Answered step by step

Verified Expert Solution

Question

1 Approved Answer

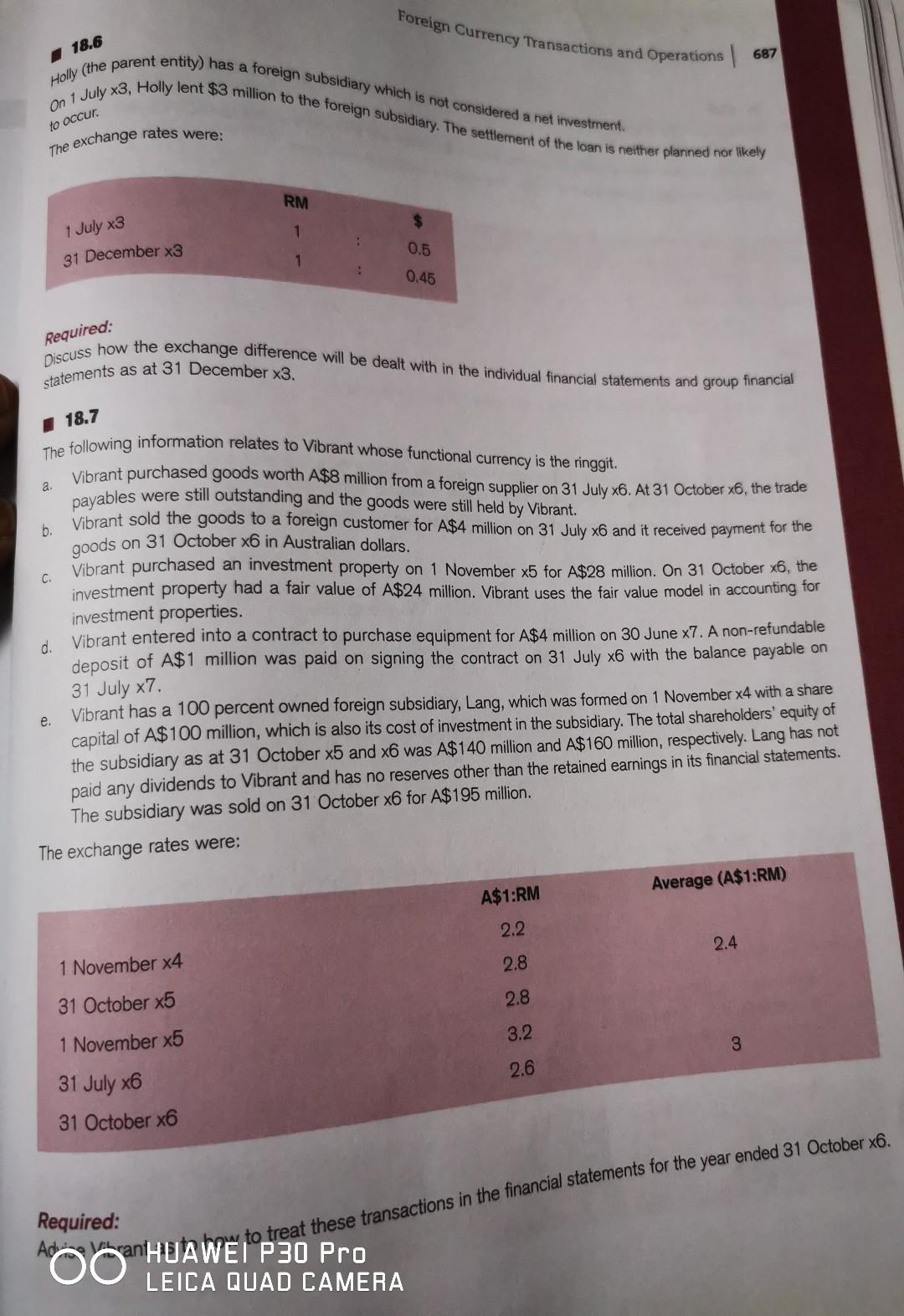

topic : foreign exchanges rate Foreign Currency Transactions and Operations | 687 Holly (the parent entity) has a foreign subsidiary which is not considered a

