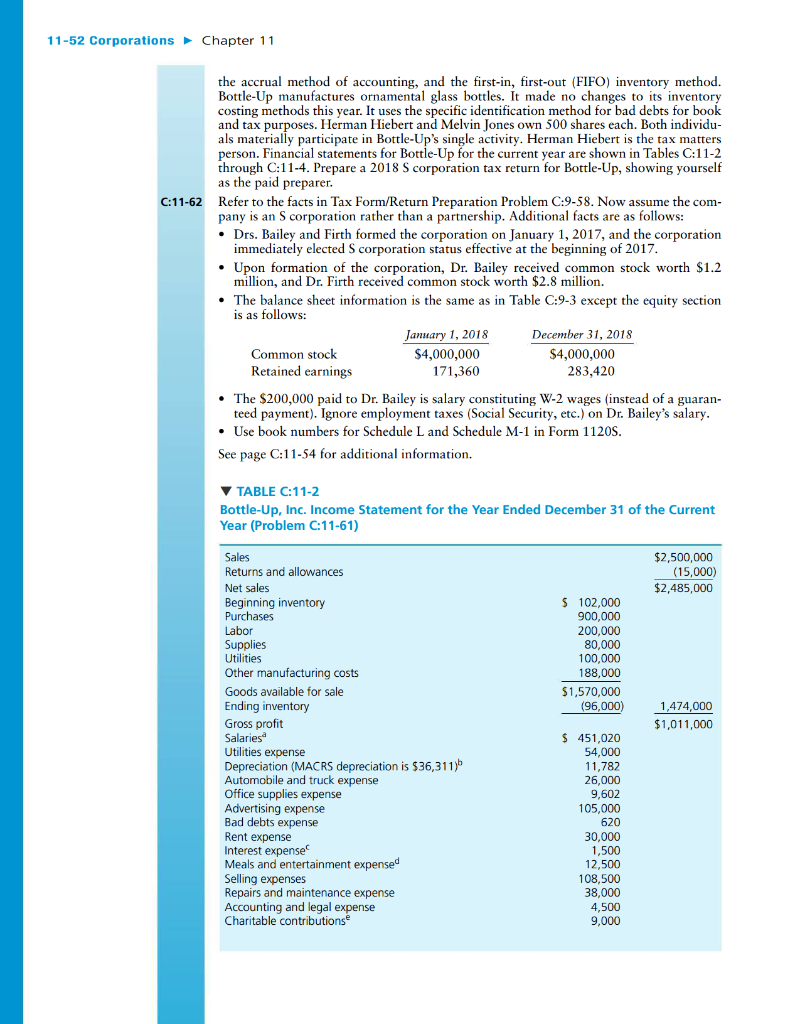

s Corporations Corporations 11-51 TAX STRATEGY AND CRITICAL THINKING PROBLEMS C:11-59 Alice, a married taxpayer, will form Morning Corporation in the current year. Alice plans to acquire all of Morning's common stock for a $1 million contribution to the corpora- tion. Morning will obtain additional capital by borrowing $200,000 from a local bank. Morning will conduct a variety of service activities with little need to retain its capital in the business. Alice expects start-up losses of $80,000 during Morning's first year of operation. She expects the corporation to earn pre-tax operating profits of $220,000 (be- fore reduction for Alice's salary) starting next year. Alice plans to withdraw $90,000 of Morning's profits as a reasonable salary. Her other income consists primarily of ordinary income (no dividends or capital gains) from other sources, including her husband's salary, and she expects these amounts to total $115,000 annually. What advice can you provide Alice about the advisability of making an Selection in the initial tax year? In the next tax year? In answering these questions, compare the following alternatives: (1) S corporation in both the current year and the next year, (2) S corporation in the current year and C corporation in the next year (i.e., by revoking the Selection next year), (3) C corporation in both the current year and the next year, and (4) C corporation in the current year and S corporation in the next year. When analyzing these alternatives, consider the total income taxes associated with each alternative, specifically, at the corporate and shareholder levels and across both years. Ignore payroll taxes, however. Also, assume the following facts: (1) for both years, the standard deduction is $24,400; (2) 2019 tax rate schedules remain the same for both years; (3) Alice claims the qualified business income (QBI) deduction where appropriate; and (4) a 7% discount rate applies for present value calculations. Although this problem asks for only a two-year analysis, discuss some shortcomings of such a short time frame. C:11-60 One way to compare the accumulation of income by alterative business entity forms is to use mathematical models. The following models express the investment after-tax accumu- lation calculation for a particular entity form: Pass-through entities (Scorporations, partnerships, and LLCs): ATA = [1 +R(1 0.8tp))" C corporation: ATA = (1 + R(1 t.)" (1 t) + ty where: ATA = after-tax accumulation in n years R = before-tax rate of return; to owner's marginal tax rate on ordinary income 0.8te = owner's marginal tax rate as adjusted to reflect the 20% QBI deduction to = corporation's marginal tax rate to = owner's tax rate on capital gains number of periods For each alternative business form, the owner makes an initial investment of $1. The following operating assumptions apply: Before-tax rate of return (R) = 0.18 Marginal tax rate for owner(t) = 0.37 and 0.8tp = 0.296 Corporate tax rate (t) = 0.21 Capital gains rate (ty)=0.238 for regular capital gains, including the 3.8% tax on net investment income Investment horizon (n) = 2, 5, or 30 years A pass-through entity distributes only enough cash each year for the owner to pay his or her taxes. Also, the shareholder claims the qualified business income (QBI) deduction. The corporation pays no dividends. The shareholder sells his or her stock at the end of the investment horizon, and the shareholder's gain is taxed at capital gains rate. (See Chapter 1:18 of the Individuals volume for a detailed explanation of these models.) Required: What is the after-tax accumulation if each business form is operated for the investment horizon and then sold for the amount of the accumulation? Which entity form is best for each investment horizon? For the C corporation alternative, do the analysis with and without the 100% Sec. 1202 exclusion. n TAX FORM/RETURN PREPARATION PROBLEMS C:11-61 Bottle-Up, Inc., was organized on January 8, 2009, and made its Selection on January 24, 2009. The necessary consents to the election were filed in a timely manner. Its ad- dress is 1234 Hill Street, City, ST 33333. Bottle-Up uses the calendar year as its tax year, 11-52 Corporations Chapter 11 the accrual method of accounting, and the first-in, first-out (FIFO) inventory method. Bottle-Up manufactures ornamental glass bottles. It made no changes to its inventory costing methods this year. It