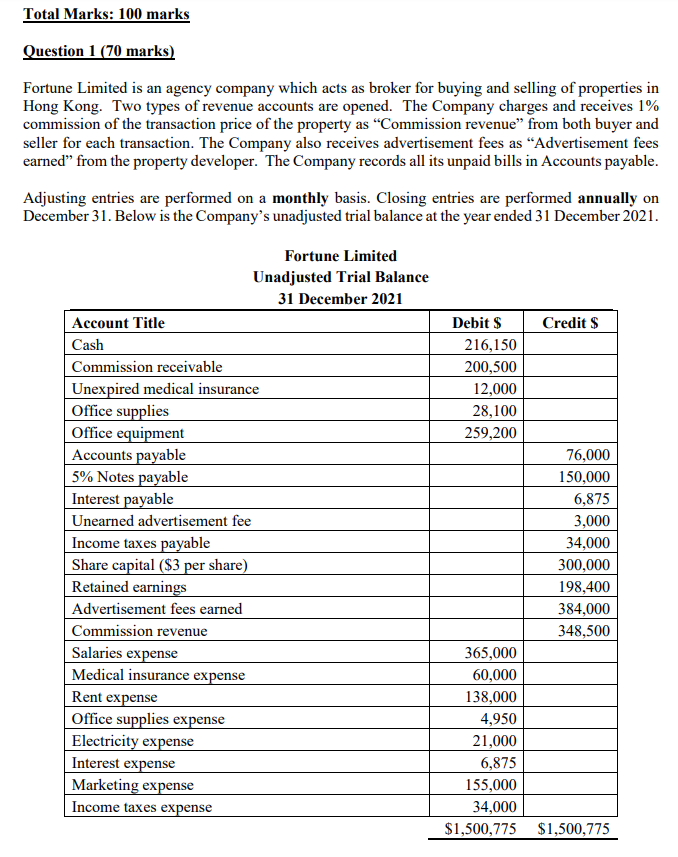

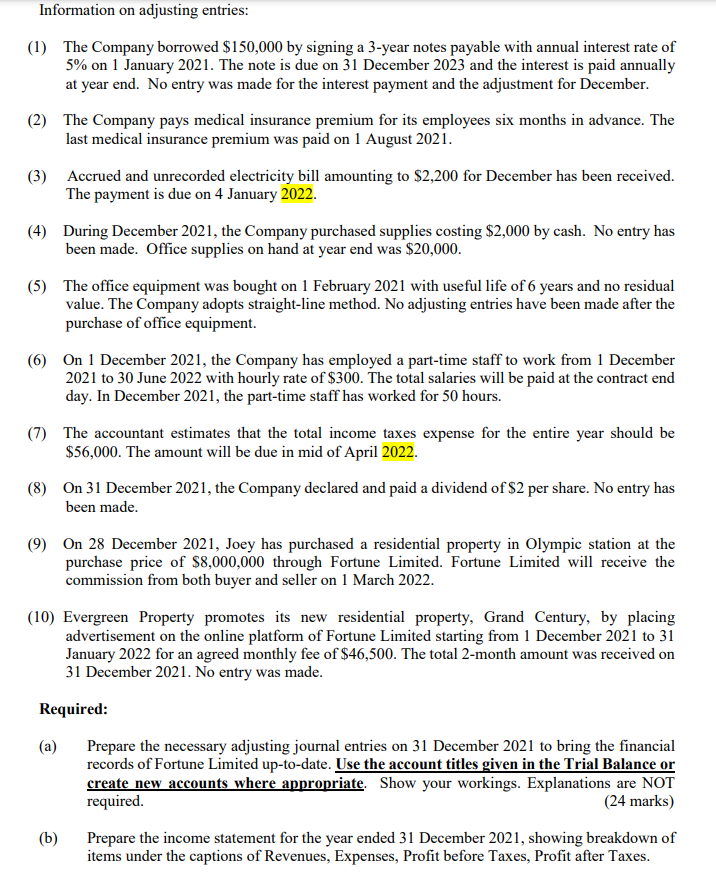

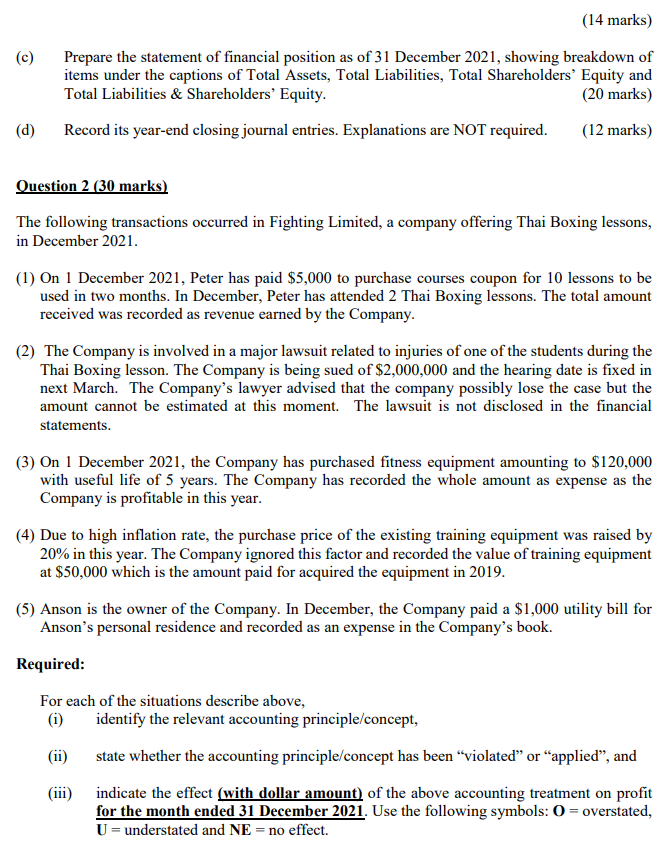

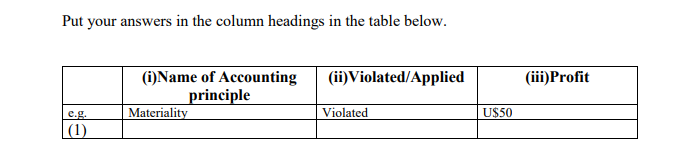

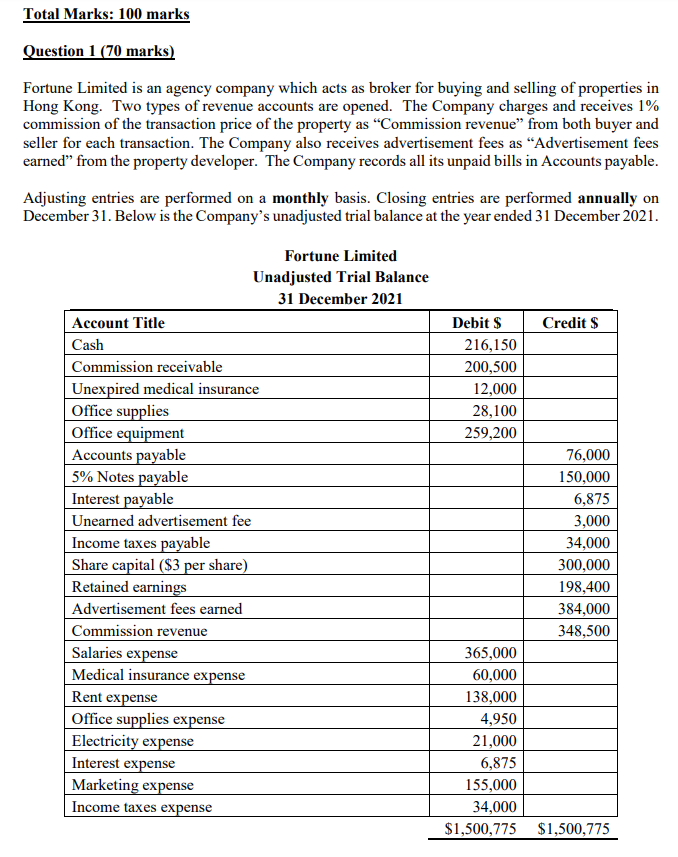

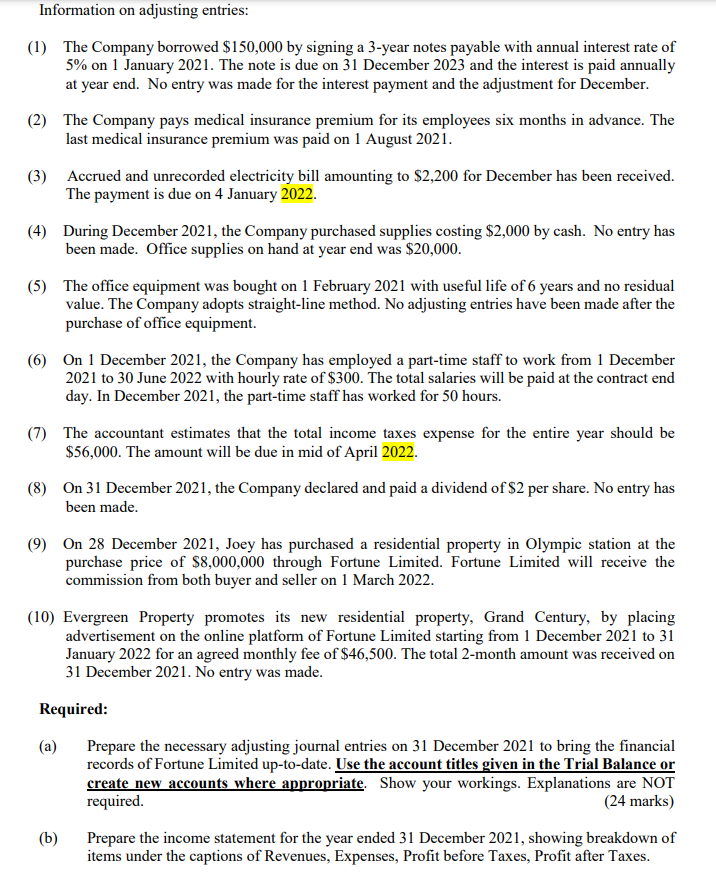

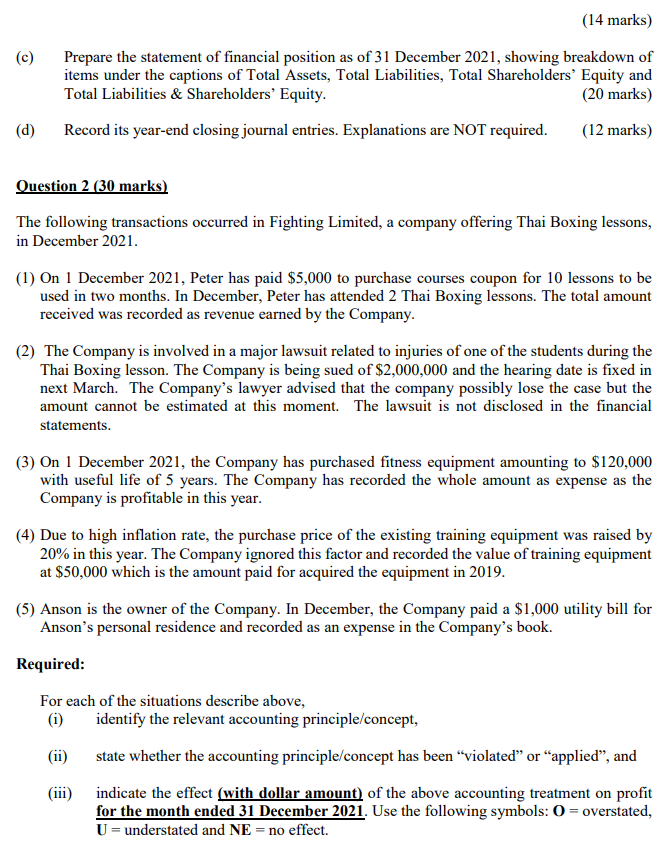

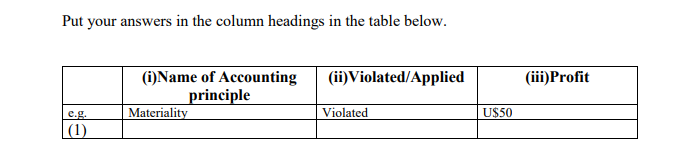

Total Marks: 100 marks Question 1 (70 marks) Fortune Limited is an agency company which acts as broker for buying and selling of properties in Hong Kong. Two types of revenue accounts are opened. The Company charges and receives 1% commission of the transaction price of the property as Commission revenue from both buyer and seller for each transaction. The Company also receives advertisement fees as Advertisement fees earned from the property developer. The Company records all its unpaid bills in Accounts payable. Adjusting entries are performed on a monthly basis. Closing entries are performed annually on December 31. Below is the Company's unadjusted trial balance at the year ended 31 December 2021. Credit $ Debit $ 216,150 200,500 12,000 28,100 259,200 Fortune Limited Unadjusted Trial Balance 31 December 2021 Account Title Cash Commission receivable Unexpired medical insurance Office supplies Office equipment Accounts payable 5% Notes payable Interest payable Unearned advertisement fee Income taxes payable Share capital ($3 per share) Retained earnings Advertisement fees earned Commission revenue Salaries expense Medical insurance expense Rent expense Office supplies expense Electricity expense Interest expense Marketing expense Income taxes expense 76,000 150,000 6,875 3,000 34,000 