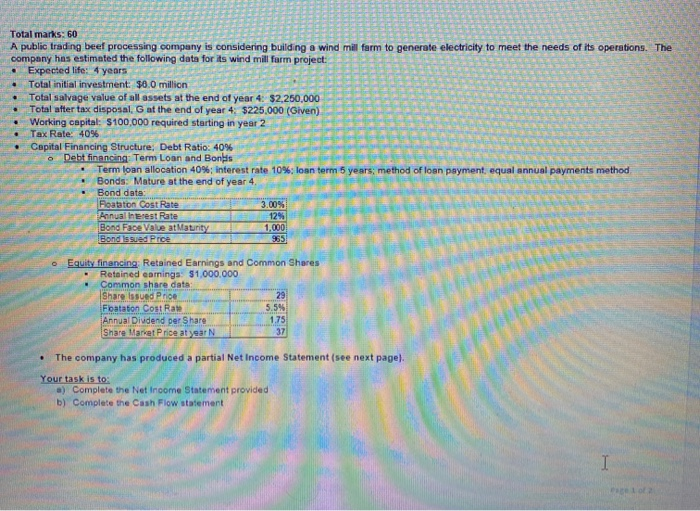

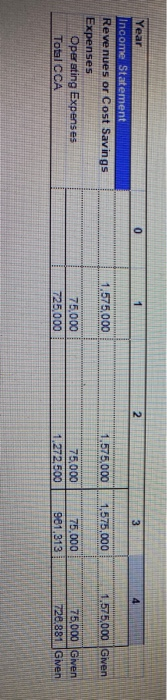

. Total marks: 60 A public trading beef processing company is considering building a wind mill farm to generate electricity to meet the needs of its operations. The company has estimated the following data for its wind mill farm project: Expected life: 4 years Total initial investment: $6.0 million Total salvage value of all assets at the end of year 4: $2,250,000 Total after tax disposal Gat the end of year 4. $225,000 (Given) Working capital: $100,000 required starting in year 2 Tax Rate: 4096 Capital Financing Structure, Debt Ratio: 40% Debt financing Term Loan and Bones Term loan allocation 40%; interest rate 10%; loan term 5 years; method of loan payment equal annual payments method Bonds: Mature at the end of year 4. Bond data: Floataton Cost Rate 3.00% Annual Interest Rate 12% Bond Face Value at Maturity 1,000 Bond issued Price 965 O Equity financing Retained Earnings and Common Shares Retained earnings: $1,000,000 Common share data Share issued Price 29 Foatation Cost Rare 5.5% Annual Dividend per Share 1.75 Share Market Price atyrN 37 . The company has produced a partial Net Income Statement (see next page). Your task is to: a) Complete the Net Income Statement provided b) Complete the Cash Flow statement I Lo 0 1 2 3 4 1.575,000 1,575,000 Year Income Statement Revenues or Cost Savings Expenses Operating Expenses Total CCA 1,575,000 1,575.000 Given 75,000 725,000 75.000 1,272,500 75.000 981,313 75,000 Given 728,881 Given . Total marks: 60 A public trading beef processing company is considering building a wind mill farm to generate electricity to meet the needs of its operations. The company has estimated the following data for its wind mill farm project: Expected life: 4 years Total initial investment: $6.0 million Total salvage value of all assets at the end of year 4: $2,250,000 Total after tax disposal Gat the end of year 4. $225,000 (Given) Working capital: $100,000 required starting in year 2 Tax Rate: 4096 Capital Financing Structure, Debt Ratio: 40% Debt financing Term Loan and Bones Term loan allocation 40%; interest rate 10%; loan term 5 years; method of loan payment equal annual payments method Bonds: Mature at the end of year 4. Bond data: Floataton Cost Rate 3.00% Annual Interest Rate 12% Bond Face Value at Maturity 1,000 Bond issued Price 965 O Equity financing Retained Earnings and Common Shares Retained earnings: $1,000,000 Common share data Share issued Price 29 Foatation Cost Rare 5.5% Annual Dividend per Share 1.75 Share Market Price atyrN 37 . The company has produced a partial Net Income Statement (see next page). Your task is to: a) Complete the Net Income Statement provided b) Complete the Cash Flow statement I Lo 0 1 2 3 4 1.575,000 1,575,000 Year Income Statement Revenues or Cost Savings Expenses Operating Expenses Total CCA 1,575,000 1,575.000 Given 75,000 725,000 75.000 1,272,500 75.000 981,313 75,000 Given 728,881 Given