uses the specific identification method for bad debts for book and tax purposes. Herman Hiebert and Melvin Jones own 500 shares each. Both individu- als materially participate in Bottle-Up's single activity. Herman Hiebert is the tax matters person. Financial statements for Bottle-Up for the current year are shown in Tables C:11-2 through C:11-4. Prepare a 2018 S corporation tax return for Bottle-Up, showing yourself as the paid preparer. C:11-62 Refer tot o the facts in Tax Form/Return Preparation Problem C:9-58. Now assume the com- pany is an Scorporation rather than a partnership. Additional facts are as follows: Drs. Bailey and Firth formed the corporation on January 1, 2017, and the corporation immediately elected corporation status effective at the beginning of 2017. Upon formation of the corporation, Dr. Bailey received common stock worth $1.2 million, and Dr. Firth received common stock worth $2.8 million. The balance sheet information is the same as in Table C:9-3 except the equity section is as follows: January 1, 2018 December 31, 2018 Common stock $4,000,000 $4,000,000 Retained earnings 171,360 283,420 The $200,000 paid to Dr. Bailey is salary constituting W-2 wages (instead of a guaran- teed payment). Ignore employment taxes (Social Security, etc.) on Dr. Bailey's salary. Use book numbers for Schedule L and Schedule M-1 in Form 1120S. See page C:11-54 for additional information. TABLE C:11-2 Bottle-Up, Inc. Income Statement for the Year Ended December 31 of the Current Year (Problem C:11-61) $2,500,000 (15,000) $2,485,000 $ 102,000 900,000 200,000 80,000 100,000 188,000 $1,570,000 (96,000) 1,474,000 $1,011,000 Sales Returns and allowances Net sales Beginning inventory Purchases Labor Supplies Utilities Other manufacturing costs Goods available for sale Ending inventory Gross profit Salaries Utilities expense Depreciation (MACRS depreciation is $36,311) Automobile and truck expense Office supplies expense Advertising expense Bad debts expense Rent expense Interest expense Meals and entertainment expensed Selling expenses Repairs and maintenance expense Accounting and legal expense Charitable contributions $ 451,020 54,000 11.782 26,000 9,602 105,000 620 30,000 1,500 12,500 108,500 38,000 4,500 9,000 s Corporations Corporations 11-51 TAX STRATEGY AND CRITICAL THINKING PROBLEMS C:11-59 Alice, a married taxpayer, will form Morning Corporation in the current year. Alice plans to acquire all of Morning's common stock for a $1 million contribution to the corpora- tion. Morning will obtain additional capital by borrowing $200,000 from a local bank. Morning will conduct a variety of service activities with little need to retain its capital in the business. Alice expects start-up losses of $80,000 during Morning's first year of operation. She expects the corporation to earn pre-tax operating profits of $220,000 (be- fore reduction for Alice's salary) starting next year. Alice plans to withdraw $90,000 of Morning's profits as a reasonable salary. Her other income consists primarily of ordinary income (no dividends or capital gains) from other sources, including her husband's salary, and she expects these amounts to total $115,000 annually. What advice can you provide Alice about the advisability of making an Selection in the initial tax year? In the next tax year? In answering these questions, compare the following alternatives: (1) S corporation in both the current year and the next year, (2) S corporation in the current year and C corporation in the next year (i.e., by revoking the Selection next year), (3) C corporation in both the current year and the next year, and (4) C corporation in the current year and S corporation in the next year. When analyzing these alternatives, consider the total income taxes associated with each alternative, specifically, at the corporate and shareholder levels and across both years. Ignore payroll taxes, however. Also, assume the following facts: (1) for both years, the standard deduction is $24,400; (2) 2019 tax rate schedules remain the same for both years; (3) Alice claims the qualified business income (QBI) deduction where appropriate; and (4) a 7% discount rate applies for present value calculations. Although this problem asks for only a two-year analysis, discuss some shortcomings of such a short time frame. C:11-60 One way to compare the accumulation of income by alterative business entity forms is to use mathematical models. The following