300,000 198,400 384,000 348,500 365,000 60,000 138,000 4,950 21,000 6,875 155,000 34,000 $1,500,775 $1,500,775 Information on adjusting entries: (1) The Company borrowed $150,000 by signing a 3-year notes payable with annual interest rate of 5% on 1 January 2021. The note is due on 31 December 2023 and the interest is paid annually at year end. No entry was made for the interest payment and the adjustment for December. (2) The Company pays medical insurance premium for its employees six months in advance. The last medical insurance premium was paid on 1 August 2021. (3) Accrued and unrecorded electricity bill amounting to $2,200 for December has been received. The payment is due on 4 January 2022. (4) During December 2021, the Company purchased supplies costing $2,000 by cash. No entry has been made. Office supplies on hand at year end was $20,000. (5) The office equipment was bought on 1 February 2021 with useful life of 6 years and no residual value. The Company adopts straight-line method. No adjusting entries have been made after the purchase of office equipment. (6) On 1 December 2021, the Company has employed a part-time staff to work from 1 December 2021 to 30 June 2022 with hourly rate of $300. The total salaries will be paid at the contract end day. In December 2021, the part-time staff has worked for 50 hours. (7) The accountant estimates that the total income taxes expense for the entire year should be $56,000. The amount will be due in mid of April 2022. (8) On 31 December 2021, the Company declared and paid a dividend of $2 per share. No entry has been made. (9) On 28 December 2021, Joey has purchased a