Answered step by step

Verified Expert Solution

Question

1 Approved Answer

topic : foreign exchanges rate memo has paid a dividend of rm 8 million during the financial year and this is not included in the

topic : foreign exchanges rate

memo has paid a dividend of rm 8 million during the financial year and this is not included in the statement of profit or loss.

required:

prepare a consolidated statement of profit or loss for the year ended 30 april x4 and a consolidated statement of financial position at the date

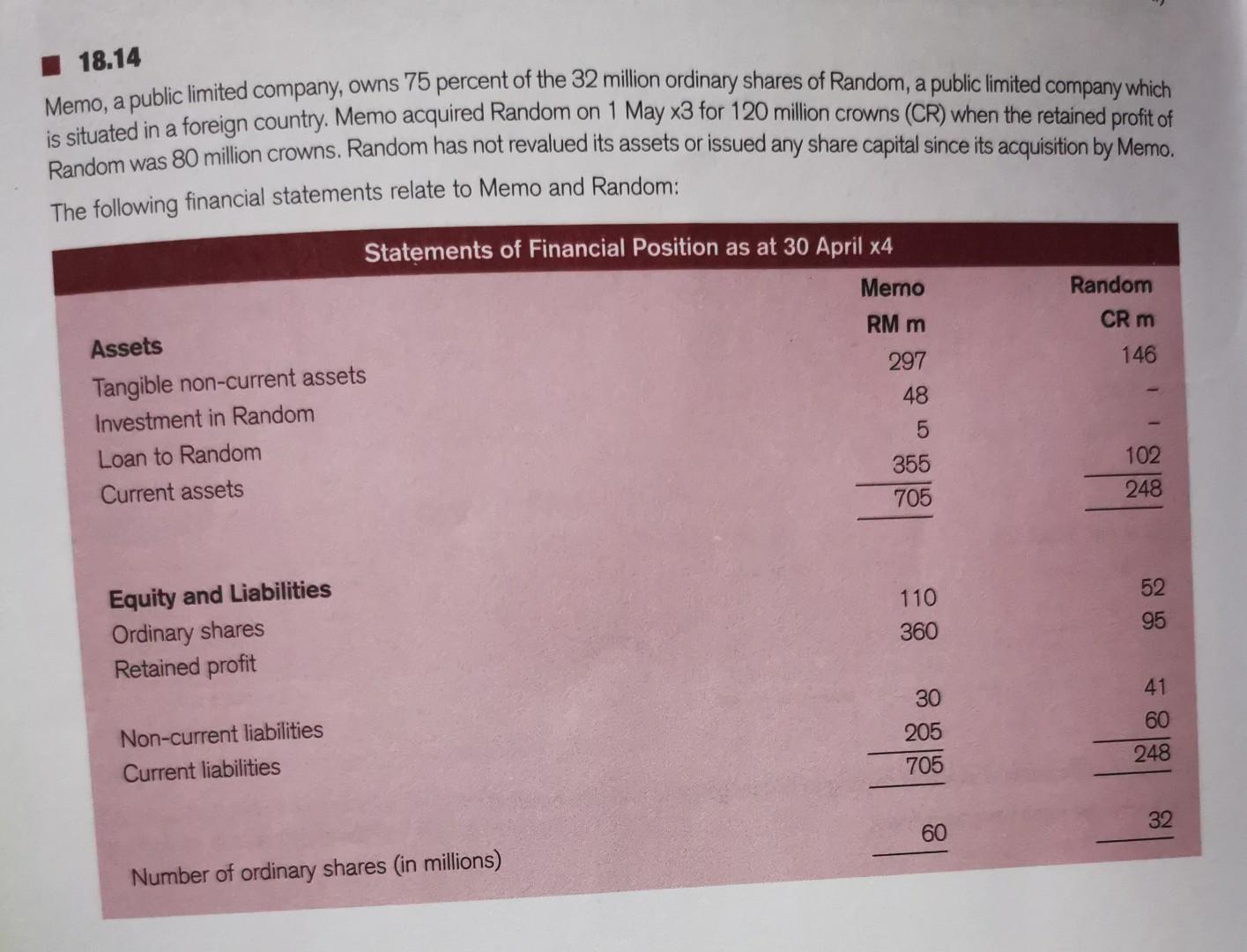

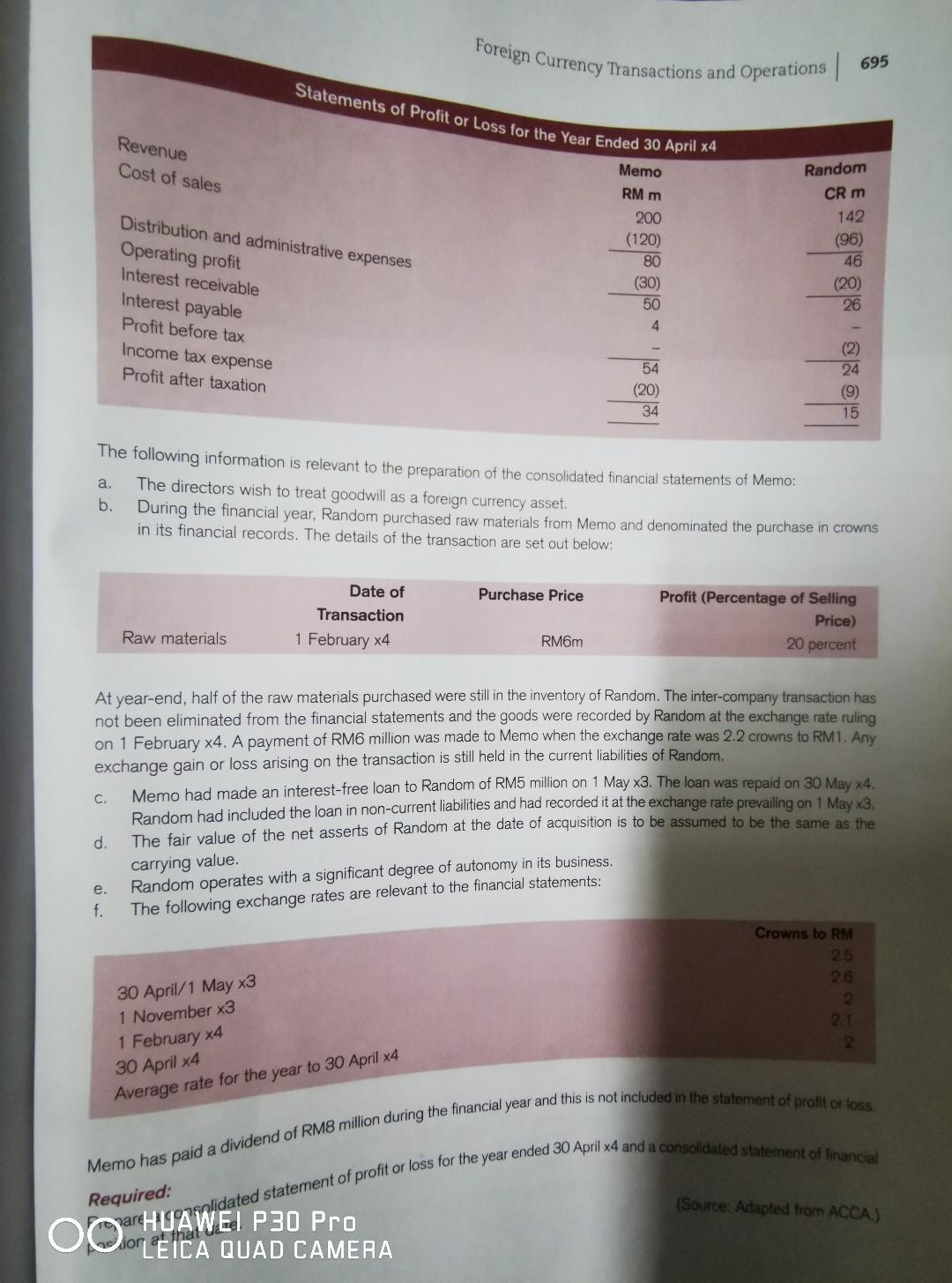

18.14 Memo, a public limited company, owns 75 percent of the 32 million ordinary shares of Random, a public limited company which is situated in a foreign country. Memo acquired Random on 1 May 3 for 120 million crowns (CR) when the retained profit of Random was 80 million crowns. Random has not revalued its assets or issued any share capital since its acquisition by Memo. The following financial statements relate to Memo and Random: The following information is relevant to the preparation of the consolidated financial statements of Memo: a. The directors wish to treat goodwill as a foreign currency asset. b. During the financial year, Random purchased raw materials from Memo and denominated the purchase in crowns in its financial records. The details of the transaction are set out below: At year-end, half of the raw materials purchased were still in the inventory of Random. The inter-company transaction has not been eliminated from the financial statements and the goods were recorded by Random at the exchange rate ruling on 1 February 4. A payment of RM6 million was made to Memo when the exchange rate was 2.2 crowns to RM1. Any exchange gain or loss arising on the transaction is still held in the current liabilities of Random. c. Memo had made an interest-free loan to Random of RM5 million on 1 May 3. The loan was repaid on 30 May 4. Random had included the loan in non-current liabilities and had recorded it at the exchange rate prevailing on 