Question

Topic: Cost of Carry, Valuation and Arbitrage Using market information as of the close of Tuesday, August 29 (see CMEGROUP.com and WSJ online or hard

Topic: Cost of Carry, Valuation and Arbitrage

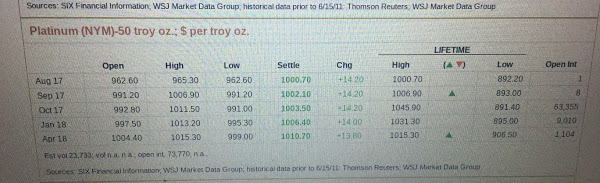

Using market information as of the close of Tuesday, August 29 (see CMEGROUP.com and WSJ online or hard copy for closing price info), address the following questions regarding the Platinum futures contract, which is listed on the CME Group futures exchange.

Assumptions: Assume the Platinum, Engelhard industrial bullion" price is a reasonable proxy for the spot (cash) price. To find this price, go to wsj.com, click on Markets then on Market Data. Next, click on Commodities & Futures and click again on Cash Commodity Prices which is listed under Spot Prices. For futures prices, keep looking for Futures Settlements under Settlement Prices, Indexes & Other Statistics (or go to cmegroup.com and look under metals). The maturity date of this futures is the 3rd last business day of the maturity month. To get your relevant financing rate (for borrowing or lending), see Money Rates under Bonds, Rates & Credit Markets and use London Interbank Offered Rates (Libor). (You can also get Libor spot rates at global-rates.com). Of the various Libor maturities reported (e.g., 1, 3, 6, or 12 months) use the one with a term most closely matching that of the futures maturity date, but when computing the financing cost please be sure to use an actual day count and a 360-day year (e.g., use Actual/360 convention). Also, assume warehousing and delivery costs are negligible and ignore for now convenience yields and leasing opportunities.

Questions:

(A) Determine the theoretical futures price ($ per ounce) for the January 2018 Platinum futures contract using procedures discussed in class. (Hint: the 3-month Libor probably is the closest in maturity.)

(B) i) Compare the actual reported futures price to your answer in (A); and ii) If the actual and theoretical futures prices differ, explicitly detail the steps for conducting an arbitrage and compute the potential arbitrage profit (per ounce) using methods presented in class.

(C) Discuss several factors that have not been accounted for that could potentially explain how an "apparent" arbitrage opportunity may have arisen in part B.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started