residential property in Olympic station at the purchase price of $8,000,000 through Fortune Limited. Fortune Limited will receive the commission from both buyer and seller on 1 March 2022. (10) Evergreen Property promotes its new residential property, Grand Century, by placing advertisement on the online platform of Fortune Limited starting from 1 December 2021 to 31 January 2022 for an agreed monthly fee of $46,500. The total 2-month amount was received on 31 December 2021. No entry was made. Required: (a) Prepare the necessary adjusting journal entries on 31 December 2021 to bring the financial records of Fortune Limited up-to-date. Use the account titles given in the Trial Balance or create new accounts where appropriate. Show your workings. Explanations are NOT required. (24 marks) Prepare the income statement for the year ended 31 December 2021, showing breakdown of items under the captions of Revenues, Expenses, Profit before Taxes, Profit after Taxes. (b) (c) (14 marks) Prepare the statement of financial position as of 31 December 2021, showing breakdown of items under the captions of Total Assets, Total Liabilities, Total Shareholders' Equity and Total Liabilities & Shareholders' Equity. (20 marks) Record its year-end closing journal entries. Explanations are NOT required. (12 marks) (d) Question 2 (30 marks) The following transactions occurred in Fighting Limited, a company offering Thai Boxing lessons, in December 2021. (1) On 1 December 2021, Peter has paid $5,000 to purchase courses coupon for 10 lessons to be used in two months. In December, Peter has attended 2 Thai Boxing lessons. The total amount received