models express the investment after-tax accumu- lation calculation for a particular entity form: Pass-through entities (Scorporations, partnerships, and LLCs): ATA = [1 +R(1 0.8tp))" C corporation: ATA = (1 + R(1 t.)" (1 t) + ty where: ATA = after-tax accumulation in n years R = before-tax rate of return; to owner's marginal tax rate on ordinary income 0.8te = owner's marginal tax rate as adjusted to reflect the 20% QBI deduction to = corporation's marginal tax rate to = owner's tax rate on capital gains number of periods For each alternative business form, the owner makes an initial investment of $1. The following operating assumptions apply: Before-tax rate of return (R) = 0.18 Marginal tax rate for owner(t) = 0.37 and 0.8tp = 0.296 Corporate tax rate (t) = 0.21 Capital gains rate (ty)=0.238 for regular capital gains, including the 3.8% tax on net investment income Investment horizon (n) = 2, 5, or 30 years A pass-through entity distributes only enough cash each year for the owner to pay his or her taxes. Also, the shareholder claims the qualified business income (QBI) deduction. The corporation pays no dividends. The shareholder sells his or her stock at the end of the investment horizon, and the shareholder's gain is taxed at capital gains rate. (See Chapter 1:18 of the Individuals volume for a detailed explanation of these models.) Required: What is the after-tax accumulation if each business form is operated for the investment horizon and then sold for the amount of the accumulation? Which entity form is best for each investment horizon? For the C corporation alternative, do the analysis with and without the 100% Sec. 1202 exclusion. n TAX FORM/RETURN PREPARATION PROBLEMS C:11-61 Bottle-Up, Inc., was organized on January 8, 2009, and made its Selection on January 24, 2009. The necessary consents to the election were filed in a timely manner. Its ad- dress is 1234 Hill Street, City, ST 33333. Bottle-Up uses the calendar year as its tax year, 11-52 Corporations Chapter 11 the accrual method of accounting, and the first-in, first-out (FIFO) inventory method. Bottle-Up manufactures ornamental glass bottles. It made no changes to its inventory costing methods this year. It uses the specific identification method for bad debts for book and tax purposes. Herman Hiebert and Melvin Jones own 500 shares each. Both individu- als materially participate in Bottle-Up's single activity. Herman Hiebert is the tax matters person. Financial statements for Bottle-Up for the current year are shown in Tables C:11-2 through C:11-4. Prepare a 2018 S corporation tax return for Bottle-Up, showing yourself as the paid preparer. C:11-62 Refer tot o the facts in Tax Form/Return Preparation Problem C:9-58. Now assume the com- pany is an Scorporation rather than a partnership. Additional facts are as follows: Drs. Bailey and Firth formed the corporation on January 1, 2017, and the corporation immediately elected corporation status effective at the beginning of 2017. Upon formation of the corporation, Dr. Bailey received common stock worth $1.2 million, and Dr. Firth received common stock worth $2.8 million. The balance sheet information is the same as in Table C:9-3 except the equity section is as follows: January 1, 2018 December 31, 2018 Common stock $4,000,000 $4,000,000 Retained earnings 171,360 283,420 The $200,000 paid to Dr. Bailey is salary constituting W-2 wages (instead of a guaran- teed payment). Ignore employment taxes (Social Security, etc.) on Dr. Bailey's salary. Use book numbers for Schedule L and Schedule M-1 in Form 1120S. See page C:11-54 for additional information. TABLE C:11-2 Bottle-Up, Inc. Income Statement for the Year Ended December 31 of the Current Year (Problem C:11-61) $2,500,000 (15,000) $2,485,000 $ 102,000 900,000 200,000 80,000 100,000 188,000 $1,570,000 (96,000) 1,474,000 $1,011,000 Sales Returns and allowances Net sales Beginning inventory Purchases Labor Supplies Utilities Other manufacturing costs Goods available for sale Ending inventory Gross profit Salaries Utilities expense Depreciation (MACRS depreciation is $36,311) Automobile and truck expense Office supplies expense Advertising expense Bad debts expense Rent expense Interest expense Meals and entertainment expensed Selling expenses Repairs and maintenance expense Accounting and legal expense Charitable contributions $ 451,020 54,000 11.782 26,000 9,602 105,000 620 30,000 1,500 12,500 108,500 38,000 4,500 9,000