topic : foreign exchanges rate

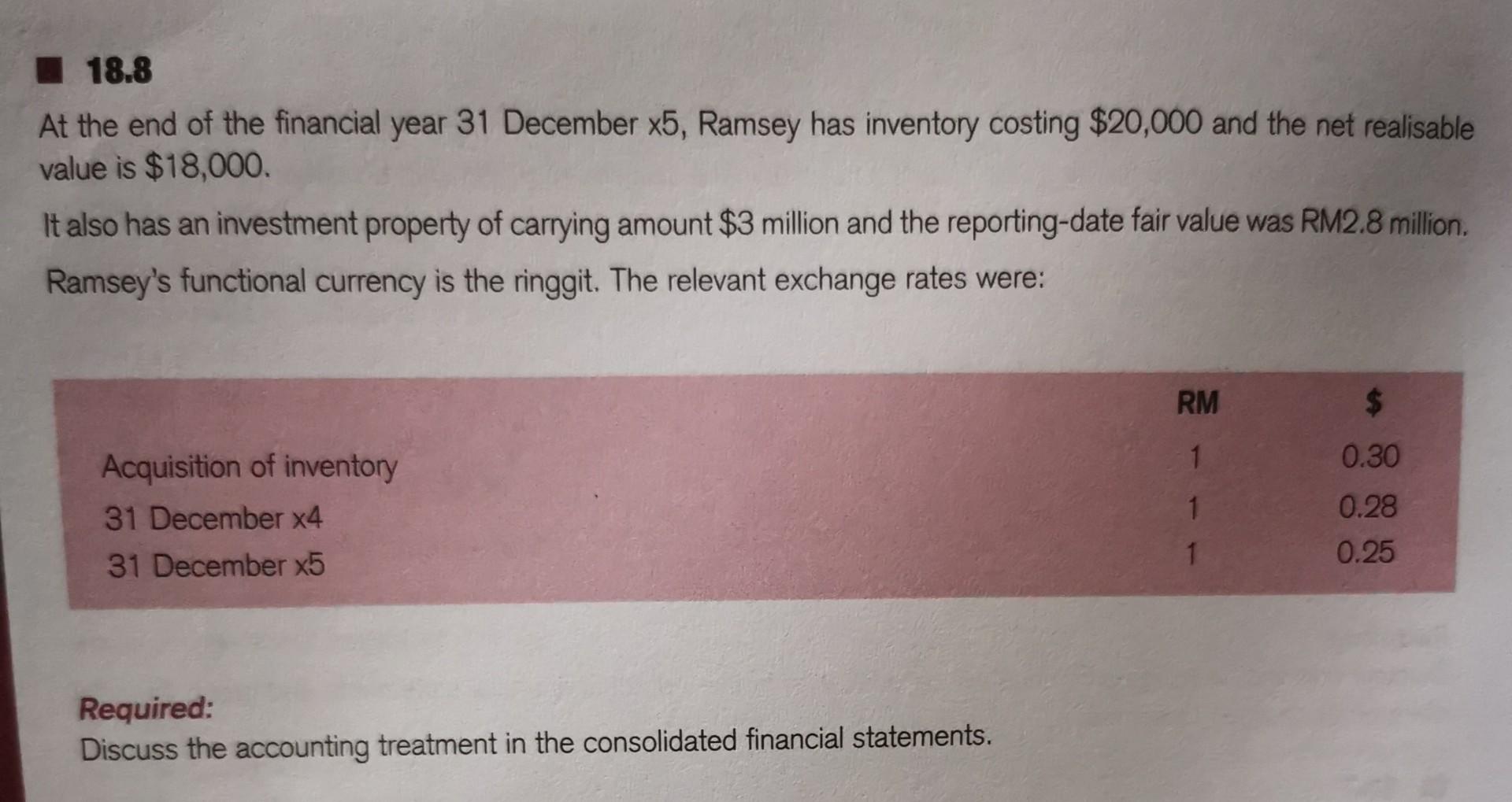

Foreign Currency Transactions and Operations | 687 Holly (the parent entity) has a foreign subsidiary which is not considered a net investment. on 1 July 3, Holly lent $3 million to the foreign subsidiary. The sidered a net investment. to occur. The exchange rates were: Required: Discuss how the exchange difference will be dealt with in the individual financial statements and group financial statements as 31 December 3. 18.7 The following information relates to Vibrant whose functional currency is the ringgit. 2. Vibrant purchased goods worth A$8 million from a foreign supplier on 31 July 6. At 31 October 6, the trade payables were still outstanding and the goods were still held by Vibrant. b. Vibrant sold the goods to a foreign customer for A$4 million on 31 July 6 and it received payment for the goods on 31 October x6 in Australian dollars. c. Vibrant purchased an investment property on 1 November x5 for A $28 million. On 31 October 6, the investment property had a fair value of A$24 million. Vibrant uses the fair value model in accounting for investment properties. d. Vibrant entered into a contract to purchase equipment for A$4 million on 30 June x7. A non-refundable deposit of A$1 million was paid on signing the contract on 31 July 6 with the balance payable on e. Vibrant has a 100 percent owned foreign subsidiary, Lang, which was formed on 1 November x4 with a share 31 July 7. capital of A$100 million, which is also its cost of investment in the subsidiary. The total shareholders' equity of the subsidiary as at 31 October x5 and x6 was A$140 million and A$160 million, respectively. Lang has not paid any dividends to Vibrant and has no reserves other than the retained earnings in its financial statements. The subsidiary was sold on 31 October x6 for A$195 million. The exchange rates were: Required: Adriag yanithta Wel to 30 Preat these trar LEICA QUAD CAMERA At the end of the financial year 31 December x5, Ramsey has inventory costing $20,000 and the net realisable value is $18,000. It also has an investment property of carrying amount $3 million and the reporting-date fair value was RM2.8 million. Ramsey's functional currency is the ringgit. The relevant exchange rates were: Acquisition of inventory 31 December 4 31 December 5 Required: Discuss the accounting treatment in the consolidated financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started