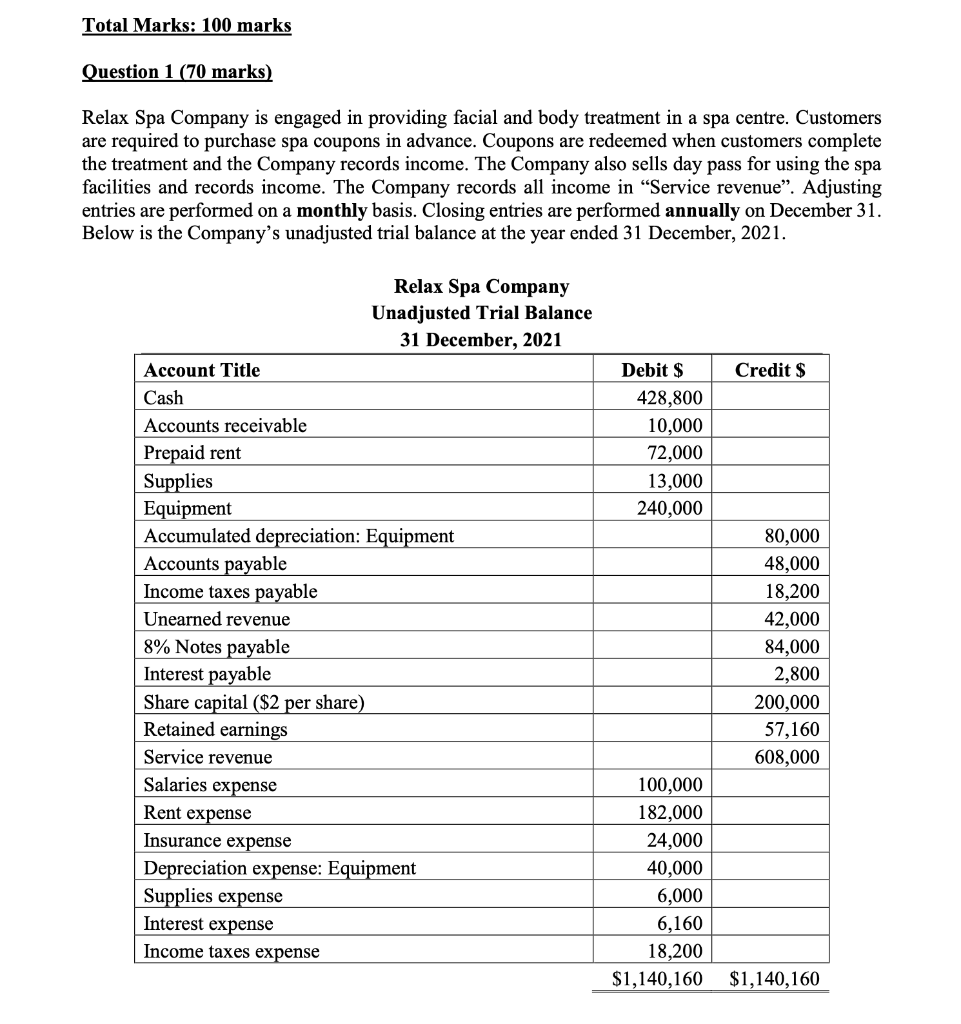

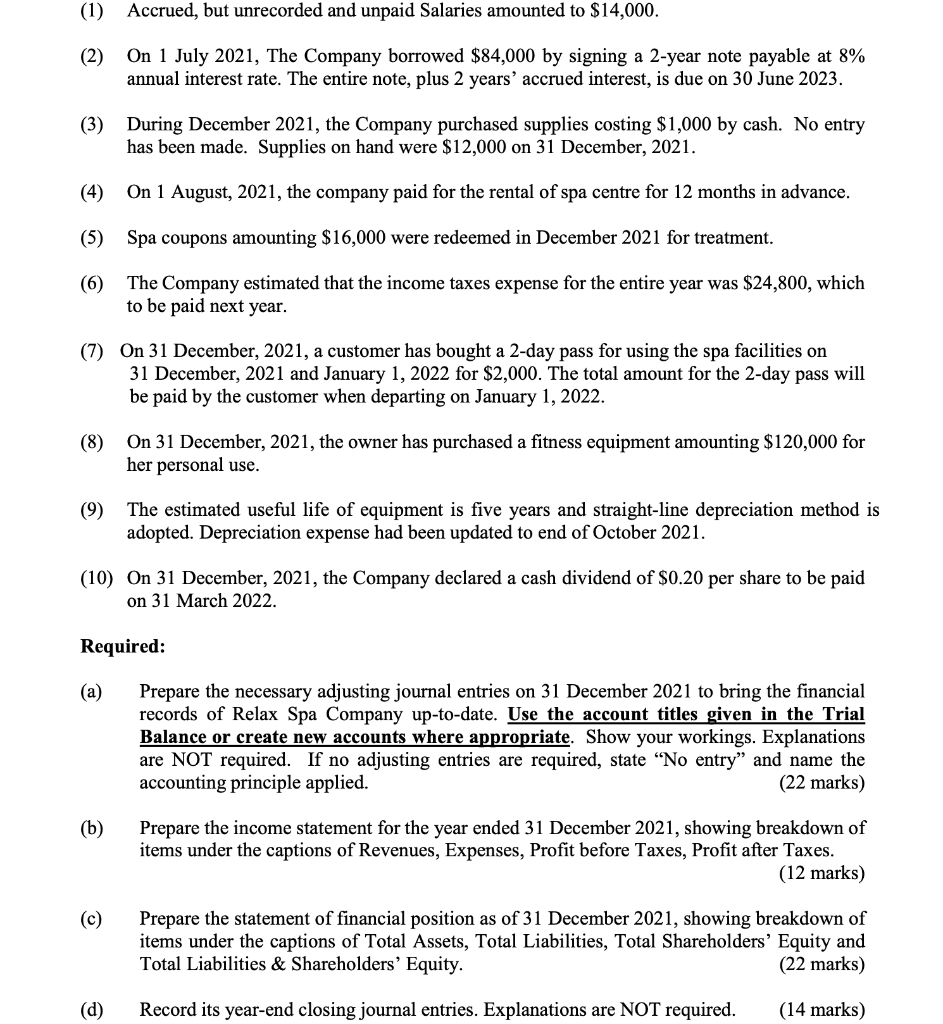

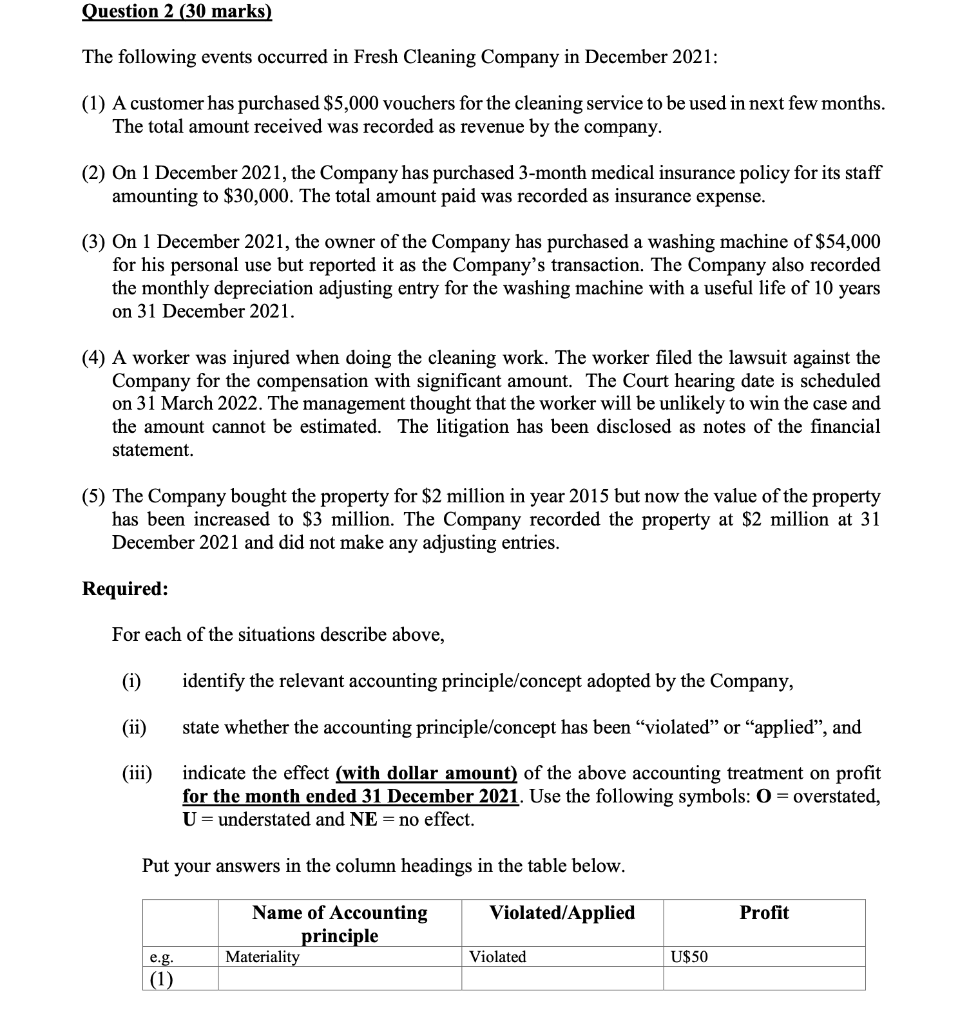

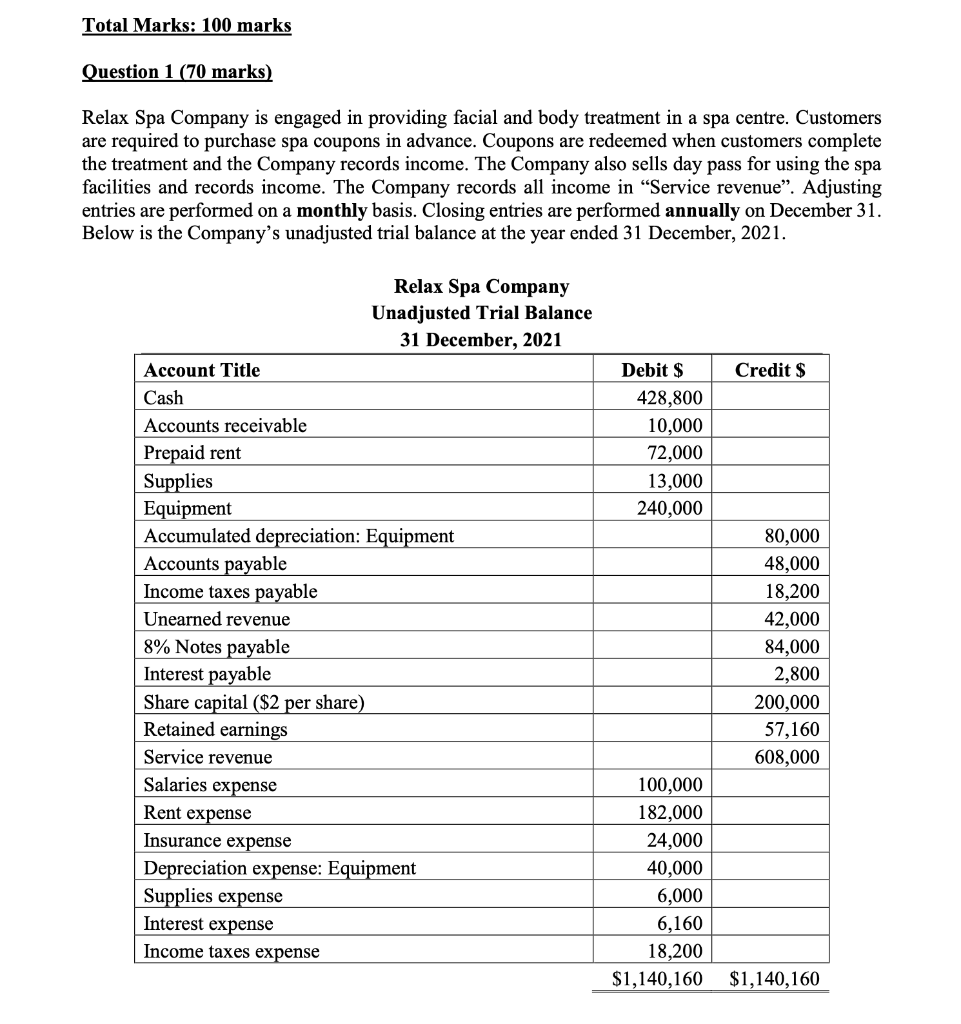

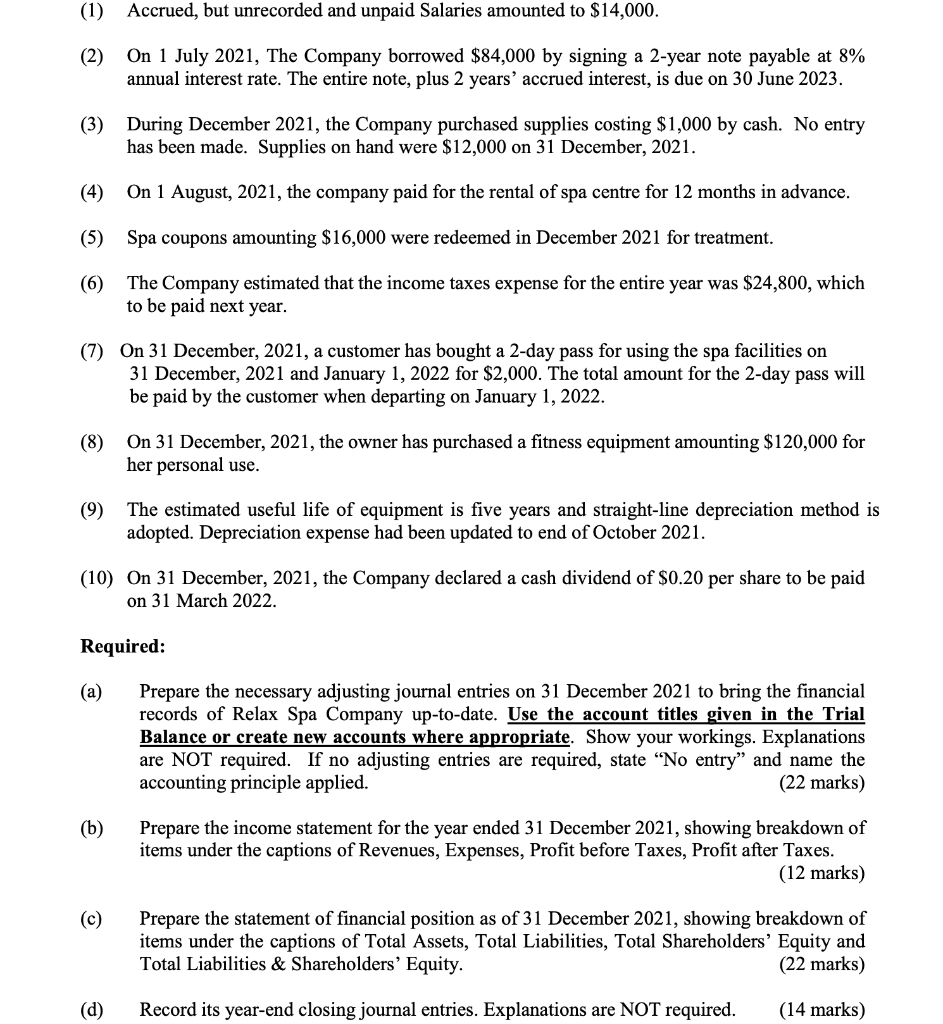

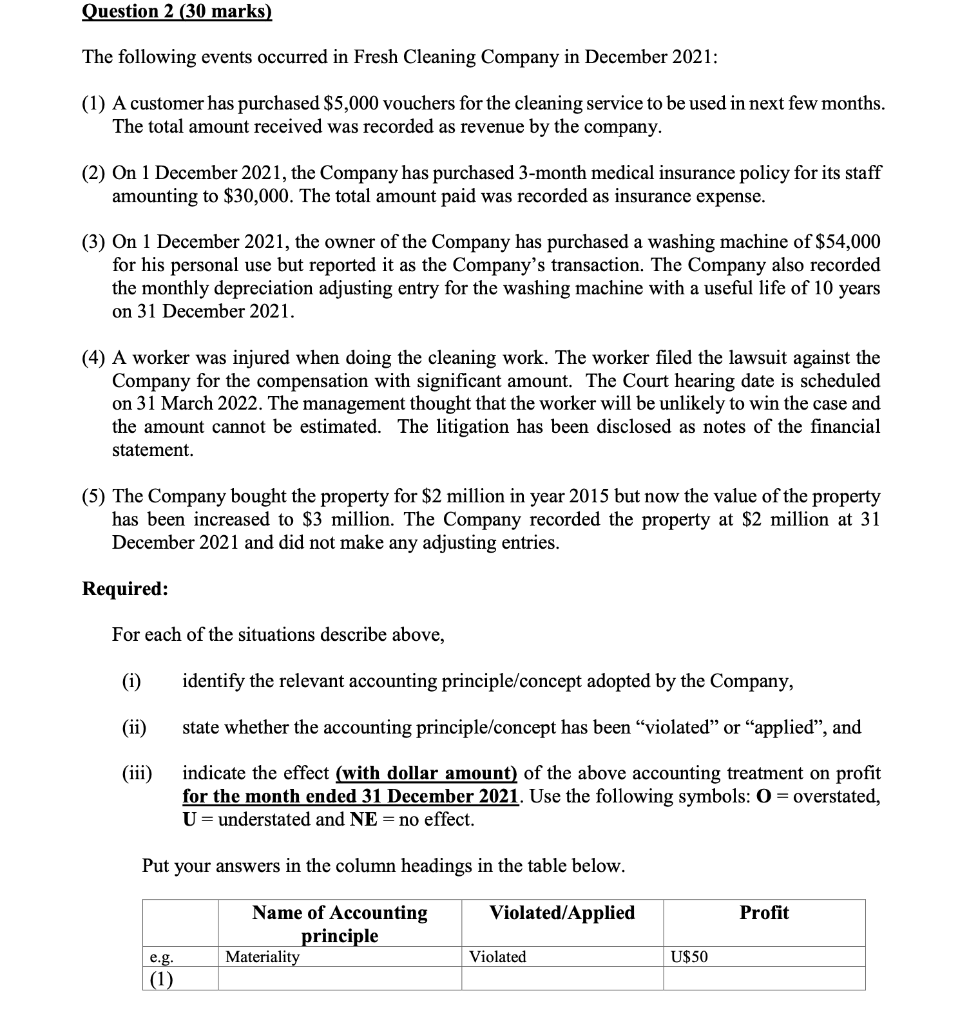

Total Marks: 100 marks Question 1 (70 marks) Relax Spa Company is engaged in providing facial and body treatment in a spa centre. Customers are required to purchase spa coupons in advance. Coupons are redeemed when customers complete the treatment and the Company records income. The Company also sells day pass for using the spa facilities and records income. The Company records all income in Service revenue. Adjusting entries are performed on a monthly basis. Closing entries are performed annually on December 31. Below is the Company's unadjusted trial balance at the year ended 31 December, 2021. Credit $ Debit $ 428,800 10,000 72,000 13,000 240,000 Relax Spa Company Unadjusted Trial