Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Total Marks: 100 marks Question 1 Part I (70 marks) Metalla Travel is a tourism company arranging local tours for the staff of corporate

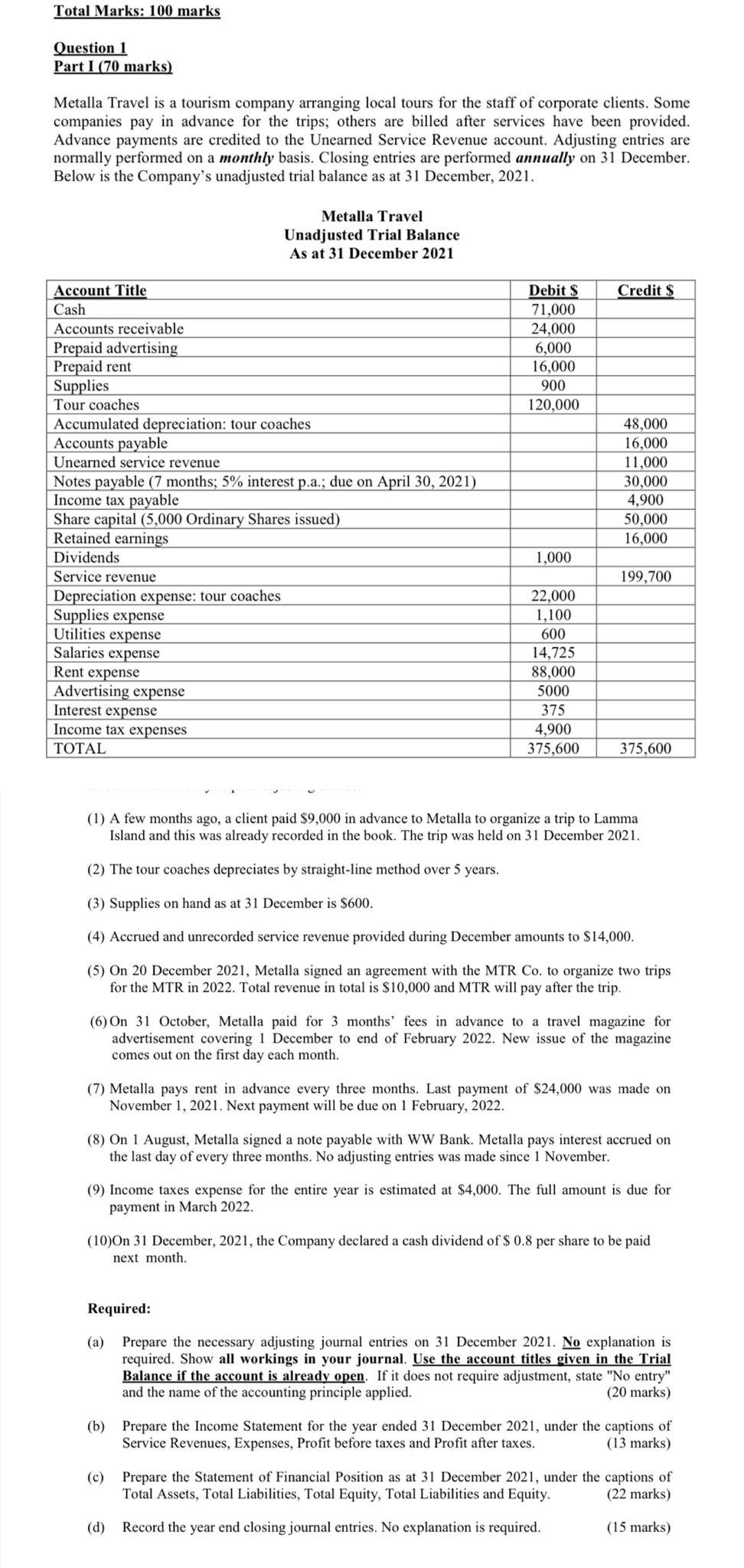

Total Marks: 100 marks Question 1 Part I (70 marks) Metalla Travel is a tourism company arranging local tours for the staff of corporate clients. Some companies pay in advance for the trips; others are billed after services have been provided. Advance payments are credited to the Unearned Service Revenue account. Adjusting entries are normally performed on a monthly basis. Closing entries are performed annually on 31 December. Below is the Company's unadjusted trial balance as at 31 December, 2021. Metalla Travel Unadjusted Trial Balance As at 31 December 2021 Account Title Cash Accounts receivable Prepaid advertising Prepaid rent Supplies Tour coaches Accumulated depreciation: tour coaches Accounts payable Unearned service revenue Notes payable (7 months; 5% interest p.a.; due on April 30, 2021) Income tax payable Share capital (5,000 Ordinary Shares issued) Retained earnings Dividends Service revenue Depreciation expense: tour coaches Supplies expense Utilities expense Salaries expense Rent expense Advertising expense Interest expense Income tax expenses TOTAL Debit $ Credit $ 71,000 24,000 6,000 16,000 900 120,000 48,000 16,000 11,000 30,000 4,900 50,000 16,000 1,000 199,700 22,000 1,100 600 14,725 88,000 5000 375 4,900 375,600 375,600 (1) A few months ago, a client paid $9,000 in advance to Metalla to organize a trip to Lamma Island and this was already recorded in the book. The trip was held on 31 December 2021. (2) The tour coaches depreciates by straight-line method over 5 years. (3) Supplies on hand as at 31 December is $600. (4) Accrued and unrecorded service revenue provided during December amounts to $14,000. (5) On 20 December 2021, Metalla signed an agreement with the MTR Co. to organize two trips for the MTR in 2022. Total revenue in total is $10,000 and MTR will pay after the trip. (6) On 31 October, Metalla paid for 3 months' fees in advance to a travel magazine for advertisement covering 1 December to end of February 2022. New issue of the magazine comes out on the first day each month. (7) Metalla pays rent in advance every three months. Last payment of $24,000 was made on November 1, 2021. Next payment will be due on 1 February, 2022. (8) On 1 August, Metalla signed a note payable with WW Bank. Metalla pays interest accrued on the last day of every three months. No adjusting entries was made since 1 November. (9) Income taxes expense for the entire year is estimated at $4,000. The full amount is due for payment in March 2022. (10)On 31 December, 2021, the Company declared a cash dividend of $ 0.8 per share to be paid next month. Required: (a) Prepare the necessary adjusting journal entries on 31 December 2021. No explanation is required. Show all workings in your journal. Use the account titles given in the Trial Balance if the account is already open. If it does not require adjustment, state "No entry" and the name of the accounting principle applied. (20 marks) (b) Prepare the Income Statement for the year ended 31 December 2021, under the captions of Service Revenues, Expenses, Profit before taxes and Profit after taxes. (13 marks) (c) Prepare the Statement of Financial Position as at 31 December 2021, under the captions of Total Assets, Total Liabilities, Total Equity, Total Liabilities and Equity. (22 marks) (d) Record the year end closing journal entries. No explanation is required. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started