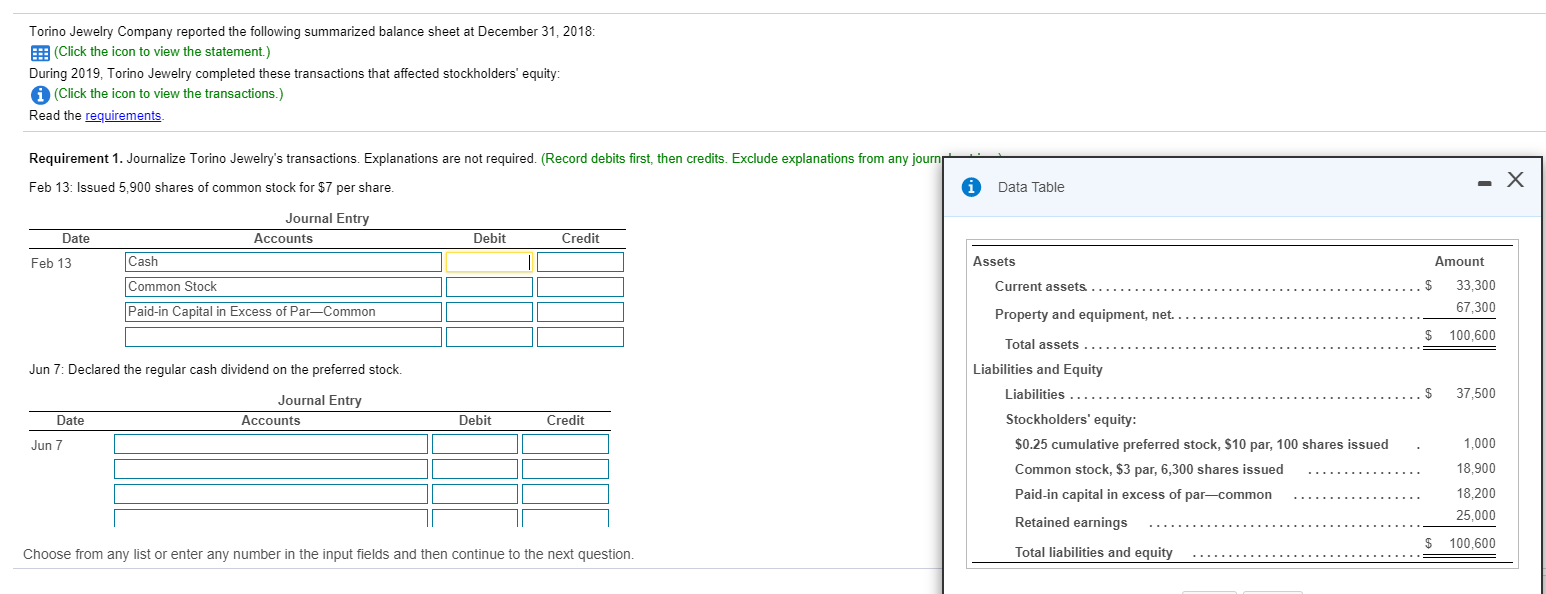

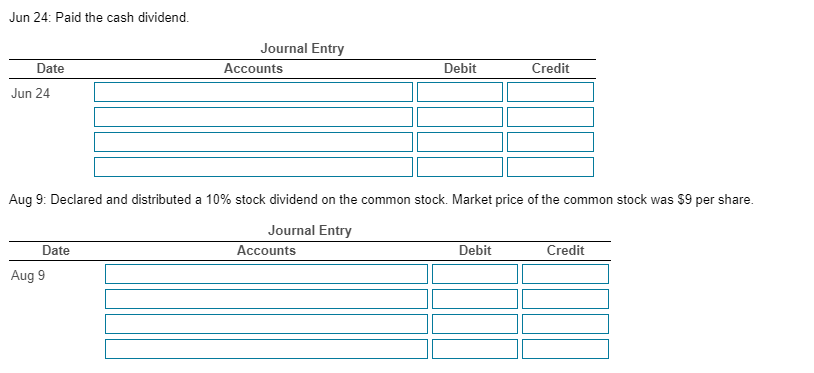

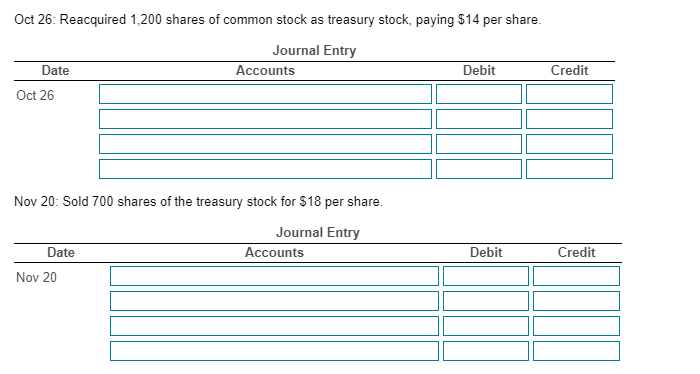

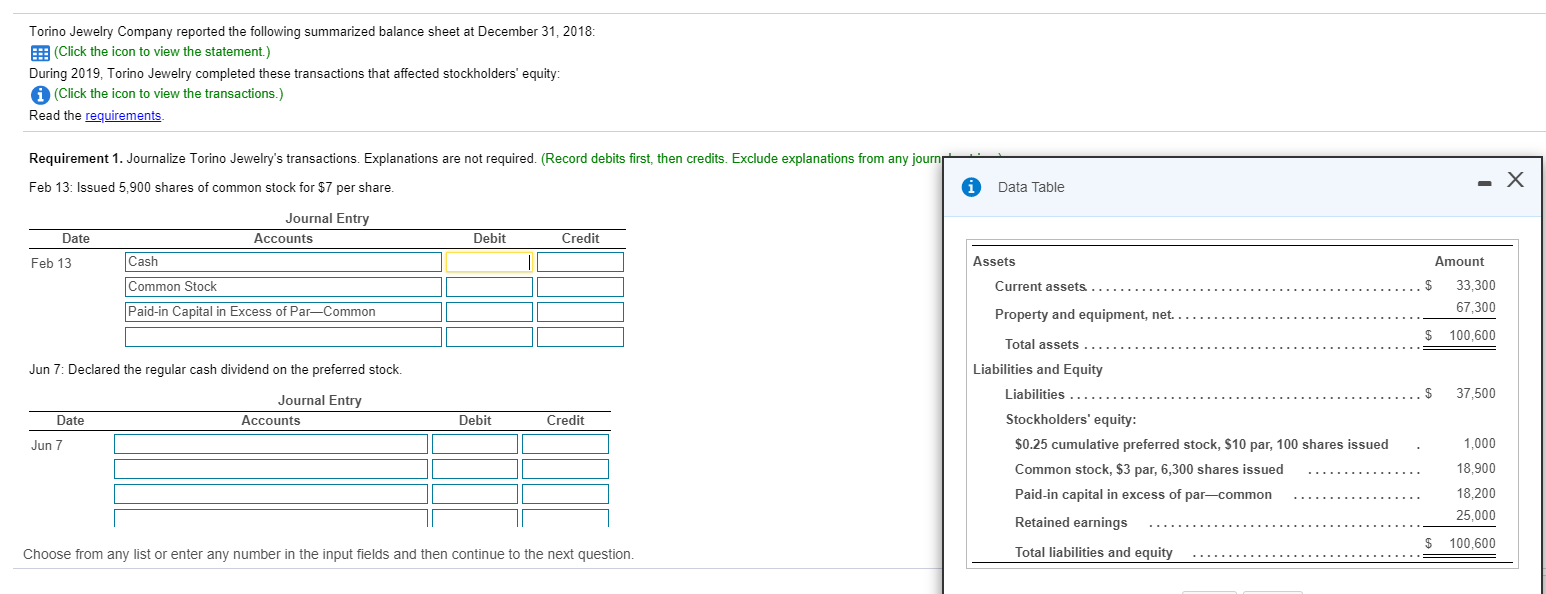

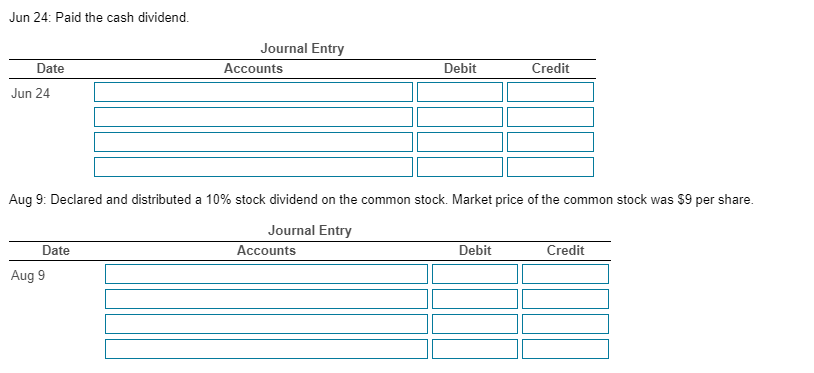

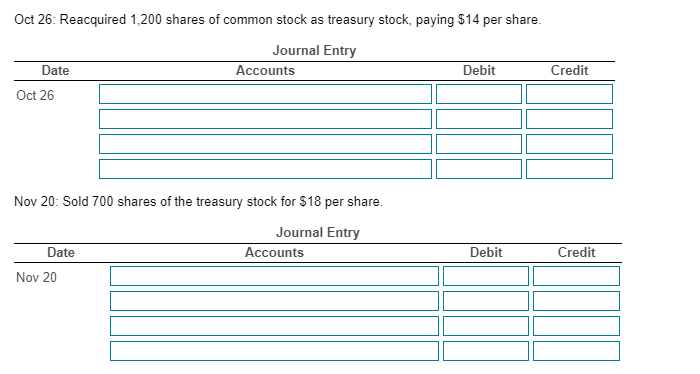

Torino Jewelry Company reported the following summarized balance sheet at December 31, 2018: E (Click the icon to view the statement.) During 2019, Torino Jewelry completed these transactions that affected stockholders' equity: (Click the icon to view the transactions.) Read the requirements Requirement 1. Journalize Torino Jewelry's transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from any journ Feb 13: Issued 5,900 shares of common stock for $7 per share. - X Data Table Journal Entry Accounts Date Debit Credit Feb 13 Cash Assets Common Stock Current assets.. Amount 33,300 67,300 Paid-in Capital in Excess of ParCommon Property and equipment, net.. $ 100,600 Jun 7: Declared the regular cash dividend on the preferred stock. 