Answered step by step

Verified Expert Solution

Question

1 Approved Answer

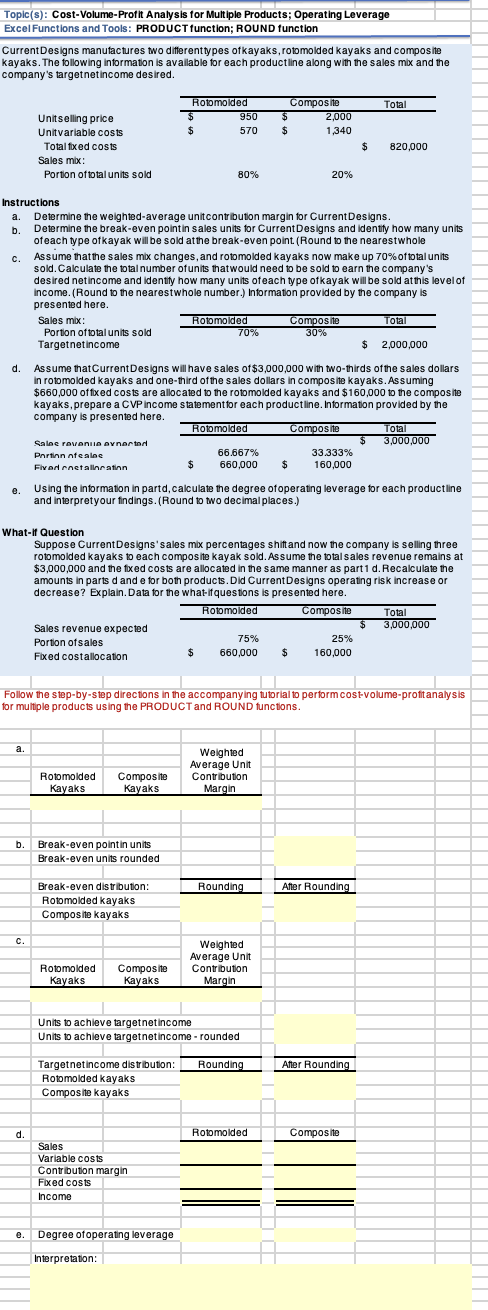

Topic ( s ) : Cost - Volume - Proftt A nalysis for Multiple Products; Operating Leverage Excel Functions and Tools: PRODUCT function; ROUND function

Topics: CostVolumeProftt A nalysis for Multiple Products; Operating Leverage

Excel Functions and Tools: PRODUCT function; ROUND function

CurrentDesigns manufactures two differenttypes ofkayaks, rotomolded kayaks and composite

kayaks. The following information is avallable for each productiline along with the sales mix and the

company's targetnetincome desired.

Unitselling price

Unitvariable costs

Total fixed costs

Sales mix:

Portion of total units sold

Instructions

a Determine the weightedaverage unitcontribution margin for CurrentDesigns.

b Determine the breakeven point in sales units for CurrentDesigns and identity how many units

of each type ofkayak will be sold at the breakeven point. Round to the nearestwhole

c Assume that the sales mix changes, and rotomolded kayaks now make up of total units

sold. Calculate the total number of units thatwould need to be sold to earn the company's

desired netincome and identily how many units of each type ofkayak will be sold at this level of

income.Round ti

Sales mix:

Portion of total units sold

Targetnetincome

d Assume thatCurrentDesigns will have sales of $ with wothirds of the sales dollars

in rotomolded kayaks and onethird of the sales dollars in composite kayaks. Assuming

$ offixed costs are allocated to the rotomolded kayaks and $ to the composite

kayaks, prepare a CVP income statementfor each productiline. Information provided by the

company is presented here.

Salec ravanue avnartar

Portinn ntealoe

e Using the information in partd, calculate the degree ofoperating leverage for each product line

and interpretyour findings. Round to two decimal places.

WhatIt Question

Suppose CurrentDesigns'sales mix percentages shitt and now the company is selling three

rotomolded kayaks to each composite kayak sold. Assume the total sales revenue remains at

$ and the fixed costs are allocated in the same manner as part Recalculate the

amounts in parts and e for both products. Did CurrentDesigns operating risk increase or

decrease? Explain. Data for the whatifquestions is presented here.

Sales revenue expected

Portion of sales

Fixed costallocation

Follow the stepbystep directions in the accompanying tutorial to perform costvolumeproftanalysis

for multiple products using the PRODUCT and ROUND functions.

a

b

Units to achieve targetnetincome

Units to achieve targetnetincome rounded

Targetnetincome distribution:

Rounding

Rotomolded kayaks

Composite kayaks

d

Sales

Variable costs

Contribution margin

Fixed costs

income

e Degree ofoperating leverage

Interpretation:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started