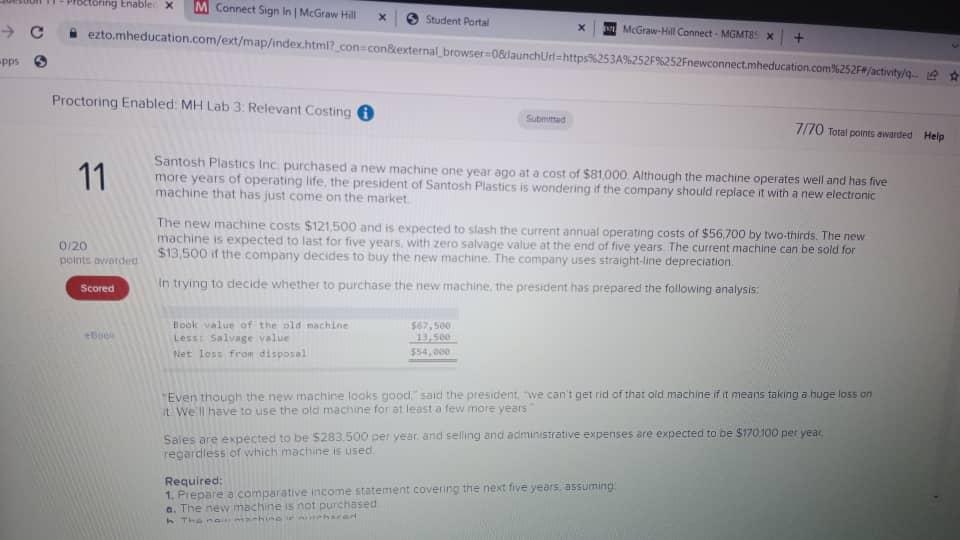

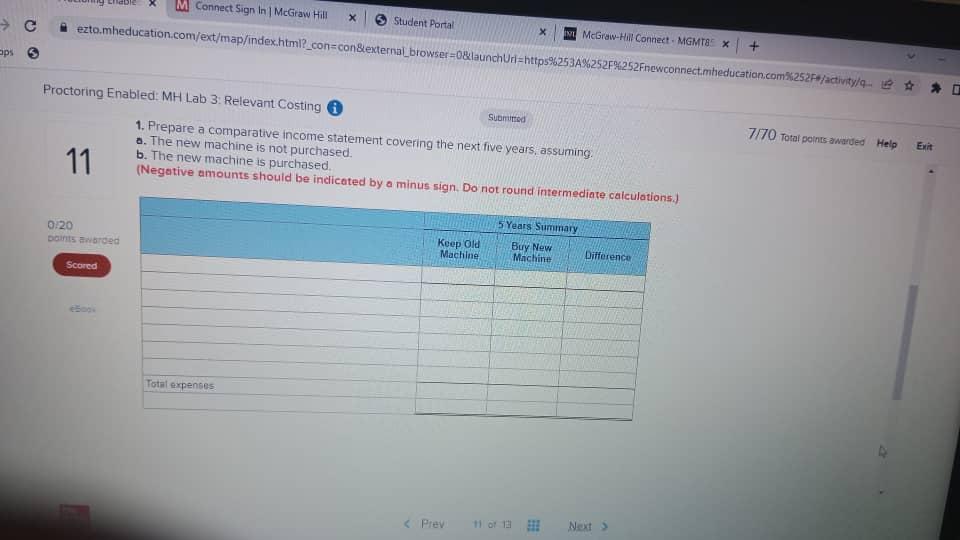

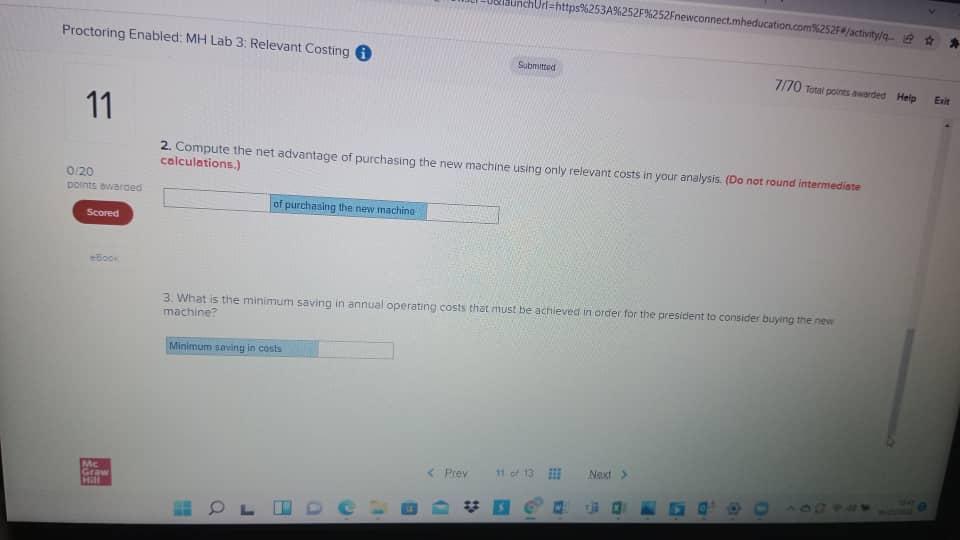

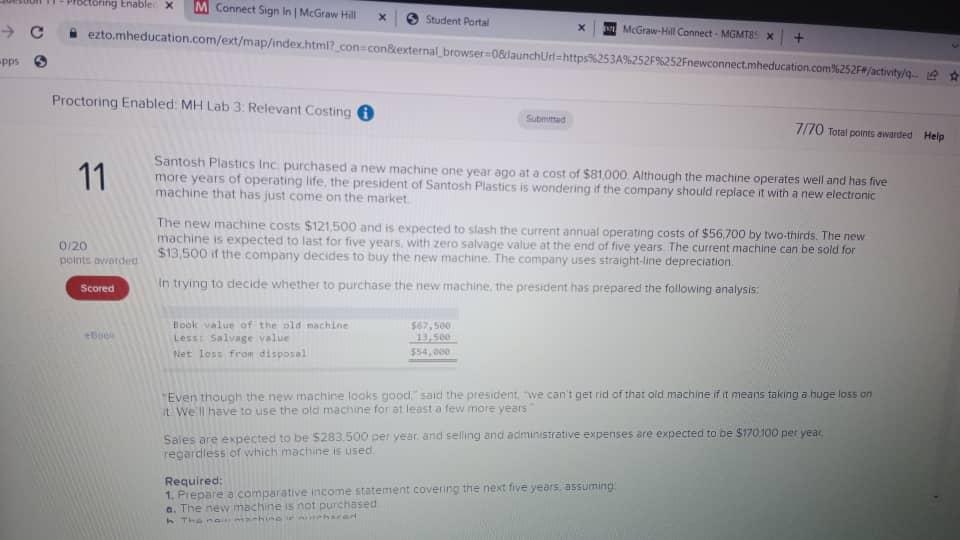

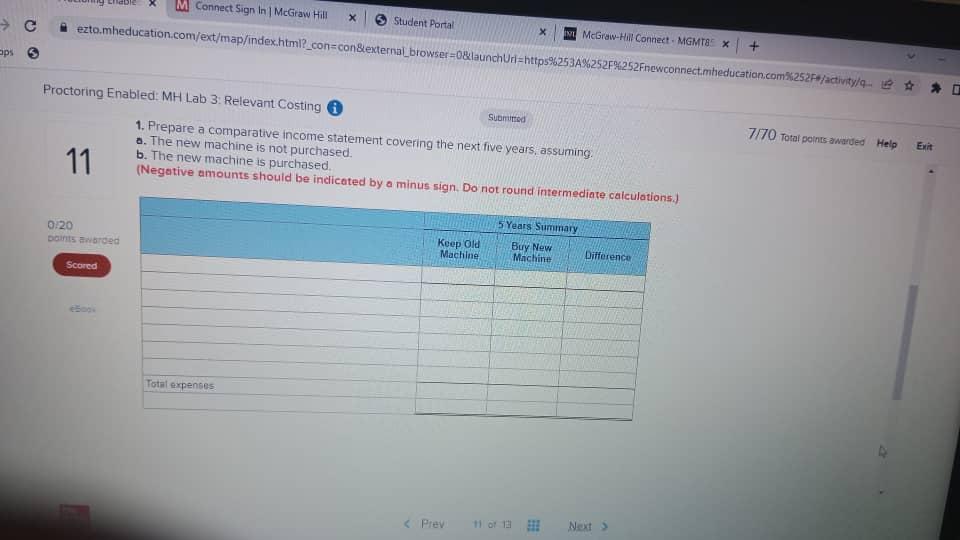

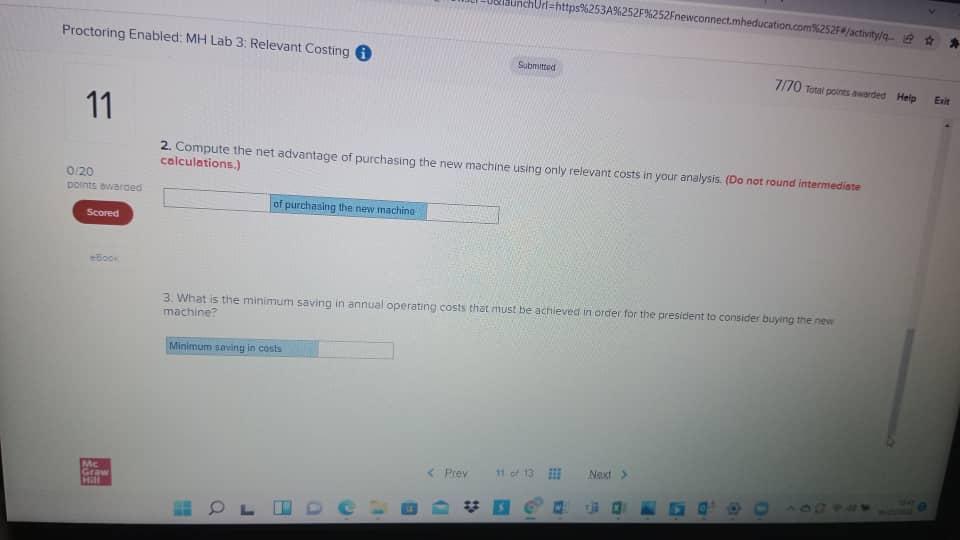

toring Enable X M Connect Sign In McGraw Hill Student Portal ezto.mheducation.com/ext/map/index.html?_con=conexternal browset launchin=http%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/9 McGraw-Hill Connect - MGMTES X .pps Proctoring Enabled MH Lab 3: Relevant Costing Subad 7/70 Total points awarded Help 11 Santosh Plastics Inc purchased a new machine one year ago at a cost of $81000 Although the machine operates well and has five more years of operating life, the president of Santosh Plastics is wondering if the company should replace it with a new electronic machine that has just come on the market The new machine costs $121,500 and is expected to slash the current annual operating costs of $56,700 by two-thirds. The new machine is expected to