1May3. d. The fair value of the net asserts of Random at the date of acquisition is to be assumed to be the same as the e. Random operates with a significant degree of autonomy in its business. carrying value. f. The following exchange rates are relevant to the financial statements: 18.14 Memo, a public limited company, owns 75 percent of the 32 million ordinary shares of Random, a public limited company which is situated in a foreign country. Memo acquired Random on 1 May 3 for 120 million crowns (CR) when the retained profit of Random was 80 million crowns. Random has not revalued its assets or issued any share capital since its acquisition by Memo. The following financial statements relate to Memo and Random: The following information is relevant to the preparation of the consolidated financial statements of Memo: a. The directors wish to treat goodwill as a foreign currency asset. b. During the financial year, Random purchased raw materials from Memo and denominated the purchase in crowns in its financial records. The details of the transaction are set out below: At year-end, half of the raw materials purchased were still in the inventory of Random. The inter-company transaction has not been eliminated from the financial statements and the goods were recorded by Random at the exchange rate ruling on 1 February 4. A payment of RM6 million was made to Memo when the exchange rate was 2.2 crowns to RM1. Any exchange gain or loss arising on the transaction is still held in the current liabilities of Random. c. Memo had made an interest-free loan to Random of RM5 million on 1 May 3. The loan was repaid on 30 May 4. Random had included the loan in non-current liabilities and had recorded it at the exchange rate prevailing on 1May3. d. The fair value of the net asserts of Random at the date of acquisition is to be assumed to be the same as the e. Random operates with a significant degree of autonomy in its business. carrying value. f. The following exchange rates are relevant to the financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started