was recorded as revenue earned by the Company. (2) The Company is involved in a major lawsuit related to injuries of one of the students during the Thai Boxing lesson. The Company is being sued of $2,000,000 and the hearing date is fixed in next March. The Company's lawyer advised that the company possibly lose the case but the amount cannot be estimated at this moment. The lawsuit is not disclosed in the financial statements. (3) On 1 December 2021, the Company has purchased fitness equipment amounting to $120,000 with useful life of 5 years. The Company has recorded the whole amount as expense as the Company is profitable in this year. (4) Due to high inflation rate, the purchase price of the existing training equipment was raised by 20% in this year. The Company ignored this factor and recorded the value of training equipment at $50,000 which is the amount paid for acquired the equipment in 2019. (5) Anson is the owner of the Company. In December, the Company paid a $1,000 utility bill for Anson's personal residence and recorded as an expense in the Company's book. Required: For each of the situations describe above, (i) identify the relevant accounting principle/concept, (ii) state whether the accounting principle/concept has been "violated or applied, and (iii) indicate the effect (with dollar amount) of the above accounting treatment on profit for the month ended 31 December 2021. Use the following symbols: 0 = overstated, U= understated and NE = no effect. Put your answers in the column headings in the table below. (ii)Violated/Applied (iii)Profit (i)Name of Accounting principle Materiality Violated U$50 e.g. (1)