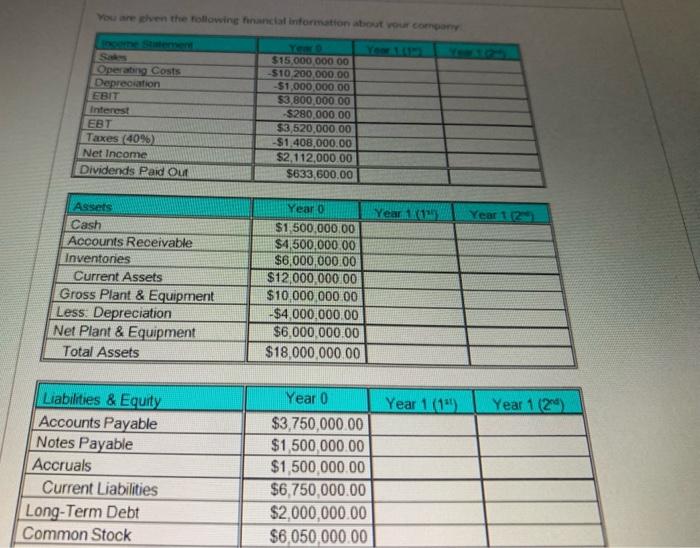

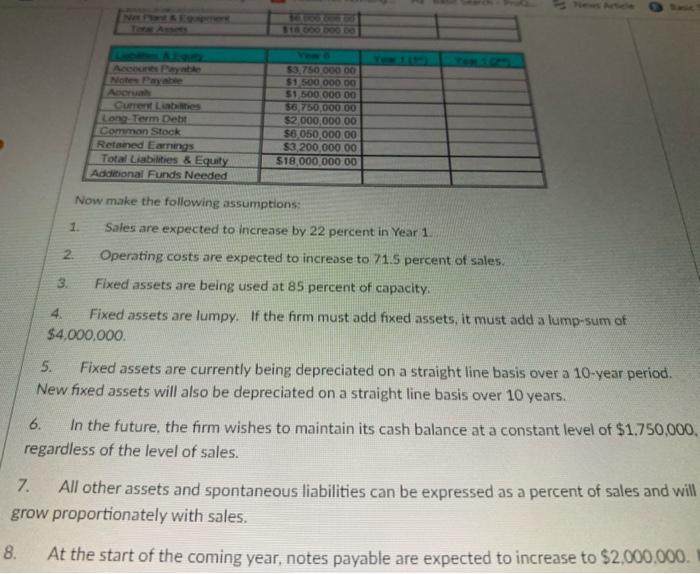

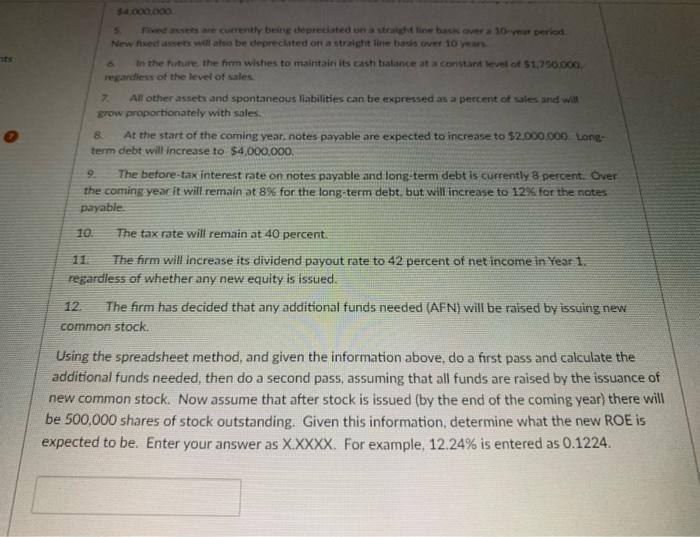

Tos ikre dhen the following fonaneial intarination atsont pon corngarre Now make the following assumptions: 1. Sales are expected to increase by 22 percent in Year 1 2. Operating costs are expected to increase to 71.5 percent of sales. 3. Fixed assets are being used at 85 percent of capacity. 4. Fixed assets are lumpy. If the firm must add fixed assets, it must add a lump-sum of $4,000,000 5. Fixed assets are currently being depreciated on a straight line basis over a 10 -year period. New fixed assets will also be depreciated on a straight line basis over 10 years. 6. In the future, the firm wishes to maintain its cash balance at a constant level of $1.750,000 regardless of the level of sales. 7. All other assets and spontaneous liabilities can be expressed as a percent of sales and will grow proportionately with sales. At the start of the coming year, notes payable are expected to increase to $2,000,000. New hxed assets will aloo be deprecisted on a straight line bash over 10 years 6. In the futire, the firm wisties to maintain its cash balance at a constant level of 51.250 .000 regardiess of the level of sales: 7. An other assets and spontaneous liabilities can be expressed as a percent of sales and win row proportionately with sales. 8. At the start of the coming year, notes payable are expected to increase to $2,000,000 Long term debt will increase to $4.000.000 9. The before-tax interest rate on notes payable and long-term debt is currently B percent. Over the comingyear it will remain at 8% for the long-term debt, but will increase to 12% for the notes paryable. 10. The tax rate will remain at 40 percent. 11. The firm will increase its dividend payout rate to 42 percent of net income in fear 1 . regardless of whether any new equity is issued. 12. The firm has decided that any additional funds needed (AF N ) will be raised by issuing new common stock. Using the spreadsheet method, and given the information above, do a first pass and calculate the additional funds needed, then do a second pass, assuming that all funds are raised by the issuance of new common stock. Now assume that after stock is issued (by the end of the coming year) there will be 500,000 shares of stock outstanding. Given this information, determine what the new ROE is expected to be. Enter your answer as X.XXXX. For example, 12.24% is entered as 0.1224. Tos ikre dhen the following fonaneial intarination atsont pon corngarre Now make the following assumptions: 1. Sales are expected to increase by 22 percent in Year 1 2. Operating costs are expected to increase to 71.5 percent of sales. 