37,500 Journal Entry Accounts Date Debit Credit Jun 7 Total assets Liabilities and Equity Liabilities ... Stockholders' equity: $0.25 cumulative preferred stock, $10 par, 100 shares issued Common stock, $3 par, 6,300 shares issued Paid-in capital in excess of par-common Retained earnings Total liabilities and equity 1,000 18,900 18,200 25,000 100.600 Choose from any list or enter any number in the input fields and then continue to the next question. Jun 24: Paid the cash dividend. Journal Entry Accounts Debit Credit Date Jun 24 Aug 9: Declared and distributed a 10% stock dividend on the common stock Market price of the common stock was $9 per share. Journal Entry Accounts Debit Credit Date Aug 9 Oct 26: Reacquired 1,200 shares of common stock as treasury stock, paying $14 per share. Journal Entry Accounts Date Debit Credit Oct 26 Nov 20: Sold 700 shares of the treasury stock for $18 per share. Journal Entry Accounts Debit Credit Date Nov 20 Dec 31: Declared a cash dividend of $0.30 per share on the outstanding common stock, dividends will be paid in January, 2020. (Round your answer to the nearest whole dollar.) Journal Entry Accounts Date Debit Credit Dec 31 Requirement 2. Report the company's stockholders' equity at December 31, 2019. Net income for 2019 was $31,000. (Enter the accounts in the proper order for the stockholders' equity section of the balance sheet.) Torino Jewelry Company Balance Sheet (partial) December 31, 2019 Stockholders' Equity $ $ par shares $ par shares shares Total paid-in capital shares Total stockholders' equity i Data Table Amount $ 33,300 67,300 $ 100,600 $ 37,500 Assets Current assets.. Property and equipment, net. Total assets... Liabilities and Equity Liabilities....... Stockholders' equity: $0.25 cumulative preferred stock, $10 par, 100 shares issued Common stock, $3 par, 6,300 shares issued Paid-in capital in excess of par-common. Retained earnings ..... Total liabilities and equity. 1,000 18,900 18,200 25,000 $ 100,600 Print Done