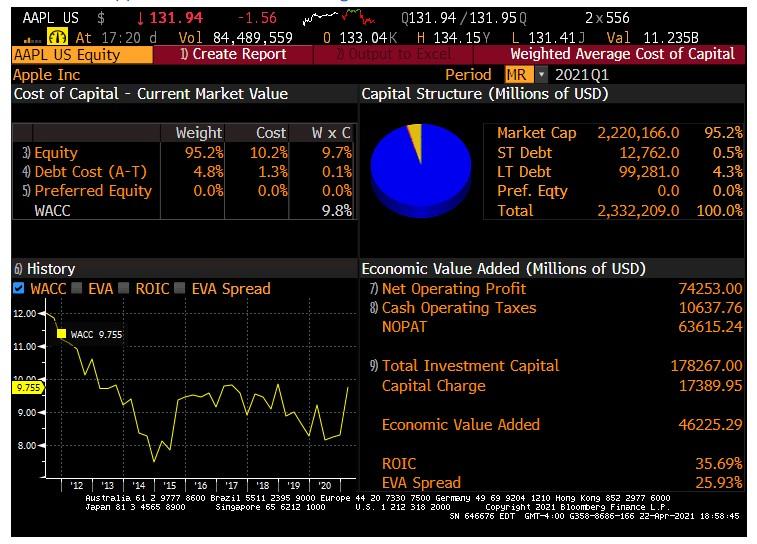

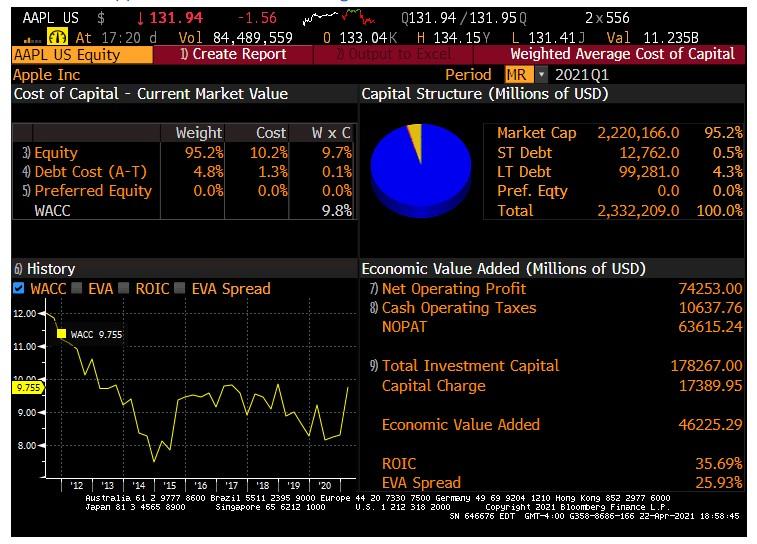

Topic: WACC Analysis After graduating with a degree in finance, you land a job at Apple as a financial analyst. The first project to which you have been assigned is the valuation of a potential acquisition target. Apple is considering widening its competition with Amazon to include big-box retail sales. To that end, Apple is exploring the purchase of a mass merchandiser that is likely to be valued at around $100 billion. You have been asked to retrieve Apple's WACC as it is often used as the appropriate discount rate when valuing acquisition targets. Sitting at a Bloomberg terminal, you pull up Apple's current WACC . Before sending the WACC to your manager, you pause and ponder the following questions: 1. Is it appropriate to use Apple's WACC to value this target firm? 2. Will using Apple's WACC as the required return ause us to make a bad investment decision? 3. If we choose not to use Apple's WACC, how can we come up with an appropriate required return for this investment? 4. What would be the most challenging aspects of running an analysis to come up with the appropriate required return? Write a memo to the manager of your team, Emma May, that includes Apple's WACC and addresses these questions. AAPL US $ | 131.94 -1.56 T! At 17:20 d Vol 84,489,559 AAPL US Equity D Create Report Apple Inc Cost of Capital - Current Market Value Q131.94/131.95 Q 2 x 556 0 133.04K H 134, 15, L 131.41) Val 11.235B Output to Excel Weighted Average Cost of Capital Period MR2021Q1 Capital Structure (Millions of USD) 3) Equity 4 Debt Cost (A-T) 5) Preferred Equity WACC Weight 95.2% 4.8% 0.0% Cost 10.2% 1.3% 0.0% WxC 9.7% 0.1% 0.0% 9.8% Market Cap ST Debt LT Debt Pref. Eqty Total 2,220,166.0 95.2% 12,762.0 0.5% 99,281.0 4.3% 0.0 0.0% 2,332,209.0 100.0% History WACC EVA ROIC EVA Spread Economic Value Added (Millions of USD) 7) Net Operating Profit 8) Cash Operating Taxes NOPAT 12.00- 74253.00 10637.76 63615.24 WACC 9.755 11.00- 1AM 9.755 9) Total Investment Capital Capital Charge 178267.00 17389.95 9.00- Economic Value Added 46225.29 8.00 ROIC 35.69% '12 '13 '14 '15 '16 '17 '18 '19 20 EVA Spread 25.93% Australia 61 2 9777 8600 Brazil 5511 2395 9000 Europe 44 20 7330 7500 Germeny 49 69 9204 1210 Hong Kong 852 2977 6000 Japan 81 3 4565 8900 Singapore 65 6212 1000 U.S. 1 212 318 2000 Copyright 2021 Bloomberg Finance L.P. SN 646676 EDT GMT-4:00 G358-8686-166 22-Apr-2021 18:58:45