Question

Topwood Ltd is a 40-year-old company producing furniture. 22 years ago, it acquired a 100% interest in Fleetwood Ltd. In 2011, it acquired a 40%

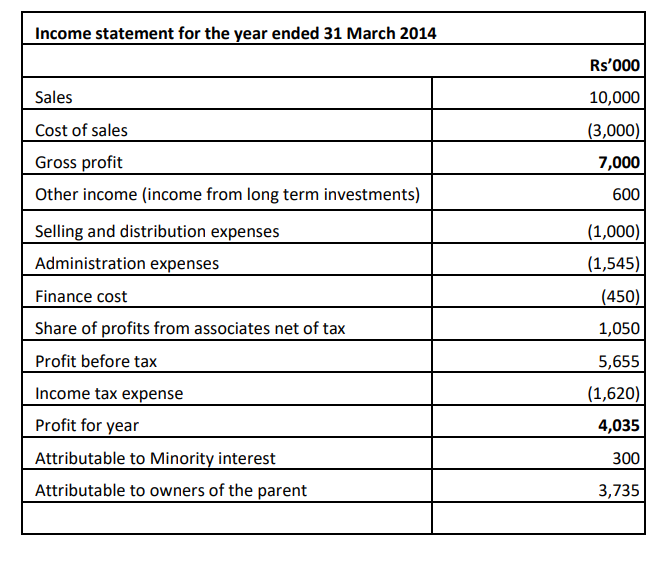

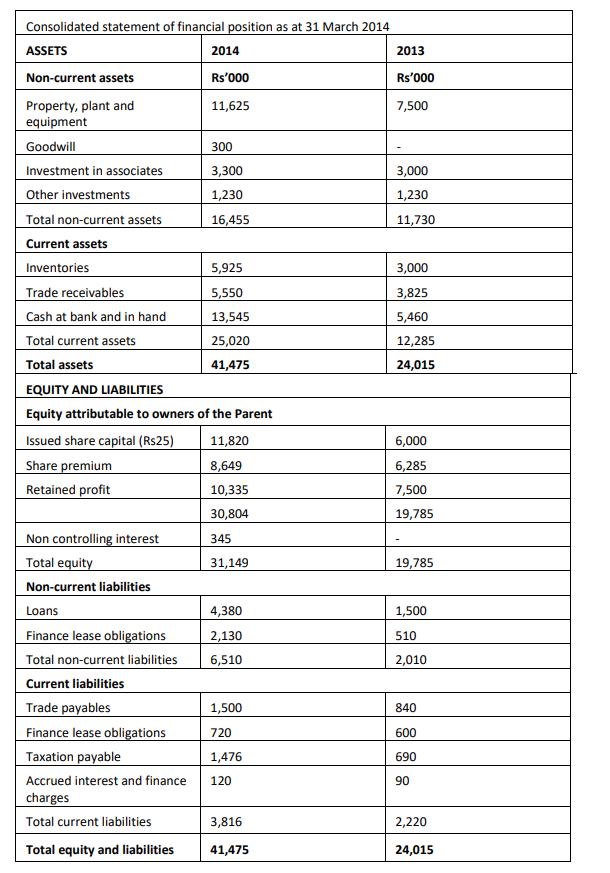

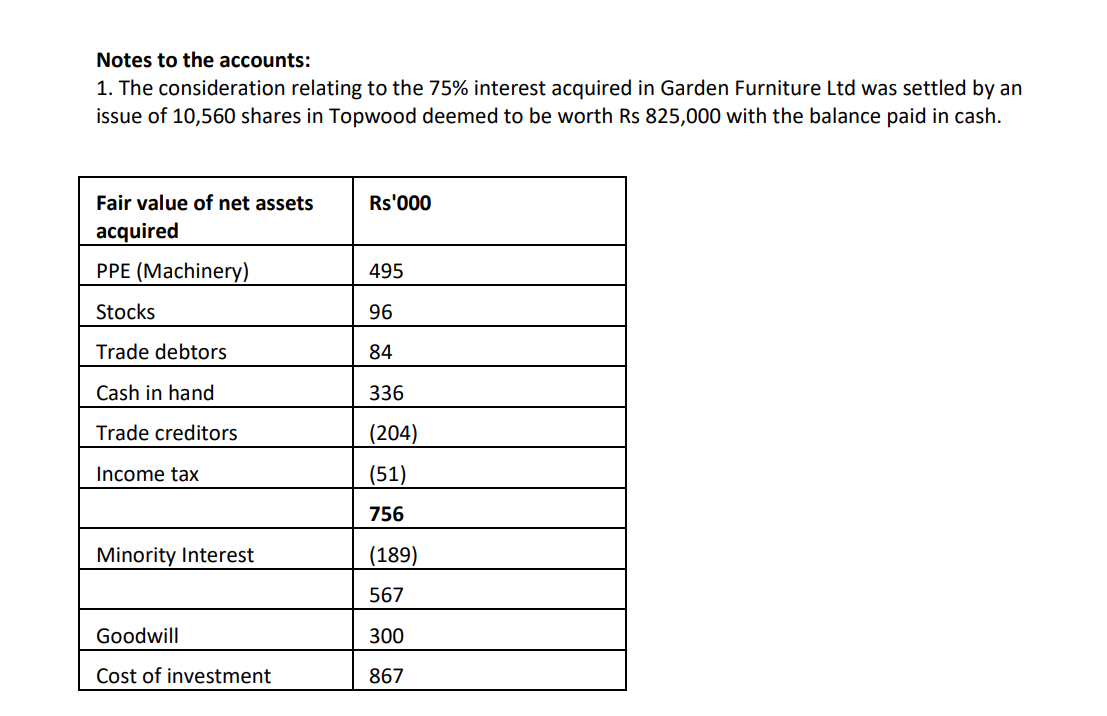

Topwood Ltd is a 40-year-old company producing furniture. 22 years ago, it acquired a 100% interest in Fleetwood Ltd. In 2011, it acquired a 40% interest in Landscapes Ltd and on 1 April 2013, it acquired a 75% interest in Garden Furniture Ltd. The draft consolidated accounts for the Topwood Group are as follows:

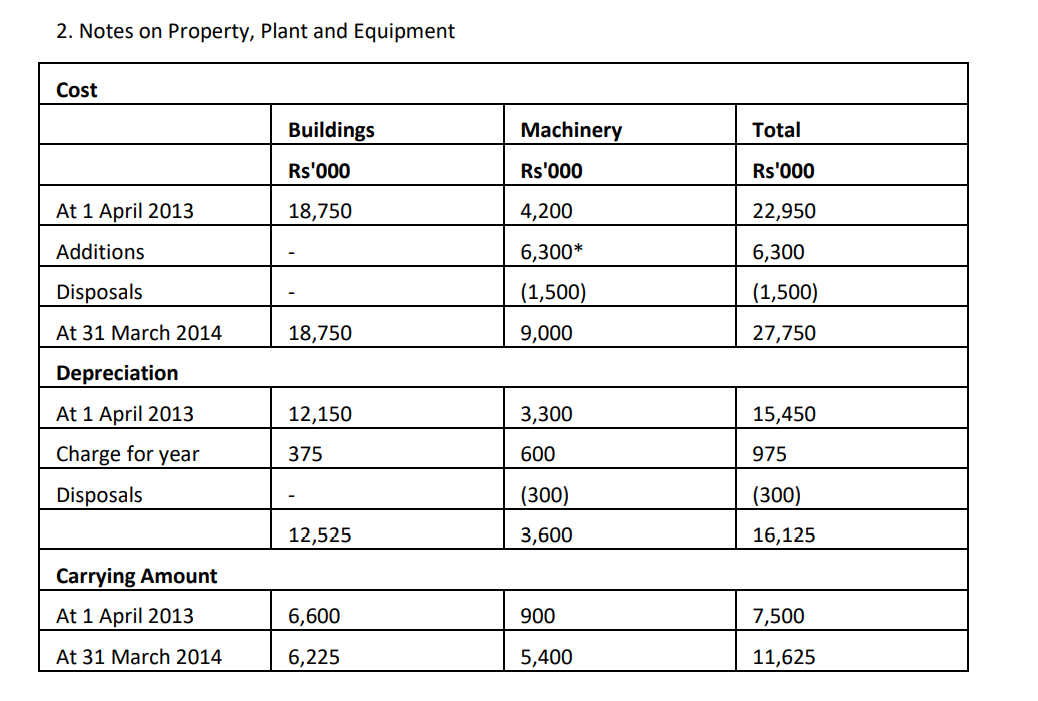

*Inclusive of Rs2,550,000 acquired under finance leases.

3. An item of machinery was sold during the year ended 31 March 2014 for Rs1,500,000.

Required:

(1) Prepare the consolidated statement of cash flows for the year ended 31 March 2014. (30 marks)

(2) Analyse the consolidated statement of cash flows in (1), highlighting the key features of each category of cash flows. (5 marks)

Income statement for the year ended 31 March 2014 Rs'000 Sales 10,000 Cost of sales (3,000) 7,000 Gross profit Other income (income from long term investments) 600 (1,000) (1,545) (450) 1,050 Selling and distribution expenses Administration expenses Finance cost Share of profits from associates net of tax Profit before tax Income tax expense Profit for year Attributable to Minority interest Attributable to owners of the parent 5,655 (1,620) 4,035 300 3,735 Consolidated statement of financial position as at 31 March 2014 ASSETS 2014 2013 Non-current assets Rs'000 Rs'000 Property, plant and 11,625 7,500 equipment Goodwill 300 Investment in associates 3,300 3,000 Other investments 1,230 1,230 Total non-current assets 16,455 11,730 Current assets Inventories 5,925 3,000 Trade receivables 5,550 3,825 Cash at bank and in hand 13,545 5,460 Total current assets 25,020 12,285 Total assets 41,475 24,015 EQUITY AND LIABILITIES Equity attributable to owners of the Parent Issued share capital (Rs25) 11,820 6,000 Share premium 8,649 6,285 Retained profit 10,335 7,500 30,804 19,785 Non controlling interest 345 Total equity 31,149 19,785 Non-current liabilities Loans 4,380 1,500 Finance lease obligations 2,130 510 Total non-current liabilities 6,510 2,010 Current liabilities Trade payables 1,500 840 Finance lease obligations 720 600 Taxation payable 1,476 690 Accrued interest and finance 120 90 charges Total current liabilities 3,816 2,220 Total equity and liabilities 41,475 24,015 Notes to the accounts: 1. The consideration relating to the 75% interest acquired in Garden Furniture Ltd was settled by an issue of 10,560 shares in Topwood deemed to be worth Rs 825,000 with the balance paid in cash. Rs'000 Fair value of net assets acquired PPE (Machinery) 495 Stocks 96 Trade debtors 84 Cash in hand 336 Trade creditors (204) Income tax (51) 756 Minority Interest (189) 567 Goodwill 300 Cost of investment 867 2. Notes on Property, plant and Equipment Cost Buildings Machinery Total Rs'000 Rs'000 Rs'000 At 1 April 2013 18,750 4,200 22,950 Additions 6,300* 6,300 Disposals (1,500) (1,500) At 31 March 2014 18,750 9,000 27,750 Depreciation At 1 April 2013 12,150 3,300 15,450 Charge for year 375 600 975 Disposals (300) (300) 12,525 3,600 16,125 Carrying Amount At 1 April 2013 6,600 900 7,500 At 31 March 2014 6,225 5,400 11,625Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started