3. Fixed assets are being used at 85 percent of capacity. 4. Fixed assets are lumpy. If the firm must add fixed assets, it must add a lump-sum of $4,000,000 5. Fixed assets are currently being depreciated on a straight line basis over a 10 -year period. New fixed assets will also be depreciated on a straight line basis over 10 years. 6. In the future, the firm wishes to maintain its cash balance at a constant level of $1.750,000 regardless of the level of sales. 7. All other assets and spontaneous liabilities can be expressed as a percent of sales and will grow proportionately with sales. At the start of the coming year, notes payable are expected to increase to $2,000,000. New hxed assets will aloo be deprecisted on a straight line bash over 10 years 6. In the futire, the firm wisties to maintain its cash balance at a constant level of 51.250 .000 regardiess of the level of sales: 7. An other assets and spontaneous liabilities can be expressed as a percent of sales and win row proportionately with sales. 8. At the start of the coming year, notes payable are expected to increase to $2,000,000 Long term debt will increase to $4.000.000 9. The before-tax interest rate on notes payable and long-term debt is currently B percent. Over the comingyear it will remain at 8% for the long-term debt, but will increase to 12% for the notes paryable. 10. The tax rate will remain at 40 percent. 11. The firm will increase its dividend payout rate to 42 percent of net income in fear 1 . regardless of whether any new equity is issued. 12. The firm has decided that any additional funds needed (AF N ) will be raised by issuing new common stock. Using the spreadsheet method, and given the information above, do a first pass and calculate the additional funds needed, then do a second pass, assuming that all funds are raised by the issuance of new common stock. Now assume that after stock is issued (by the end of the coming year) there will be 500,000 shares of stock outstanding. Given this information, determine what the new ROE is expected to be. Enter your answer as X.XXXX. For example, 12.24% is entered as 0.1224