Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Total cash collections in February, RM369,000 Total purchases in March, RM325,000 Total cash payments in January, RM180,200 Net income, RM611,000 PR 9-8 Statement of Profit

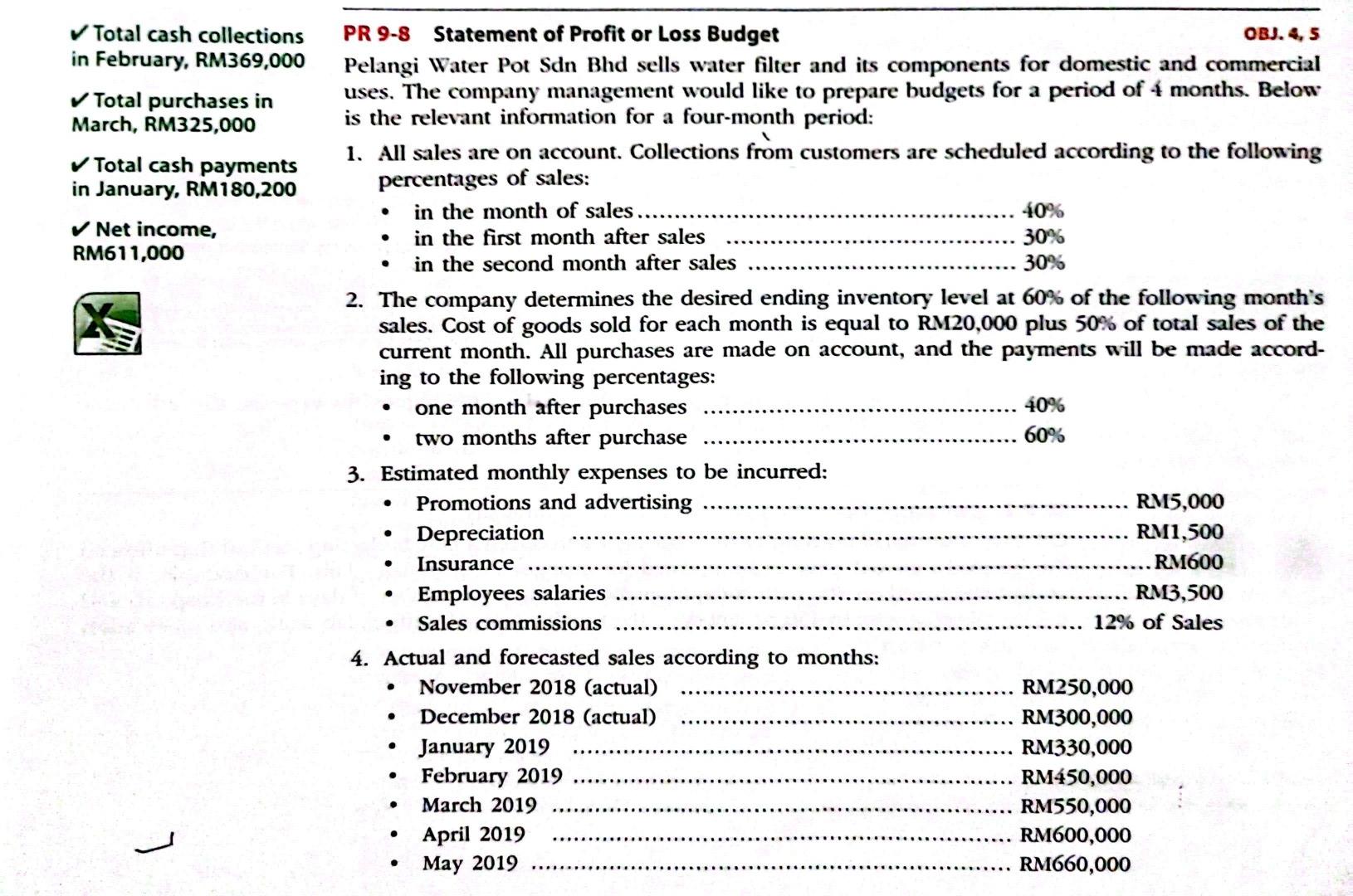

Total cash collections in February, RM369,000 Total purchases in March, RM325,000 Total cash payments in January, RM180,200 Net income, RM611,000 PR 9-8 Statement of Profit or Loss Budget OBJ. 4, 5 Pelangi Water Pot Sdn Bhd sells water filter and its components for domestic and commercial uses. The company management would like to prepare budgets for a period of 4 months. Below is the relevant information for a four-month period: 1. All sales are on account. Collections from customers are scheduled according to the following percentages of sales: - in the month of sales 40% - in the first month after sales 30% - in the second month after sales 30% 2. The company determines the desired ending inventory level at 60% of the following month's sales. Cost of goods sold for each month is equal to RM20,000 plus 50% of total sales of the current month. All purchases are made on account, and the payments will be made according to the following percentages: - one month after purchases 40% - two months after purchase 60% Instructions Prepare the followings for the months of January through April, 2019: a. Sales budget b. Schedule of cash collections from customers c. Purchases, ending inventory and cost of goods sold budgets d. Schedule of payments for purchases e. Operating expenses budget f. Statement of Profit or Loss Budget Total cash collections in February, RM369,000 Total purchases in March, RM325,000 Total cash payments in January, RM180,200 Net income, RM611,000 PR 9-8 Statement of Profit or Loss Budget OBJ. 4, 5 Pelangi Water Pot Sdn Bhd sells water filter and its components for domestic and commercial uses. The company management would like to prepare budgets for a period of 4 months. Below is the relevant information for a four-month period: 1. All sales are on account. Collections from customers are scheduled according to the following percentages of sales: - in the month of sales 40% - in the first month after sales 30% - in the second month after sales 30% 2. The company determines the desired ending inventory level at 60% of the following month's sales. Cost of goods sold for each month is equal to RM20,000 plus 50% of total sales of the current month. All purchases are made on account, and the payments will be made according to the following percentages: - one month after purchases 40% - two months after purchase 60% Instructions Prepare the followings for the months of January through April, 2019: a. Sales budget b. Schedule of cash collections from customers c. Purchases, ending inventory and cost of goods sold budgets d. Schedule of payments for purchases e. Operating expenses budget f. Statement of Profit or Loss Budget

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started