Balance 31 December, 2021 Account Title Cash Accounts receivable Prepaid rent Supplies Equipment Accumulated depreciation: Equipment Accounts payable Income taxes payable Unearned revenue 8% Notes payable Interest payable Share capital ($2 per share) Retained earnings Service revenue Salaries expense Rent expense Insurance expense Depreciation expense: Equipment Supplies expense Interest expense Income taxes expense 80,000 48,000 18,200 42,000 84,000 2,800 200,000 57,160 608,000 100,000 182,000 24,000 40,000 6,000 6,160 18,200 $1,140,160 $1,140,160 = (1) Accrued, but unrecorded and unpaid Salaries amounted to $14,000. (2) On 1 July 2021, The Company borrowed $84,000 by signing a 2-year note payable at 8% annual interest rate. The entire note, plus 2 years' accrued interest, is due on 30 June 2023. (3) During December 2021, the Company purchased supplies costing $1,000 by cash. No entry has been made. Supplies on hand were $12,000 on 31 December, 2021. (4) On 1 August, 2021, the company paid for the rental of spa centre for 12 months in advance. (5) Spa coupons amounting $16,000 were redeemed in December 2021 for treatment. (6) The Company estimated that the income taxes expense for the entire year was $24,800, which to be paid next year. (7) On 31 December, 2021, a customer has bought a 2-day pass for using the spa facilities on 31 December, 2021 and January 1, 2022 for $2,000. The total amount for the 2-day pass will be paid by the customer when departing on January 1, 2022. (8) On 31 December, 2021, the owner has purchased a fitness equipment amounting $120,000 for her personal use. (9) The estimated useful life of equipment is five years and straight-line depreciation method is adopted. Depreciation expense had been updated to end of October 2021. (10) On 31 December, 2021, the Company declared a cash dividend of $0.20 per share to be paid on 31 March 2022. Required: (a) Prepare the necessary adjusting journal entries on 31 December 2021 to bring the financial records of Relax Spa Company up-to-date. Use the account titles given in the Trial Balance or create new accounts where appropriate. Show your workings. Explanations are NOT required. If no adjusting entries are required, state No entry" and name the accounting principle applied. (22 marks) (b) Prepare the income statement for the year ended 31 December 2021, showing breakdown of items under the captions of Revenues, Expenses, Profit before Taxes, Profit after Taxes. (12 marks) (C) Prepare the statement of financial position as of 31 December 2021, showing breakdown of items under the captions of Total Assets, Total Liabilities, Total Shareholders' Equity and Total Liabilities & Shareholders' Equity. (22 marks) (d) Record its year-end closing journal entries. Explanations are NOT required. (14 marks) Question 2 (30 marks) The following events occurred in Fresh Cleaning Company in December 2021: (1) A customer has purchased $5,000 vouchers for the cleaning service to be used in next few months. The total amount received was recorded as revenue by the company. (2) On 1 December 2021, the Company has purchased 3-month medical insurance policy for its staff amounting to $30,000. The total amount paid was recorded as insurance expense. (3) On 1 December 2021, the owner of the Company has purchased a washing machine of $54,000 for his personal use but reported it as the Company's transaction. The Company also recorded the monthly depreciation adjusting entry for the washing machine with a useful life of 10 years on 31 December 2021. (4) A worker was injured when doing the cleaning work. The worker filed the lawsuit against the Company for the compensation with significant amount. The Court hearing date is scheduled on 31 March 2022. The management thought that the worker will be unlikely to win the case and the amount cannot be estimated. The litigation has been disclosed as notes of the financial statement. (5) The Company bought the property for $2 million in year 2015 but now the value of the property has been increased to $3 million. The Company recorded the property at $2 million at 31 December 2021 and did not make any adjusting entries. Required: For each of the situations describe above, (i) identify the relevant accounting principle/concept adopted by the Company, (ii) state whether the accounting principle/concept has been "violated" or "applied, and (iii) indicate the effect (with dollar amount) of the above accounting treatment on profit for the month ended 31 December 2021. Use the following symbols: 0 = overstated, U=understated and NE = no effect. Put your answers in the column headings in the table below. Violated/Applied Profit Name of Accounting principle Materiality Violated U$50 e.g. (1)