last for five years with zero salvage value at the end of five years. The current machine can be sold for $13,500 if the company decides to buy the new machine. The company uses straight-line depreciation in trying to decide whether to purchase the new machine, the president has prepared the following analysis: 0/20 Doints awarded Scored 500 HOK value of the old machine Less Salvage value Het loss from disposal 567,500 13,500 554.00 Even though the new machine looks good" said the president, we can't get rid of that old machine if it means taking a huge loss on it well have to use the old machine for at least a few more years Sales are expected to be 5283.500 per year and selling and admunistrative expenses are expected to be $170.100 per year regardless of which machine is used Required: 1. Prepare a comparative income statement covering the next five years, assuming a. The new machine is not purchased Thana-huna M Connect Sign In | McGraw Hill Student Portal ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.meducation.com 252F%/activity/9.. IN McGraw-Hill Connect - MGMT X + aps Sund Proctoring Enabled: MH Lab 3: Relevant Costing 1. Prepare a comparative income statement covering the next five years, assuming. a. The new machine is not purchased b. The new machine is purchased, (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.) 7/70 Total points awarded Help Exit 11 0:20 Dit worde Keep Ola Machine 5 Years Summary Buy New Difference Machine Scored Total expenses dl=https%253A%252F%252Fnewconnect.mheducation.com%252F*/activity Proctoring Enabled: MH Lab 3: Relevant Costing Submitted 7/70 Total points awarded Help Exit 11 2. Compute the net advantage of purchasing the new machine using only relevant costs in your analysis. (Do not round intermediate calculations.) 0/20 Doints warded of purchasing the new machina Scored 600 3. What is the minimum saving in annual operating costs that must be achieved in order for the president to consider buying the new machine? Minimum seving in costs MC GE o L **