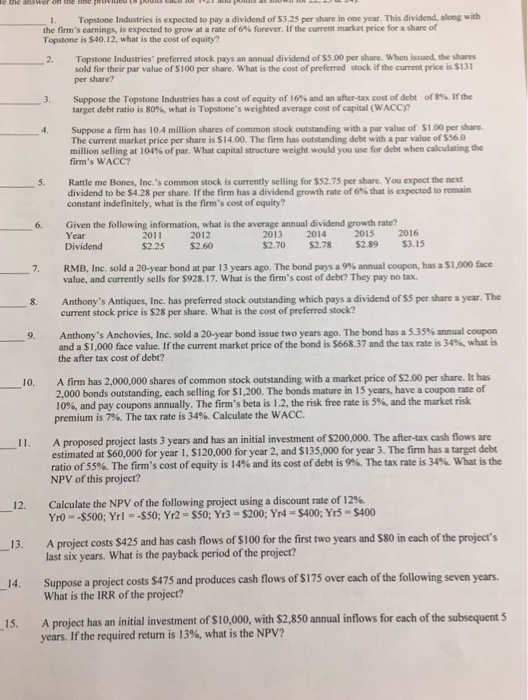

Topstone Industries is expected to pay a dividend of $3.25 per share in one year. This dividend, along with the firm's earnings, is expected to grow at a rate of 6% forever. If the current market price for a share of Topstone is $40.12, what is the cost of equity? Topstone Industries' preferred stock pays an annual dividend of $5.00 per share. When issued, the shares sold for their par value of $100 per share. What is the cost of preferred stock if the current price is $131 per share? Suppose the Topstone Industries has a cost of equity of 16% and an after-tax cost of debt of 8%. If the target debt ratio is 80%, what is Topstone's weighted average cost of capital (WACC)? Suppose a firm has 10.4 million shares of common stock outstanding with a par value of $1.00 per share. The current market price per share is $14.00. The firm has outstanding debt with a par value of $56.0 million selling at 104% of par. What capital structure weight would you use for debt when calculating the firm's WACC? Rattle me Bones, Inc.'s common stock is currently selling for $52.75 per share. You expect the next dividend to be $4.28 per share. If the firm has a dividend growth rate of 6% that is expected to remain constant indefinitely, what is the firm's cost of equity? Given the following information, what is the average annual dividend growth rate? RMB, Inc. sold a 20-year bond at par 13 years ago. The bond pays a 9% annual coupon, has a $1,000 face value, and currently sells for $928.17. What is the firm's cost of debt? They pay no tax. Anthony's Antiques, Inc. has preferred stock outstanding which pays a dividend of $5 per share a year. The current stock price is $28 per share. What is the cost of preferred stock? Anthony's Anchovies. Inc. sold a 20-year bond issue two years ago. The bond has a 5.35% annual coupon and a $1,000 face value. If the current market price of the bond is $668.37 and the tax rate is 34%, what is the after tax cost of debt? A firm has 2,000,000 shares of common stock outstanding with a market price of $2.00 per share. It has 2,000 bonds outstanding, each selling for $1, 200. The bonds mature in 15 years, have a coupon rate of 10%, and pay coupons annually. The firm's beta is 1.2, the risk free rate is 5%, and the market risk premium is 7%. The tax rate is 34%. Calculate the WACC. A proposed project lasts 3 years and has an initial investment of $200,000. The after-tax cash flows are estimated at $60,000 for year 1, $120,000 for year 2, and $135,000 for year 3. The firm has a target debt ratio of 55%. The firm's cost of equity is 14% and its cost of debt is 9%. The tax rate is 34%. What is the NPV of this project? Calculate the NPV of the following project using a discount rate of 12%. Yr0 = -$500; Yr1 = -$50; Yr2 = $50; Yr3 = $200; Yr4 = $400; Yr5 = $400 A project costs $425 and has cash flows of $100 for the first two years and $80 in each of the project's last six years. What is the payback period of the project? Suppose a project costs $475 and produces cash flows of $175 over each of the following seven years. What is the IRR of the project? A project has an initial investment of $10,000, with $2, 850 annual inflows for each of the subsequent 5 years. If the required return is 13%, what is the NPV